6032 El Camino Dr Plain City, OH 43064

Estimated Value: $470,000 - $532,000

4

Beds

3

Baths

2,044

Sq Ft

$243/Sq Ft

Est. Value

About This Home

This home is located at 6032 El Camino Dr, Plain City, OH 43064 and is currently estimated at $497,269, approximately $243 per square foot. 6032 El Camino Dr is a home located in Union County with nearby schools including Plain City Elementary School, Jonathan Alder Junior High School, and Canaan Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 21, 2016

Sold by

Bishop Linda and Bishop John

Bought by

Bishop Linda and Bishop John

Current Estimated Value

Purchase Details

Closed on

Oct 14, 2011

Sold by

Bishop Linda

Bought by

Bishop John and Bishop Linda

Purchase Details

Closed on

Jan 14, 2009

Sold by

Bishop John D and Bishop Linda J

Bought by

Bishop Linda J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$197,350

Outstanding Balance

$124,074

Interest Rate

5.08%

Mortgage Type

New Conventional

Estimated Equity

$373,195

Purchase Details

Closed on

Jun 6, 2000

Sold by

Arlington Co Ltd

Bought by

Bishop John D and Bishop Linda J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,000

Interest Rate

8.18%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 2, 1999

Sold by

Evergreen Land Co

Bought by

Arlington Land Co

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Interest Rate

6.94%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bishop Linda | -- | Attorney | |

| Bishop John | -- | None Available | |

| Bishop Linda J | -- | Attorney | |

| Bishop John D | $218,448 | -- | |

| Arlington Land Co | $37,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bishop Linda J | $197,350 | |

| Closed | Bishop John D | $110,000 | |

| Previous Owner | Arlington Land Co | $180,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,393 | $123,770 | $24,230 | $99,540 |

| 2023 | $4,393 | $123,770 | $24,230 | $99,540 |

| 2022 | $4,530 | $123,770 | $24,230 | $99,540 |

| 2021 | $4,072 | $106,420 | $18,640 | $87,780 |

| 2020 | $3,854 | $106,420 | $18,640 | $87,780 |

| 2019 | $3,868 | $106,420 | $18,640 | $87,780 |

| 2018 | $3,371 | $91,480 | $14,900 | $76,580 |

| 2017 | $3,368 | $91,480 | $14,900 | $76,580 |

| 2016 | $3,395 | $91,480 | $14,900 | $76,580 |

| 2015 | $3,710 | $95,120 | $14,330 | $80,790 |

| 2014 | $3,705 | $95,120 | $14,330 | $80,790 |

| 2013 | $3,742 | $95,120 | $14,330 | $80,790 |

Source: Public Records

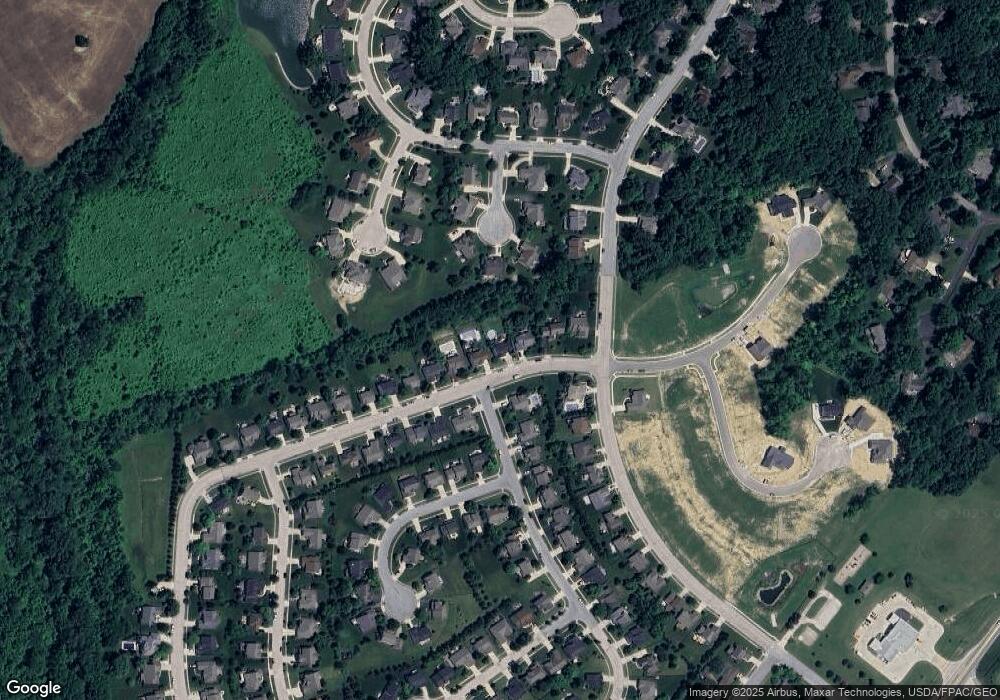

Map

Nearby Homes

- 9755 Fresno Ct

- 11033 Sacramento Ct

- 9740 Camarillo Cir

- 10700 Laguna Cir

- 10035 Corona Ln

- 9794 Mimosa Ct

- 10260 Carmel Dr

- Biscayne Plan at Reserve at New California

- Galveston Plan at Reserve at New California

- Bradenton Plan at Reserve at New California

- Barrington Plan at Reserve at New California

- Sanibel Plan at Reserve at New California

- Augustine Plan at Reserve at New California

- Manchester Plan at Reserve at New California

- Brookhaven Plan at Reserve at New California

- McKenzie Plan at Reserve at New California

- Stonehurst Plan at Reserve at New California

- Aberdeen Plan at Reserve at New California

- Lauderdale Plan at Reserve at New California

- 10119 Biscayne Ct

- 6044 El Camino Dr

- 6020 El Camino Dr

- 6056 El Camino Dr

- 9722 Fresno Ct

- 6012 El Camino Dr

- 6025 El Camino Dr

- 6068 El Camino Dr

- 9734 Fresno Ct

- 9731 Fresno Ct

- 9727 New California Dr

- 6061 El Camino Dr

- 6007 El Camino Dr

- 9690 Mission Dr

- 9835 Malibu Ct

- 9735 New California Dr

- 6071 El Camino Dr

- 6084 El Camino Dr

- 9680 Mission Dr

- 9650 Camarillo Cir

- 9748 Fresno Ct