6075 Boulder Ridge NE Unit 21 Belmont, MI 49306

Estimated Value: $656,084 - $838,000

--

Bed

--

Bath

--

Sq Ft

0.49

Acres

About This Home

This home is located at 6075 Boulder Ridge NE Unit 21, Belmont, MI 49306 and is currently estimated at $725,521. 6075 Boulder Ridge NE Unit 21 is a home located in Kent County with nearby schools including Crestwood Elementary School, East Rockford Middle School, and Rockford High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 12, 2014

Sold by

Carter Denise

Bought by

Carter Denise and Carter Kenneth

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,000

Outstanding Balance

$199,121

Interest Rate

4.15%

Mortgage Type

New Conventional

Estimated Equity

$526,400

Purchase Details

Closed on

Jun 3, 2013

Sold by

Mikita James John and Mikita Joanne Genevieve

Bought by

Schutmaat Jane and Schutmaat Frederick L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$275,200

Interest Rate

3.38%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 18, 2005

Sold by

J A D Development Llc

Bought by

Mikita James John and Mikita Joanne Genevieve

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$435,000

Interest Rate

5.79%

Mortgage Type

Construction

Purchase Details

Closed on

Jan 13, 1998

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Carter Denise | -- | None Available | |

| Carter Denise | $380,000 | Acker Title Agency | |

| Schutmaat Jane | $344,000 | Grand Rapids Title Agency Ll | |

| Mikita James John | $80,000 | -- | |

| -- | $9,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Carter Denise | $260,000 | |

| Previous Owner | Schutmaat Jane | $275,200 | |

| Previous Owner | Mikita James John | $435,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,411 | $306,900 | $0 | $0 |

| 2024 | $4,411 | $289,400 | $0 | $0 |

| 2023 | $4,220 | $264,400 | $0 | $0 |

| 2022 | $6,184 | $220,200 | $0 | $0 |

| 2021 | $6,021 | $212,900 | $0 | $0 |

| 2020 | $3,886 | $205,700 | $0 | $0 |

| 2019 | $5,880 | $175,300 | $0 | $0 |

| 2018 | $6,189 | $179,500 | $0 | $0 |

| 2017 | $6,027 | $187,800 | $0 | $0 |

| 2016 | $5,826 | $172,900 | $0 | $0 |

| 2015 | $5,648 | $172,900 | $0 | $0 |

| 2013 | -- | $154,700 | $0 | $0 |

Source: Public Records

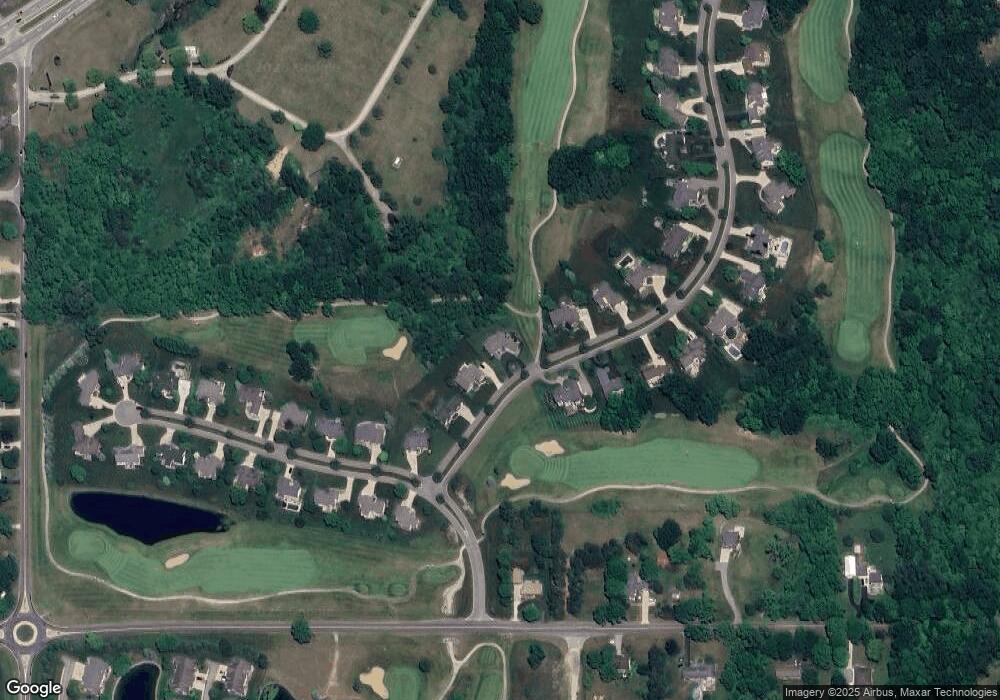

Map

Nearby Homes

- 4055 Boulder Meadow Dr NE

- 6300 Boulder Ridge Dr NE

- 4008 Tom Morris Dr NE Unit 44

- 3965 Boulder View Dr NE

- 4026 Boulder View Dr NE

- Wilshere Plan at Ravines at Inwood

- Remington Plan at Ravines at Inwood

- Enclave Plan at Ravines at Inwood

- Cascade Plan at Ravines at Inwood

- Croswell Plan at Ravines at Inwood

- Carson Plan at Ravines at Inwood

- Avery Plan at Ravines at Inwood

- Ashton Plan at Ravines at Inwood

- Sycamore Plan at Ravines at Inwood - Woodland Series

- Sequoia Plan at Ravines at Inwood - Woodland Series

- Redwood Plan at Ravines at Inwood - Woodland Series

- Oakwood Plan at Ravines at Inwood - Woodland Series

- Maplewood Plan at Ravines at Inwood - Woodland Series

- Elmwood Plan at Ravines at Inwood - Woodland Series

- Chestnut Plan at Ravines at Inwood - Woodland Series

- 6075 Boulder Ridge Dr NE

- 6069 Boulder Ridge NE Unit 20

- 6069 Boulder Ridge Dr NE

- 6099 Boulder Ridge Dr NE

- 6099 Boulder Ridge NE Unit 22

- 6055 Boulder Ridge Dr NE

- 6090 Boulder Ridge NE Unit 53

- 6090 Boulder Ridge Dr NE

- 6121 Boulder Ridge Dr NE

- 6104 Boulder Ridge NE

- 6135 Boulder Ridge NE

- 4155 Boulder Meadow NE Unit 17

- 4155 Boulder Meadow Dr NE

- 6118 Boulder Ridge NE Unit 51

- 6118 Boulder Ridge Dr NE

- 4147 Boulder Meadow NE Unit 16

- 4147 Boulder Meadow NE

- 6132 Boulder Ridge Dr NE

- 4180 Boulder Meadow NE Unit 1

- 6167 Boulder Ridge NE Unit 25