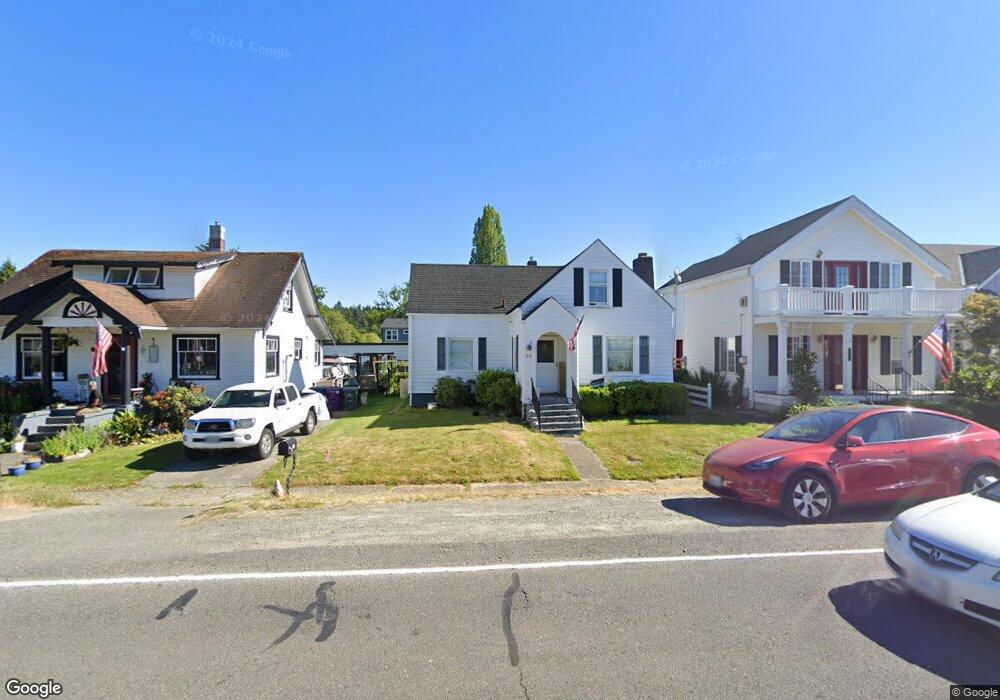

612 Martin St Steilacoom, WA 98388

Estimated Value: $451,000 - $629,000

4

Beds

1

Bath

1,520

Sq Ft

$347/Sq Ft

Est. Value

About This Home

This home is located at 612 Martin St, Steilacoom, WA 98388 and is currently estimated at $526,716, approximately $346 per square foot. 612 Martin St is a home located in Pierce County with nearby schools including Saltars Point Elementary School, Cherrydale Elementary School, and Pioneer Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 9, 2010

Sold by

Wetmore Dale A and Wetmore Elizabeth

Bought by

Fulps Roger A and Fulps Kristina

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$245,100

Interest Rate

4.27%

Mortgage Type

VA

Purchase Details

Closed on

Sep 14, 2004

Sold by

Morgan Cyril

Bought by

Wetmore Dale A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,700

Interest Rate

5.5%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fulps Roger A | $239,950 | Chicago Title | |

| Wetmore Dale A | $133,000 | Chicago Title | |

| Wetmore Dale A | -- | Chicago Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fulps Kristina | $84,800 | |

| Open | Fulps Roger A | $230,550 | |

| Closed | Fulps Roger A | $239,600 | |

| Closed | Fulps Roger A | $245,100 | |

| Previous Owner | Wetmore Dale A | $119,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,344 | $436,100 | $246,500 | $189,600 |

| 2024 | $3,344 | $425,000 | $240,700 | $184,300 |

| 2023 | $3,344 | $387,600 | $196,300 | $191,300 |

| 2022 | $3,221 | $410,500 | $202,000 | $208,500 |

| 2021 | $3,208 | $297,200 | $144,300 | $152,900 |

| 2019 | $2,729 | $272,400 | $133,900 | $138,500 |

| 2018 | $2,844 | $245,900 | $108,900 | $137,000 |

| 2017 | $2,517 | $223,200 | $92,000 | $131,200 |

| 2016 | $2,246 | $183,400 | $75,700 | $107,700 |

| 2014 | $2,135 | $174,600 | $68,100 | $106,500 |

| 2013 | $2,135 | $156,500 | $66,600 | $89,900 |

Source: Public Records

Map

Nearby Homes

- 718 Union Ave

- 1310 Sequalish St

- 1514 Rainier St

- 2009 Nisqually St

- 2003 Nisqually St

- 814 5th St

- 1207 Adams St

- 1810 Rainier St

- 1607 Harrison St

- 728 Blaine St

- 2005 Nisqually St

- 1202 Eleanor Ct

- 214 Cedar St

- 709 Chris David Dr

- 1307 Walnut Ln

- 715 Stevens St

- 2514 Shepard St

- 2503 Natalie Ln

- 2322 Pamela Place

- 10719 115th Ave SW