6179 Lynanne Ct Columbus, OH 43231

Northern Woods NeighborhoodEstimated Value: $413,000 - $504,000

3

Beds

4

Baths

2,336

Sq Ft

$196/Sq Ft

Est. Value

About This Home

This home is located at 6179 Lynanne Ct, Columbus, OH 43231 and is currently estimated at $457,772, approximately $195 per square foot. 6179 Lynanne Ct is a home located in Franklin County with nearby schools including Northgate Intermediate, Avalon Elementary School, and Woodward Park Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 9, 2006

Sold by

Smith Brenda G and Brenda G Smith Trust

Bought by

Sweeney Timothy M and Sweeney Rebecca A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,000

Outstanding Balance

$153,798

Interest Rate

6.68%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$303,974

Purchase Details

Closed on

Apr 26, 2006

Sold by

Smith Brenda G

Bought by

Smith Brenda G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,000

Outstanding Balance

$153,798

Interest Rate

6.68%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$303,974

Purchase Details

Closed on

May 6, 2003

Sold by

Jtl Construction Inc

Bought by

Smith Gary R and Smith Brenda G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,750

Interest Rate

5.87%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sweeney Timothy M | $325,000 | Talon Group | |

| Smith Brenda G | -- | None Available | |

| Smith Gary R | $363,500 | Stewart Title Agency Of Colu |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sweeney Timothy M | $260,000 | |

| Previous Owner | Smith Gary R | $260,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,167 | $137,410 | $30,870 | $106,540 |

| 2023 | $6,088 | $137,410 | $30,870 | $106,540 |

| 2022 | $5,500 | $106,050 | $15,330 | $90,720 |

| 2021 | $5,510 | $106,050 | $15,330 | $90,720 |

| 2020 | $5,517 | $106,050 | $15,330 | $90,720 |

| 2019 | $5,117 | $84,350 | $12,250 | $72,100 |

| 2018 | $5,567 | $84,350 | $12,250 | $72,100 |

| 2017 | $5,114 | $84,350 | $12,250 | $72,100 |

| 2016 | $6,641 | $100,250 | $18,310 | $81,940 |

| 2015 | $6,028 | $100,250 | $18,310 | $81,940 |

| 2014 | $6,043 | $100,250 | $18,310 | $81,940 |

| 2013 | $3,136 | $105,490 | $19,250 | $86,240 |

Source: Public Records

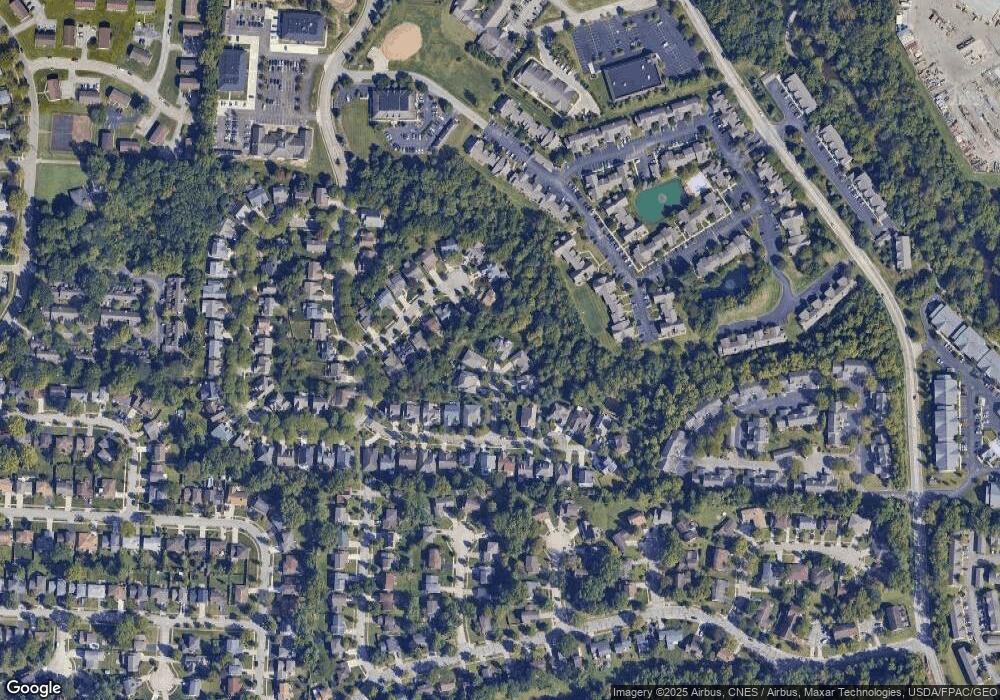

Map

Nearby Homes

- 3066 Ravine Pointe Dr Unit 3066

- 2721 Woodland Trail Dr Unit 2721

- 2981 Blendon Woods Blvd Unit 983

- 3038 Highcliff Ct

- 3001 Cooper Bluff Dr Unit 3001

- 2727 Patrick Ave

- 3070 Highcliff Ct Unit 3070

- 3068 Highcliff Ct Unit 3068

- 5841 Forest Hills Blvd Unit 5843

- 2677-2679 Blossom Ave

- 2800 Overview Ct Unit 2800B

- 5678 Great Hall Ct Unit 12C

- 5681 Oliver St

- 5670 Oliver St

- 5600 Cartwright Ln Unit 19

- 3129 Rainier Ave

- 2292 Laurelwood Dr Unit 2292L

- 89 Lancelot Ln Unit 89

- 3160 Adirondack Ave

- 3194 Adirondack Ave

- 6170 Lynanne Ct

- 6171 Lynanne Ct

- 2867 Hollow Cove Ct

- 2861 Hollow Cove Ct

- 6162 Lynanne Ct

- 2855 Hollow Cove Ct

- 6163 Lynanne Ct

- 2873 Hollow Cove Ct

- 2849 Hollow Cove Ct

- 2906 Kool Air Way

- 2914 Kool Air Way

- 2843 Hollow Cove Ct

- 2874 Kool Air Way

- 2864 Hollow Cove Ct

- 2837 Hollow Cove Ct

- 2866 Kool Air Way

- 2922 Kool Air Way

- 2858 Hollow Cove Ct

- 2852 Hollow Cove Ct

- 0 Kool Air Way