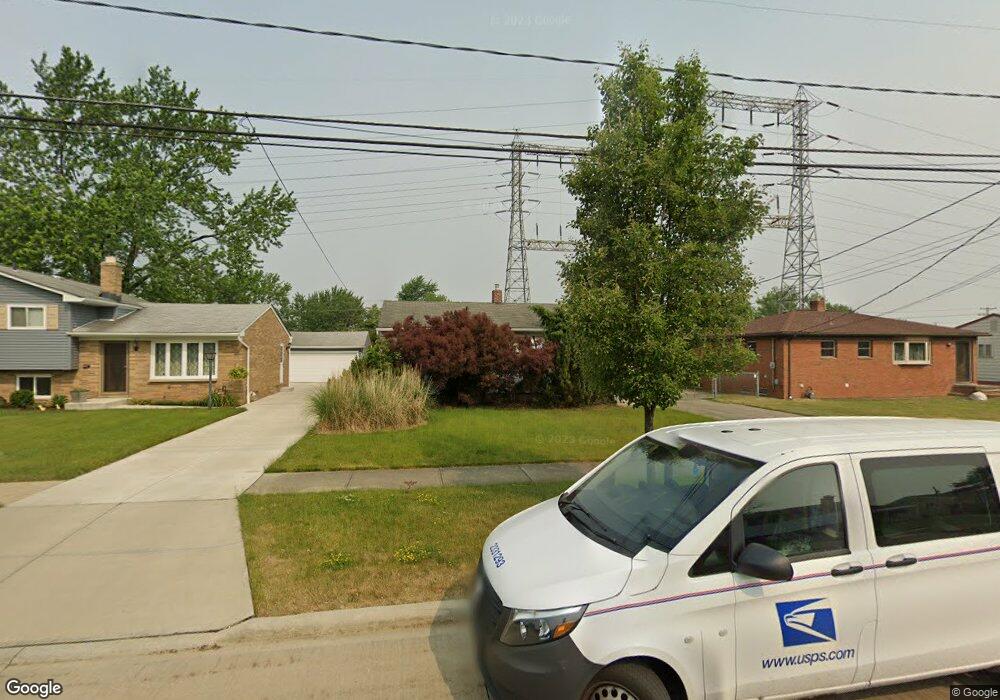

6164 Middlebrook Blvd Brookpark, OH 44142

Estimated Value: $191,504 - $234,000

3

Beds

1

Bath

999

Sq Ft

$210/Sq Ft

Est. Value

About This Home

This home is located at 6164 Middlebrook Blvd, Brookpark, OH 44142 and is currently estimated at $210,126, approximately $210 per square foot. 6164 Middlebrook Blvd is a home located in Cuyahoga County with nearby schools including Berea-Midpark Middle School, Berea-Midpark High School, and Huber Heights Preparatory Academy Parma Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 28, 2022

Sold by

Pasipanki Jennifer and Pasipanki Michael

Bought by

Felon Michael Charles

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$99,750

Outstanding Balance

$96,513

Interest Rate

6.7%

Mortgage Type

New Conventional

Estimated Equity

$113,613

Purchase Details

Closed on

Jun 18, 2007

Sold by

Webb Randy A and Webb Jennifer L

Bought by

Webb Jennifer L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,950

Interest Rate

6.2%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 19, 1998

Sold by

Webb Matthew A

Bought by

Webb Randy A and Webb Jennifer L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$98,600

Interest Rate

6.59%

Purchase Details

Closed on

Nov 12, 1992

Sold by

Diana Kasicki

Bought by

Webb Matthew A

Purchase Details

Closed on

Feb 26, 1980

Sold by

Kasicki Thomas J

Bought by

Diana Kasicki

Purchase Details

Closed on

Jul 15, 1976

Sold by

Henry Joseph P and Henry Sharon L

Bought by

Kasicki Thomas J

Purchase Details

Closed on

Jan 1, 1975

Bought by

Henry Joseph P and Henry Sharon L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Felon Michael Charles | $105,000 | None Listed On Document | |

| Webb Jennifer L | -- | American Title & Trust | |

| Webb Randy A | $116,000 | American Title & Trust Agenc | |

| Webb Matthew A | $83,900 | -- | |

| Diana Kasicki | -- | -- | |

| Kasicki Thomas J | $38,800 | -- | |

| Henry Joseph P | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Felon Michael Charles | $99,750 | |

| Previous Owner | Webb Jennifer L | $112,950 | |

| Previous Owner | Webb Randy A | $98,600 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,058 | $60,620 | $14,385 | $46,235 |

| 2023 | $3,162 | $51,910 | $12,080 | $39,830 |

| 2022 | $3,140 | $51,910 | $12,080 | $39,830 |

| 2021 | $3,121 | $51,910 | $12,080 | $39,830 |

| 2020 | $2,814 | $41,200 | $9,590 | $31,610 |

| 2019 | $2,730 | $117,700 | $27,400 | $90,300 |

| 2018 | $2,567 | $41,200 | $9,590 | $31,610 |

| 2017 | $2,617 | $36,620 | $9,700 | $26,920 |

| 2016 | $2,595 | $36,620 | $9,700 | $26,920 |

| 2015 | $2,318 | $36,620 | $9,700 | $26,920 |

| 2014 | $2,318 | $34,860 | $9,240 | $25,620 |

Source: Public Records

Map

Nearby Homes

- 14396 Park Dr

- 14801 Larkfield Dr

- 6095 Stark Dr

- 6103 Westbrook Dr

- 14024 Donald Dr

- 14398 Sheldon Rd

- 15424 Holland Rd

- 6014 Westbrook Dr

- 13602 Holland Rd

- 6330 Sandfield Dr

- 6386 Sandfield Dr

- 6377 Ledgebrook Dr

- 13750 Belfair Dr

- 6330 Ledgebrook Dr

- 5889 Westbrook Dr

- 13375 Kathleen Dr

- 6333 W 130th St

- 15532 Rademaker Dr

- 15496 Shaleside Ct

- 16117 Hocking Blvd

- 6170 Middlebrook Blvd

- 6156 Middlebrook Blvd

- 6148 Middlebrook Blvd

- 6178 Middlebrook Blvd

- 6184 Middlebrook Blvd

- 6140 Middlebrook Blvd

- 6159 Middlebrook Blvd

- 6165 Middlebrook Blvd

- 6151 Middlebrook Blvd

- 6169 Middlebrook Blvd

- 6145 Middlebrook Blvd

- 6192 Middlebrook Blvd

- 6177 Middlebrook Blvd

- 6134 Middlebrook Blvd

- 6189 Middlebrook Blvd

- 6181 Middlebrook Blvd

- 6198 Middlebrook Blvd

- 6137 Middlebrook Blvd

- 6133 Middlebrook Blvd

- 6126 Middlebrook Blvd

Your Personal Tour Guide

Ask me questions while you tour the home.