6104 Deer Park Rd Reisterstown, MD 21136

Estimated Value: $686,000 - $910,000

5

Beds

4

Baths

3,240

Sq Ft

$249/Sq Ft

Est. Value

About This Home

This home is located at 6104 Deer Park Rd, Reisterstown, MD 21136 and is currently estimated at $806,285, approximately $248 per square foot. 6104 Deer Park Rd is a home located in Baltimore County with nearby schools including Cedarmere Elementary School, Franklin Middle, and Franklin High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 16, 2008

Sold by

Snyder Michael L

Bought by

Gaa Scott A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$428,000

Outstanding Balance

$284,728

Interest Rate

6.27%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$521,557

Purchase Details

Closed on

Dec 5, 2008

Sold by

Snyder Michael L

Bought by

Gaa Scott A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$428,000

Outstanding Balance

$284,728

Interest Rate

6.27%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$521,557

Purchase Details

Closed on

Mar 14, 1984

Sold by

Beall Joseph V 3Rd

Bought by

Snyder Michael L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gaa Scott A | $535,000 | -- | |

| Gaa Scott A | $535,000 | -- | |

| Snyder Michael L | $33,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gaa Scott A | $428,000 | |

| Closed | Gaa Scott A | $428,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,517 | $493,100 | -- | -- |

| 2024 | $5,517 | $452,300 | $146,400 | $305,900 |

| 2023 | $2,741 | $447,333 | $0 | $0 |

| 2022 | $5,373 | $442,367 | $0 | $0 |

| 2021 | $542 | $437,400 | $146,400 | $291,000 |

| 2020 | $542 | $430,233 | $0 | $0 |

| 2019 | $5,188 | $423,067 | $0 | $0 |

| 2018 | $5,101 | $415,900 | $146,400 | $269,500 |

| 2017 | $5,055 | $415,900 | $0 | $0 |

| 2016 | $5,430 | $415,900 | $0 | $0 |

| 2015 | $5,430 | $420,700 | $0 | $0 |

| 2014 | $5,430 | $420,700 | $0 | $0 |

Source: Public Records

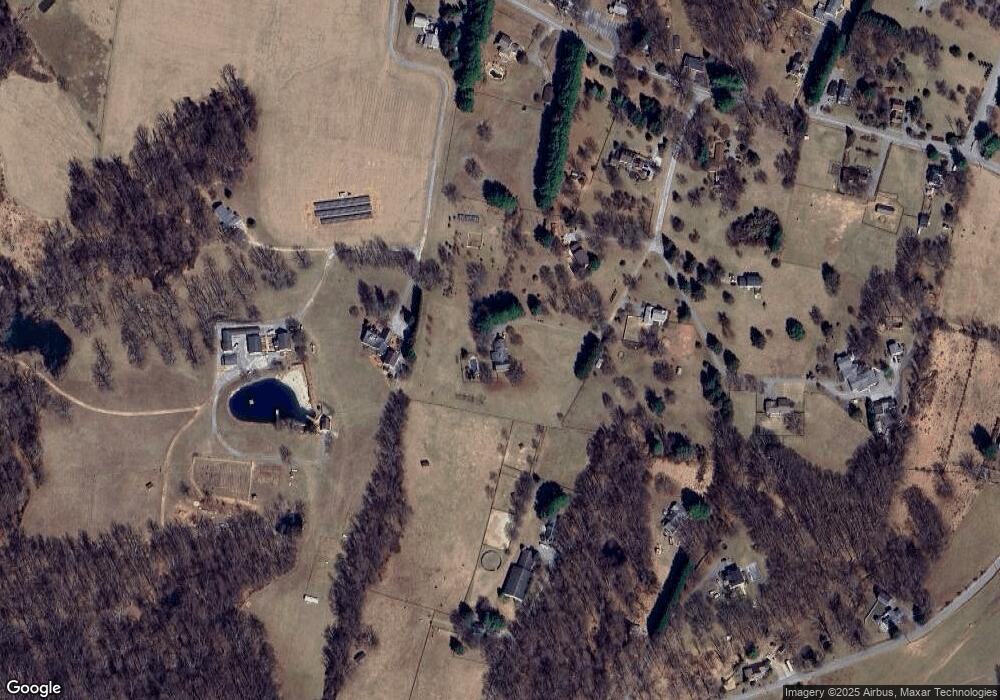

Map

Nearby Homes

- 5 Fox Field Ct

- 6524 Deer Park Rd

- 5010 Wards Chapel Rd

- 623 Berrymans Ln

- Presley Plan at Worthington Grove

- Melody Plan at Worthington Grove

- Hemingway Plan at Worthington Grove

- Donovan Plan at Worthington Grove

- Preston Plan at Worthington Grove

- 617 Berrymans Ln

- 625 Berrymans Ln

- 701 Berrymans Ln

- 607 Church Rd

- 1015 Nicodemus Rd

- 902 Honeyflower Dr

- 906 Honeyflower Dr

- 703 Pineapple Ct

- 700 Pineapple Ct

- 903 Honeyflower Dr

- 0 Deer Park Rd

- 6108 Deer Park Rd

- 6100 Deer Park Rd

- 6136 Deer Park Rd

- 6112 Deer Park Rd

- 1620 Oakland Rd

- 6022 Deer Park Rd

- 6026 Deer Park Rd

- 1630 Oakland Rd

- 6018 Deer Park Rd

- 6116 Deer Park Rd

- 1618 Oakland Rd

- 6120 Deer Park Rd

- 6103 Deer Park Rd

- 6101 Deer Park Rd

- 6024 Deer Park Rd

- 6107 Deer Park Rd

- 6014 Deer Park Rd

- 1524 Oakland Rd

- 6015 Deer Park Rd

- 6121 Deer Park Rd