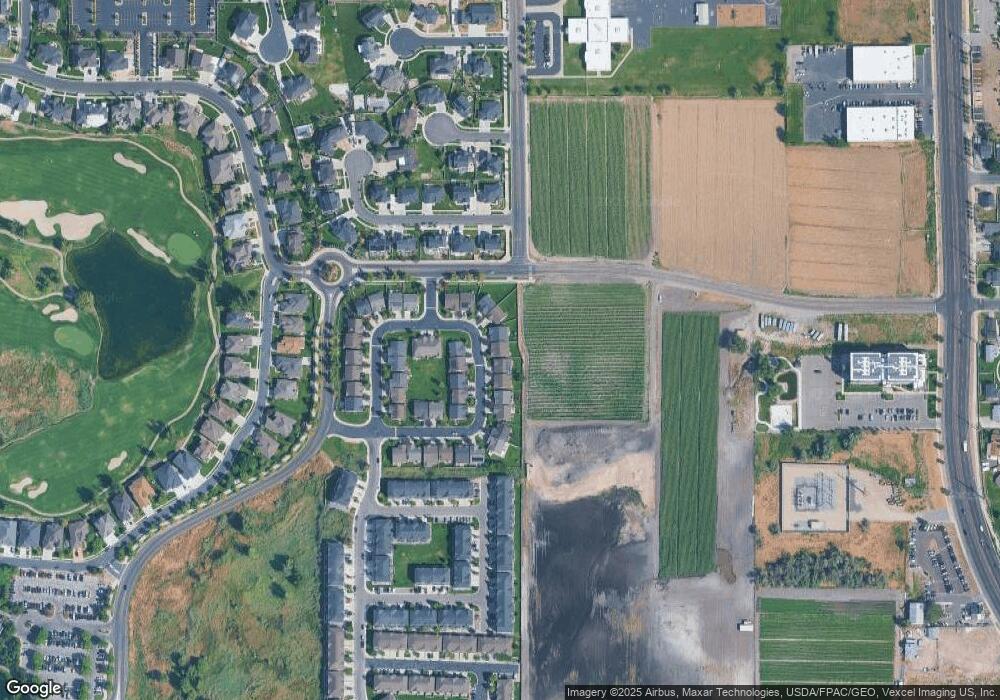

613 S 1810 W Orem, UT 84059

Sunset Heights NeighborhoodEstimated Value: $558,000 - $629,000

5

Beds

3

Baths

3,024

Sq Ft

$197/Sq Ft

Est. Value

About This Home

This home is located at 613 S 1810 W, Orem, UT 84059 and is currently estimated at $595,834, approximately $197 per square foot. 613 S 1810 W is a home located in Utah County with nearby schools including Vineyard Elementary School, Lakeridge Jr High School, and Mountain View High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 3, 2014

Sold by

Hill Tracy

Bought by

Bryson Blake R and Bryson Kalani A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$205,500

Outstanding Balance

$155,762

Interest Rate

4.34%

Mortgage Type

New Conventional

Estimated Equity

$440,072

Purchase Details

Closed on

Nov 28, 2012

Sold by

Mcgiven Ryan D and Mcgiven Sarah E

Bought by

Hill Tracy

Purchase Details

Closed on

Nov 19, 2009

Sold by

Sf North Land Llc

Bought by

Mcgiven Ryan D and Mcgiven Sarah E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$201,328

Interest Rate

4.83%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bryson Blake R | -- | Absolute Title Agency | |

| Hill Tracy | -- | First American Title Company | |

| Mcgiven Ryan D | -- | Affiliated First Title Comp |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bryson Blake R | $205,500 | |

| Previous Owner | Mcgiven Ryan D | $201,328 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,531 | $293,150 | -- | -- |

| 2024 | $2,531 | $309,485 | $0 | $0 |

| 2023 | $2,372 | $311,685 | $0 | $0 |

| 2022 | $2,249 | $286,330 | $0 | $0 |

| 2021 | $2,045 | $394,400 | $100,000 | $294,400 |

| 2020 | $1,927 | $365,200 | $100,000 | $265,200 |

| 2019 | $1,681 | $331,400 | $100,000 | $231,400 |

| 2018 | $1,760 | $331,400 | $100,000 | $231,400 |

| 2017 | $1,780 | $179,520 | $0 | $0 |

| 2016 | $1,559 | $145,035 | $0 | $0 |

| 2015 | $1,589 | $139,755 | $0 | $0 |

| 2014 | $1,451 | $127,050 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 1836 W 680 S

- 780 S 1840 W

- 825 S Pheasant Run

- 1542 W 525 S

- 1463 W 730 S

- 338 S Holdaway Rd

- 943 S 2150 W

- 167 E Lake View Dr

- 2109 W 980 S

- 99 E Powell St Unit 108

- 481 S Main St Unit Lot 139

- 473 S Main St Unit 138

- 3 W Stillwater St Unit 161

- 71 E Powell St Unit 106

- 441 S Main St Unit 135

- 12 W Stillwater St Unit 148

- 224 S Dry Creek Ln

- 16 W Stillwater St Unit 150

- 68 E Zinfandel Ln

- 350 S 1200 W Unit 2

- 605 S 1810 W

- 617 S 1810 W

- 625 S 1810 W

- 1804 W 600 S

- 612 S 1810 W

- 616 S 1810 W

- 1808 W 600 S

- 631 S 1810 W Unit 10

- 626 S 1810 W Unit 34

- 1822 W 600 S

- 630 S 1810 W

- 630 S 1810 W Unit 33

- 639 S 1810 W

- 639 S 1810 W Unit 9

- 1839 W 600 S

- 1830 W 600 S

- 636 S 1810 W Unit 32

- 636 S 1810 W

- 1847 W 600 S

- 643 S 1810 W Unit 8