6080 W 26th Ct Unit 1049 Hialeah, FL 33016

Estimated Value: $251,000 - $330,000

2

Beds

1

Bath

1,152

Sq Ft

$258/Sq Ft

Est. Value

About This Home

This home is located at 6080 W 26th Ct Unit 1049, Hialeah, FL 33016 and is currently estimated at $296,644, approximately $257 per square foot. 6080 W 26th Ct Unit 1049 is a home located in Miami-Dade County with nearby schools including Ernest R. Graham K-8 Academy, Miami Lakes Middle School, and Hialeah Gardens Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 19, 2010

Sold by

Jpmorgan Chase Bank National Association

Bought by

Salazar Yeniseh Barthelemy and Molina Carlos Francisco Parra

Current Estimated Value

Purchase Details

Closed on

Oct 14, 2010

Sold by

Federal Deposit Insurance Corporation

Bought by

Jpmorgan Chase Bank National Association

Purchase Details

Closed on

Apr 21, 2010

Sold by

Cespedes Rolando

Bought by

Washington Mutual Bank Fa

Purchase Details

Closed on

Jan 24, 2006

Sold by

Lopez Ines Maria Bustos and Mendoza Ines M

Bought by

Cespedes Rolando and Cespedes Rosalena

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,925

Interest Rate

6.21%

Mortgage Type

Negative Amortization

Purchase Details

Closed on

Nov 30, 2001

Sold by

Jacqueline Vazquez I

Bought by

Mendoza Marcos I and Mendoza Ines M

Purchase Details

Closed on

Jun 15, 1994

Sold by

Vazquez Milton A and Jinete Jacqueline

Bought by

Vazquez Milton A and Vazquez Jacqueline

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Salazar Yeniseh Barthelemy | $56,300 | Attorney | |

| Jpmorgan Chase Bank National Association | -- | Attorney | |

| Washington Mutual Bank Fa | $12,800 | None Available | |

| Cespedes Rolando | $159,900 | B & A Title Services Corp | |

| Mendoza Marcos I | $86,300 | -- | |

| Vazquez Milton A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Cespedes Rolando | $119,925 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $775 | $85,090 | -- | -- |

| 2024 | $736 | $82,692 | -- | -- |

| 2023 | $736 | $80,284 | $0 | $0 |

| 2022 | $689 | $77,946 | $0 | $0 |

| 2021 | $670 | $75,676 | $0 | $0 |

| 2020 | $659 | $74,632 | $0 | $0 |

| 2019 | $648 | $72,955 | $0 | $0 |

| 2018 | $619 | $71,595 | $0 | $0 |

| 2017 | $620 | $70,123 | $0 | $0 |

| 2016 | $626 | $68,681 | $0 | $0 |

| 2015 | $637 | $68,204 | $0 | $0 |

| 2014 | $649 | $67,663 | $0 | $0 |

Source: Public Records

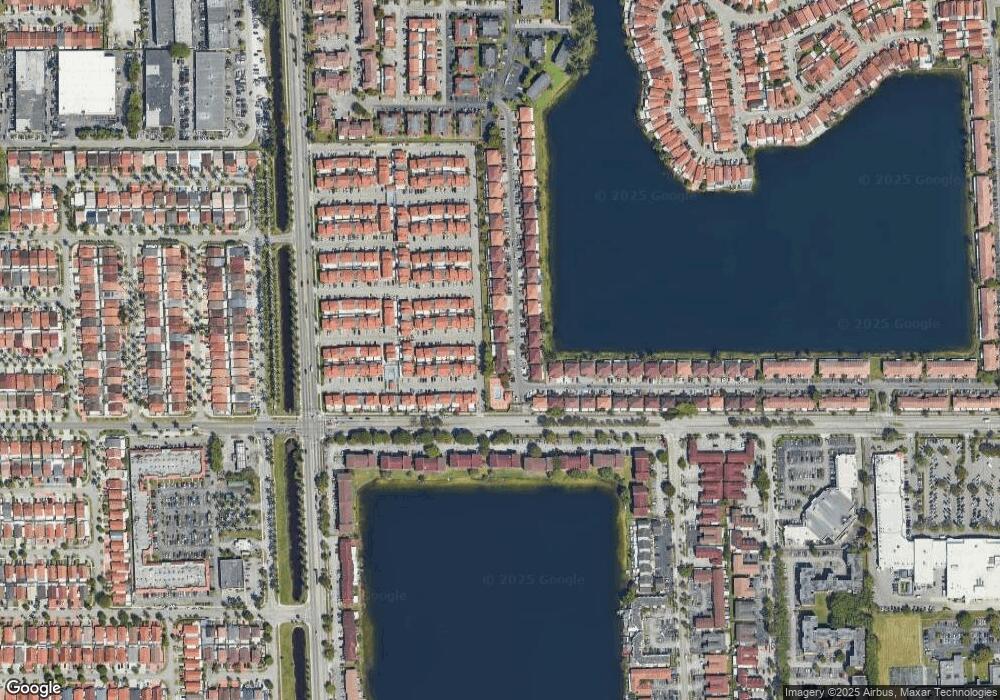

Map

Nearby Homes

- 6080 W 26th Ct Unit 1019

- 2735 W 61st Place Unit 204

- 2740 W 62nd Place Unit 202

- 2760 W 62nd Place Unit 203

- 2775 W 61st St Unit 203

- 2775 W 61st Place Unit 207

- 2730 W 60th St Unit 66

- 6411 W 27th Way Unit 201

- 2614 W 65th St

- 6455 W 27th Ave Unit 44-13

- 5888 W 25th Ct Unit 5

- 11562 NW 87th Place

- 5808 W 26th Ave Unit 211

- 5790 W 26th Ave Unit 202

- 2531 W 60th Place Unit 10518

- 11465 NW 88th Ct

- 6545 W 27th Ct Unit 2447

- 5689 W 28th Ave Unit 5689

- 6580 W 27th Ct Unit 58-21

- 6575 W 27th Ct Unit 1146

- 6080 W 26th Ct Unit 103

- 6080 W 26th Ct Unit 1039

- 6080 W 26th Ct Unit 1059

- 6080 W 26th Ct Unit 1029

- 6090 W 26th Ct Unit 10146

- 6092 W 26th Ct Unit 10246

- 6092 W 26th Ct Unit 102

- 6075 W 26th Ct Unit 10212

- 6065 W 26th Ct Unit 10210

- 6085 W 26th Ct Unit 10231

- 6067 W 26th Ct Unit 10110

- 6100 W 26 Ct Unit 101-47

- 6087 W 26th Ct Unit 10131

- 6102 W 26th Ct Unit 10247

- 6100 W 26th Ct Unit 10147

- 2735 W 60th Place Unit 207

- 2735 W 60th Place Unit 104

- 2735 W 60th Place Unit 203

- 2735 W 60th Place Unit 103

- 2735 W 60th Place Unit 102