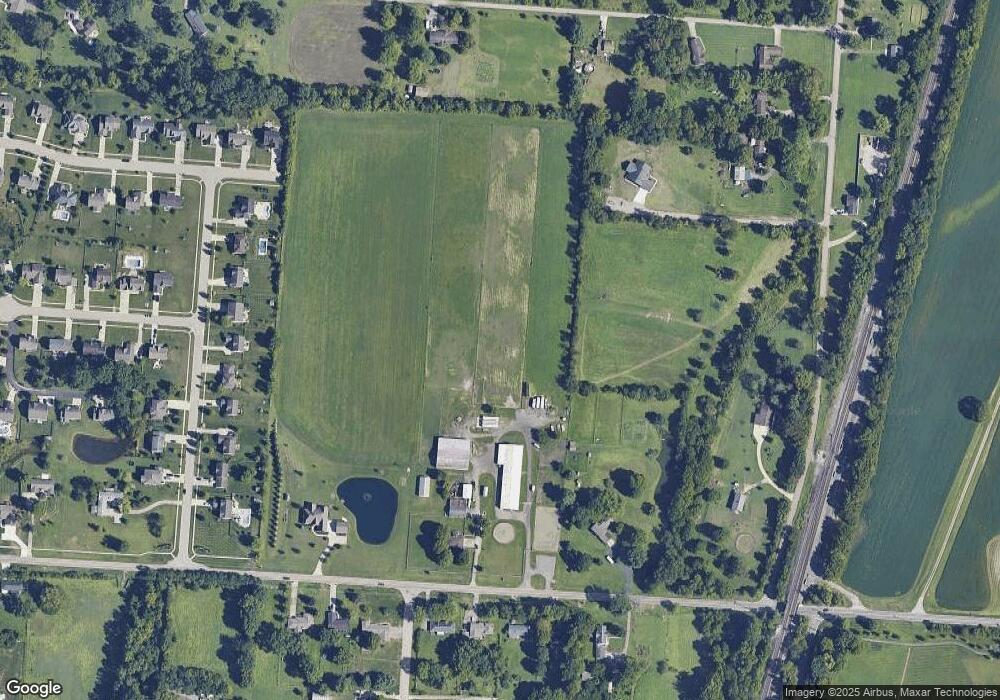

6150 Kyles Station Rd Liberty Township, OH 45011

Estimated Value: $829,000 - $849,215

2

Beds

2

Baths

1,601

Sq Ft

$524/Sq Ft

Est. Value

About This Home

This home is located at 6150 Kyles Station Rd, Liberty Township, OH 45011 and is currently estimated at $839,108, approximately $524 per square foot. 6150 Kyles Station Rd is a home located in Butler County with nearby schools including VanGorden Elementary School, Liberty Junior School, and Lakota East High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 5, 2024

Sold by

Oostdijck Bastiaan M and Oostdijck Megan E

Bought by

Fuller Gerald and Fuller Kristin

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$640,000

Outstanding Balance

$617,959

Interest Rate

6.94%

Mortgage Type

Credit Line Revolving

Estimated Equity

$221,149

Purchase Details

Closed on

May 15, 2018

Sold by

Holden Gregory C and Holden Martha R

Bought by

Ooskdijck Bastiaan M and Ooskdijck Megan E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$445,000

Interest Rate

4.4%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Dec 4, 2013

Sold by

Holden Martha Ruth

Bought by

Holden Gregory C and Holden Martha Ruth

Purchase Details

Closed on

Aug 14, 2013

Sold by

Turnau Mary Anne and Holden Martha Ruth

Bought by

Turnau Mary Anne and Holden Martha Ruth

Purchase Details

Closed on

Jun 30, 2009

Sold by

French Ruth A

Bought by

Turnau Ronald and Turnau Mary Anne

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fuller Gerald | $800,000 | None Listed On Document | |

| Fuller Gerald | $800,000 | None Listed On Document | |

| Ooskdijck Bastiaan M | $560,000 | None Available | |

| Holden Gregory C | -- | None Available | |

| Turnau Mary Anne | -- | None Available | |

| Turnau Ronald | $125,000 | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fuller Gerald | $640,000 | |

| Closed | Fuller Gerald | $640,000 | |

| Previous Owner | Ooskdijck Bastiaan M | $445,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,164 | $107,050 | $28,280 | $78,770 |

| 2023 | $4,076 | $105,160 | $28,280 | $76,880 |

| 2022 | $3,933 | $79,491 | $22,061 | $57,430 |

| 2021 | $3,912 | $79,491 | $22,061 | $57,430 |

| 2020 | $4,014 | $156,000 | $98,570 | $57,430 |

| 2019 | $13,440 | $139,520 | $91,560 | $47,960 |

| 2018 | $4,272 | $139,520 | $91,560 | $47,960 |

| 2017 | $4,272 | $139,520 | $91,560 | $47,960 |

| 2016 | $4,261 | $134,740 | $91,560 | $43,180 |

| 2015 | $4,264 | $134,740 | $91,560 | $43,180 |

| 2014 | $4,524 | $134,740 | $91,560 | $43,180 |

| 2013 | $4,524 | $188,170 | $138,670 | $49,500 |

Source: Public Records

Map

Nearby Homes

- 6035 Kyles Station Rd

- 6007 Preserve Ln

- 5798 Roden Park Dr

- 5051 Cavendish Dr

- 6534 Justess Ln

- 4961 Victoria Place

- 6466 Winding Oaks Dr

- 6394 Ashdale Ct

- 4873 Mauds Hughes Rd

- 5502 Rodeo Dr

- 5905 Brunswick Ct

- 5536 Charleston Woods Dr

- 5725 Hawthrone Reserve Dr

- 6895 Welney Run

- 203 Shyla Ct

- 5850 Millikin Rd

- BENNETT Plan at Estates of Monroe Crossings

- STRATTON Plan at Estates of Monroe Crossings

- PARKETTE Plan at Estates of Monroe Crossings

- VANDERBURGH Plan at Estates of Monroe Crossings

- 6189 Kyles Station Rd

- 6177 Kyles Station Rd

- 6201 Kyles Station Rd

- 6215 Kyles Station Rd

- 6157 Kyles Station Rd

- 6236 Kyles Station Rd

- 5442 Liberty Woods Dr

- 6145 Kyles Station Rd

- 5456 Liberty Woods Dr

- 5441 Liberty Woods Dr

- 6133 Kyles Station Rd

- 5468 Liberty Woods Dr

- 5455 Liberty Woods Dr

- 5467 Liberty Woods Dr

- 5394 Meadow Breeze Dr

- 5384 Meadow Breeze Dr

- 5482 Liberty Woods Dr

- 5369 Maud Hughes Rd

- 5481 Liberty Woods Dr

- 5374 Meadow Breeze Dr