6043 SE Glen Eagle Way Stuart, FL 34997

Estimated Value: $903,000 - $954,890

3

Beds

6

Baths

3,303

Sq Ft

$282/Sq Ft

Est. Value

About This Home

This home is located at 6043 SE Glen Eagle Way, Stuart, FL 34997 and is currently estimated at $931,223, approximately $281 per square foot. 6043 SE Glen Eagle Way is a home located in Martin County with nearby schools including Sea Wind Elementary School, Murray Middle School, and South Fork High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 28, 2013

Sold by

Santomenna Michael A and Santomenna Linda L

Bought by

Santomenna Michael A

Current Estimated Value

Purchase Details

Closed on

Sep 9, 2013

Sold by

Santomenna Michael A and Santomenna Linda L

Bought by

Santomenna Michael A

Purchase Details

Closed on

Feb 14, 2003

Sold by

Swift Ernest and Swift Frances

Bought by

Santomenna Michael A and Santomenna Linda L

Purchase Details

Closed on

Aug 14, 2000

Sold by

Andreas Brenda

Bought by

Swift Ernest and Swift Frances

Purchase Details

Closed on

Apr 2, 1997

Sold by

Forkey Raymond J and Forkey Janet R

Bought by

Virga Construction Company

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Santomenna Michael A | -- | Attorney | |

| Santomenna Michael A | $100 | -- | |

| Santomenna Michael A | $380,000 | -- | |

| Swift Ernest | $350,000 | -- | |

| Andreas Brenda | $115,800 | -- | |

| Virga Construction Company | $51,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Virga Construction Company | $85,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,505 | $422,380 | -- | -- |

| 2024 | $6,381 | $410,477 | -- | -- |

| 2023 | $6,381 | $398,522 | $0 | $0 |

| 2022 | $6,161 | $386,915 | $0 | $0 |

| 2021 | $6,183 | $375,646 | $0 | $0 |

| 2020 | $6,068 | $370,460 | $0 | $0 |

| 2019 | $5,974 | $362,131 | $0 | $0 |

| 2018 | $5,827 | $355,379 | $0 | $0 |

| 2017 | $5,177 | $348,069 | $0 | $0 |

| 2016 | $5,421 | $340,910 | $93,600 | $247,310 |

| 2015 | $5,416 | $341,840 | $90,000 | $251,840 |

| 2014 | $5,416 | $351,940 | $88,000 | $263,940 |

Source: Public Records

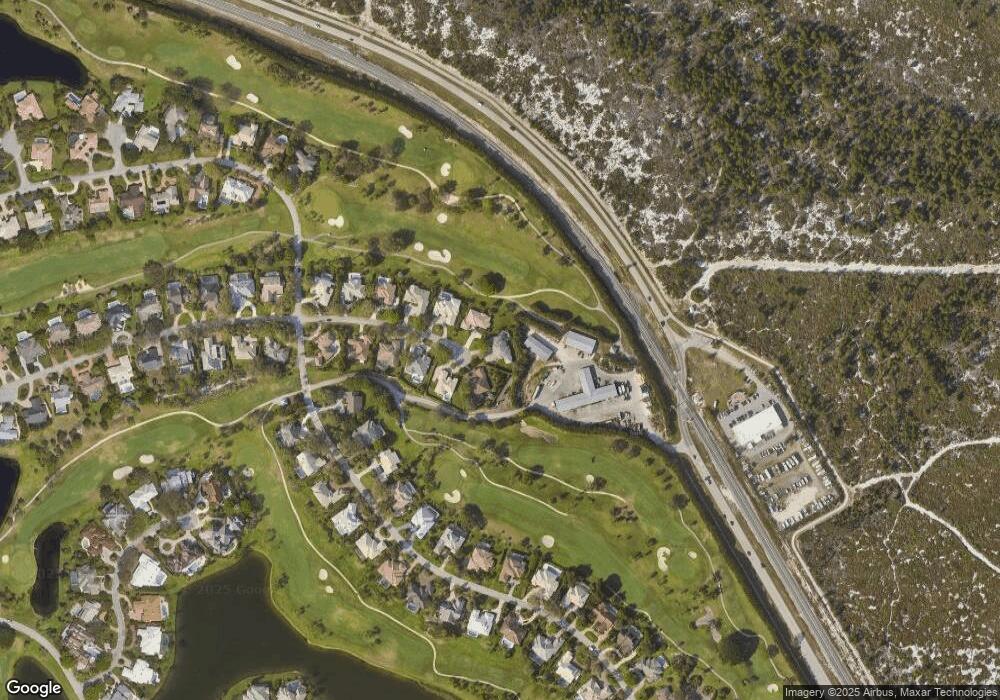

Map

Nearby Homes

- 5884 SE Glen Eagle Way

- 5711 SE Winged Foot Dr

- 5701 SE Winged Foot Dr

- 6323 SE Farmington Place

- 6420 SE Winged Foot Dr

- 5665 SE Winged Foot Dr

- 6481 SE Winged Foot Dr

- 5611 SE Foxcross Place

- 5610 SE Foxcross Place

- 6340 SE Mariner Sands Dr

- 6102 SE Oakmont Place

- 6581 SE Baltusrol Terrace

- 5361 SE Merion Way

- 6217 SE Baltusrol Terrace

- 6022 SE Oakmont Place

- 6384 SE Ironwood Cir

- 6764 SE Bunker Hill Dr

- 5360 SE Dell St

- 6303 SE Williamsburg Dr Unit 201

- 6941 SE Constitution Blvd Unit 203

- 6023 SE Glen Eagle Way

- 6024 SE Glen Eagle Way

- 6004 SE Glen Eagle Way

- 6003 SE Glen Eagle Way

- 5984 SE Glen Eagle Way

- 5964 SE Glen Eagle Way

- 5963 SE Glen Eagle Way

- 5944 SE Glen Eagle Way

- 5943 SE Glen Eagle Way

- 6131 SE Winged Foot Dr

- 6111 SE Winged Foot Dr

- 6151 SE Winged Foot Dr

- 5924 SE Glen Eagle Way

- 6171 SE Winged Foot Dr

- 5923 SE Glen Eagle Way

- 6191 SE Winged Foot Dr

- 6221 SE Winged Foot Dr

- 5904 SE Glen Eagle Way

- 6150 SE Winged Foot Dr

- 6130 SE Winged Foot Dr