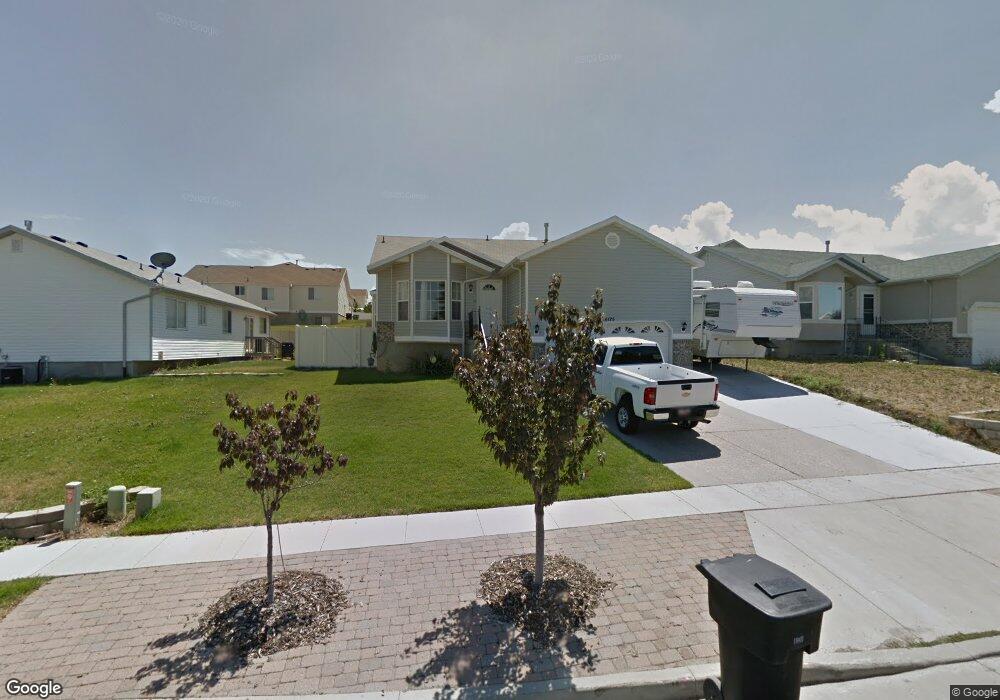

6125 W Graceland Way West Jordan, UT 84081

Oquirrh NeighborhoodEstimated Value: $553,000 - $560,182

5

Beds

3

Baths

2,648

Sq Ft

$210/Sq Ft

Est. Value

About This Home

This home is located at 6125 W Graceland Way, West Jordan, UT 84081 and is currently estimated at $556,046, approximately $209 per square foot. 6125 W Graceland Way is a home located in Salt Lake County with nearby schools including Falcon Ridge School, Sunset Ridge Middle School, and Copper Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 14, 2016

Sold by

Bingham Michael G and Bingham Carole J

Bought by

Allen Thomas Jake and Allen Crystal Leila

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$262,179

Outstanding Balance

$204,722

Interest Rate

2.75%

Mortgage Type

FHA

Estimated Equity

$351,324

Purchase Details

Closed on

May 14, 2003

Sold by

Reliance Homes Inc

Bought by

Bingham Michael G and Bingham Carole J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$146,352

Interest Rate

5.71%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Allen Thomas Jake | -- | Inwest Title Services Slc | |

| Bingham Michael G | -- | Backman Stewart Title Servic |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Allen Thomas Jake | $262,179 | |

| Previous Owner | Bingham Michael G | $146,352 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,421 | $510,300 | $131,500 | $378,800 |

| 2024 | $3,421 | $485,300 | $126,500 | $358,800 |

| 2023 | $3,419 | $460,500 | $121,600 | $338,900 |

| 2022 | $3,510 | $476,400 | $119,200 | $357,200 |

| 2021 | $3,030 | $387,000 | $91,700 | $295,300 |

| 2020 | $2,873 | $338,900 | $85,100 | $253,800 |

| 2019 | $2,801 | $322,900 | $80,300 | $242,600 |

| 2018 | $2,630 | $297,600 | $80,300 | $217,300 |

| 2017 | $2,494 | $279,500 | $80,300 | $199,200 |

| 2016 | $2,388 | $261,700 | $74,300 | $187,400 |

| 2015 | $2,047 | $215,700 | $79,900 | $135,800 |

| 2014 | $2,008 | $207,200 | $77,400 | $129,800 |

Source: Public Records

Map

Nearby Homes

- 6116 W Graceland Way

- 6150 W Nellies St

- 6761 S High Bluff Dr

- 6977 W Hidden Way S Unit 147

- 6301 W Passenger Ln Unit 2

- 6721 Adventure Way

- 5732 W Moon Crest Ct

- 6739 S Sol Rise Dr

- 6389 S Mill Valley Ct

- 6223 W Mill Valley Ln

- 6401 S High Bluff Dr

- 7134 S Rialto Way

- 5818 W Whisper View Ct

- 5818 W Whisper View Ct Unit 336

- 7368 S Travertine Rd Unit 314

- 5557 W Joshua Cir

- 6880 S Mount Berry Rd Unit 410

- Lincoln Plan at Sky Ranch - Legacy

- Mckinley Plan at Sky Ranch - Legacy

- Washington Plan at Sky Ranch - Legacy

- 6135 W Graceland Way

- 6858 S 6115 W

- 6132 W Kenyons Claim Cir

- 6132 Kenyons Claim Cir

- 6145 W Graceland Way

- 6120 Kenyons Claim Cir

- 6144 Kenyons Claim Cir

- 6144 W Kenyons Claim Cir

- 6126 W Graceland Way

- 6120 W Graceland Way

- 6138 W Graceland Way

- 6155 W Graceland Way

- 6116 W 6116 W Graceland Way

- 6156 Kenyons Claim Cir

- 6156 W Kenyons Claim Cir

- 6152 W Graceland Way

- 6108 W Graceland Way

- 6106 Placer Claim Way

- 6167 W Graceland Way

- 6133 Kenyons Claim Cir