6146 Tiffin Ct Unit 6C Mentor, OH 44060

Estimated Value: $277,000 - $300,000

2

Beds

3

Baths

1,518

Sq Ft

$189/Sq Ft

Est. Value

About This Home

This home is located at 6146 Tiffin Ct Unit 6C, Mentor, OH 44060 and is currently estimated at $286,453, approximately $188 per square foot. 6146 Tiffin Ct Unit 6C is a home located in Lake County with nearby schools including Orchard Hollow Elementary School, Shore Middle School, and Mentor High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 28, 2020

Sold by

Cgc Hcerokee Proeprties Llc

Bought by

Jenkins Douglas

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$173,400

Outstanding Balance

$154,760

Interest Rate

2.71%

Mortgage Type

New Conventional

Estimated Equity

$131,693

Purchase Details

Closed on

Sep 24, 2013

Sold by

Brown David M and Hartung Kathleen J

Bought by

Cgc Cherokee Properties Llc

Purchase Details

Closed on

Sep 17, 2001

Sold by

Callihan C Ferris and Callihan Janice L

Bought by

Brown Harry W and Brown Dorothy J

Purchase Details

Closed on

Nov 20, 1997

Sold by

Bramley Izetta M and Bramley John A

Bought by

Callihan C Ferris and Callihan Janice Lee

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$176,800

Interest Rate

7.45%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 29, 1989

Bought by

Bramley Izetta M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jenkins Douglas | $218,500 | None Available | |

| Cgc Cherokee Properties Llc | -- | None Available | |

| Brown Harry W | $210,000 | -- | |

| Callihan C Ferris | $208,000 | Midland Title Security Inc | |

| Bramley Izetta M | $132,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jenkins Douglas | $173,400 | |

| Previous Owner | Callihan C Ferris | $176,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | -- | $86,310 | $16,130 | $70,180 |

| 2023 | $7,365 | $70,880 | $13,440 | $57,440 |

| 2022 | $3,265 | $70,880 | $13,440 | $57,440 |

| 2021 | $3,355 | $70,880 | $13,440 | $57,440 |

| 2020 | $3,189 | $59,060 | $11,200 | $47,860 |

| 2019 | $3,192 | $59,060 | $11,200 | $47,860 |

| 2018 | $3,183 | $66,190 | $8,750 | $57,440 |

| 2017 | $3,752 | $66,190 | $8,750 | $57,440 |

| 2016 | $3,730 | $66,190 | $8,750 | $57,440 |

| 2015 | $3,409 | $66,190 | $8,750 | $57,440 |

| 2014 | $3,461 | $66,190 | $8,750 | $57,440 |

| 2013 | $3,464 | $66,190 | $8,750 | $57,440 |

Source: Public Records

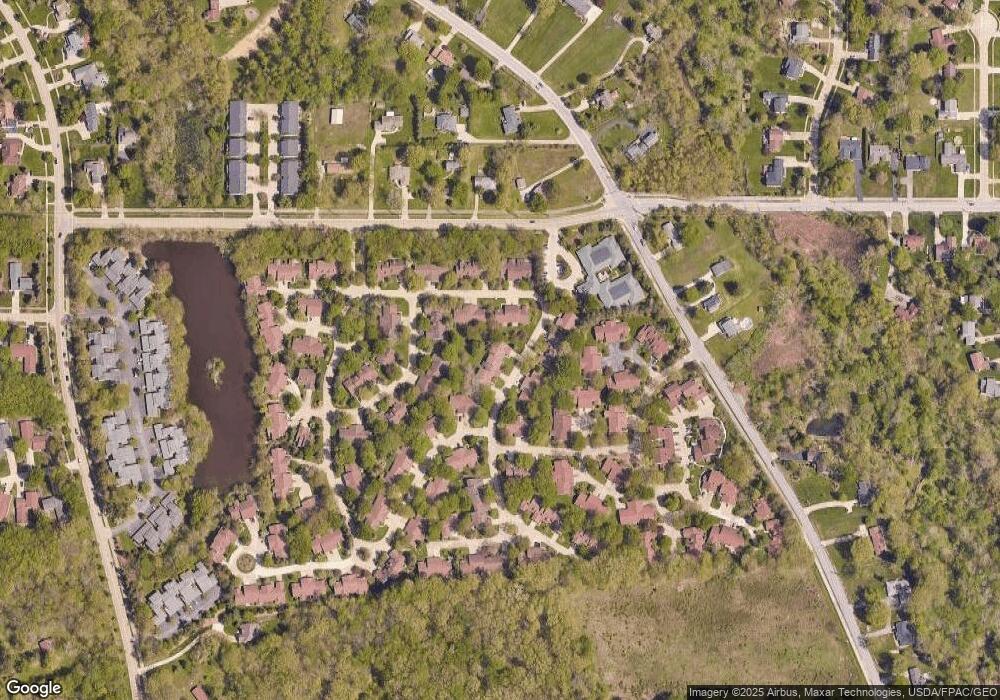

Map

Nearby Homes

- 6148 Worthington Ln Unit A14

- 8443 Trimble Ct Unit A

- 6122 Cabot Ct Unit C2

- 6283 Hopkins Rd

- 6010 Sea Pines Dr

- 8548 Cornwall Ct

- 6159 Cambridge Park Dr

- 6306 Glenwood Dr

- 8500 Barbara Dr

- 5914 S Shandle Blvd

- 8169 Dalton Ct

- 6267 Foxwood Ct

- 6581 Newhouse Ct

- 8379 Mentorwood Dr

- 8295 Mentorwood Dr

- 8804 Shandle Blvd

- 6009 Jane Dr

- 5636 Hopkins Rd

- 5592 Hopkins Rd

- 6241 Tina Dr

- 6142 Tiffin Ct

- 6138 Tiffin Ct

- 8486 Tiffin Ct Unit 8B

- 8490 Tiffin Ct Unit 7A

- 8494 Tiffin Ct Unit B

- 8494 Tiffin Ct Unit 7-B

- 6139 Tiffin Ct

- 6139 Tiffin Ct Unit 17-A

- 8482 Tiffin Ct

- 6135 Tiffin Ct

- 6135 Tiffin Ct Unit 16-B

- 6141 Tiffin Ct

- 6133 Tiffin Ct

- 6137 Worthington Ln

- 8485 Cooper Ln Unit 30B

- 6131 Worthington Ln

- 8481 Cooper Ln

- 6129 Tiffin Ct Unit 6129

- 6143 Worthington Ln Unit 10B

- 6125 Worthington Ln Unit 9A