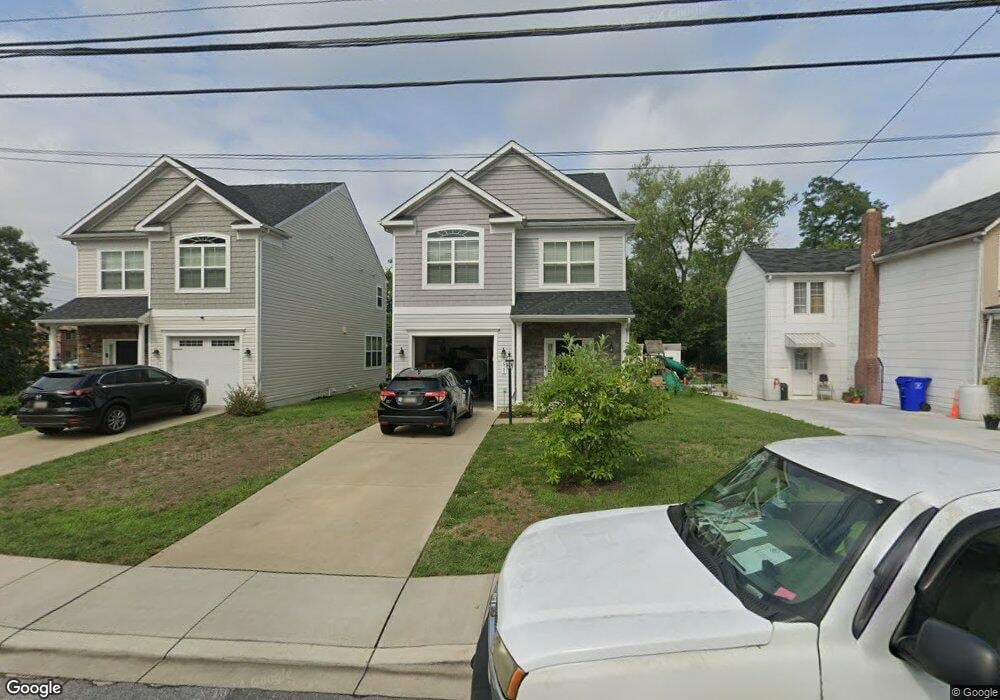

617 8th St Laurel, MD 20707

Estimated Value: $503,000 - $560,000

Studio

1

Bath

1,918

Sq Ft

$280/Sq Ft

Est. Value

About This Home

This home is located at 617 8th St, Laurel, MD 20707 and is currently estimated at $536,674, approximately $279 per square foot. 617 8th St is a home located in Prince George's County with nearby schools including Laurel Elementary School, Dwight D. Eisenhower Middle School, and Laurel High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 10, 2019

Sold by

Gibson Gail and Gibson Troy

Bought by

Gibson Troy D and Gibson Andrea L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$279,400

Outstanding Balance

$244,197

Interest Rate

3.6%

Mortgage Type

New Conventional

Estimated Equity

$292,477

Purchase Details

Closed on

Jun 3, 2005

Sold by

Gibson Gail

Bought by

Gibson Gail and Gibson Troy

Purchase Details

Closed on

Dec 5, 1995

Sold by

Gibson William and Gibson Ellen

Bought by

Gibson Gail

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gibson Troy D | -- | Accommodation | |

| Gibson Gail | -- | -- | |

| Gibson Gail | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gibson Troy D | $279,400 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,450 | $520,400 | $100,500 | $419,900 |

| 2024 | $10,450 | $484,767 | -- | -- |

| 2023 | $9,741 | $449,133 | $0 | $0 |

| 2022 | $9,020 | $413,500 | $75,200 | $338,300 |

| 2021 | $8,913 | $410,267 | $0 | $0 |

| 2020 | $8,851 | $407,033 | $0 | $0 |

| 2019 | $7,910 | $403,800 | $75,200 | $328,600 |

| 2018 | $2,681 | $191,500 | $0 | $0 |

| 2017 | $3,314 | $180,400 | $0 | $0 |

| 2016 | -- | $169,300 | $0 | $0 |

| 2015 | -- | $169,300 | $0 | $0 |

| 2014 | $3,335 | $169,300 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 903 Montrose Ave

- 501 8th St

- 1000 8th St

- 1012 Ward St

- 916 Philip Powers Dr

- 413 Talbott Ave

- 910 Montgomery St Unit A

- 1028 Ward St

- 1016 Phillip Powers Dr

- 509 4th St

- 15012 Wheatland Place

- 15008 Courtland Place

- 1116 Westview Terrace

- 505A Montgomery St

- 8218 Londonderry Ct

- 1103 Montgomery St

- 322 Laurel Ave

- 8040 Sandy Spring Rd

- 19 Post Office Ave Unit 203

- 1202 Marton St

- 615 8th St

- 619 8th St

- 613 8th St

- 611 8th St

- 607 7th St

- 607 7th St Unit 100,103

- 607 7th St Unit 100,201

- 607 7th St Unit E

- 815 Gorman Ave

- 620 8th St

- 601 8th St

- 801 8th St

- 801 8th St

- 804 West St

- 711 Gorman Ave

- 603 7th St Unit 303

- 603 7th St Unit 204

- 603 7th St Unit 201

- 603 7th St Unit 203

- 603 7th St Unit U-104

Your Personal Tour Guide

Ask me questions while you tour the home.