62 Hidden Fields Rd Hiawassee, GA 30546

Estimated Value: $1,137,574 - $1,217,000

Studio

1

Bath

3,641

Sq Ft

$324/Sq Ft

Est. Value

About This Home

This home is located at 62 Hidden Fields Rd, Hiawassee, GA 30546 and is currently estimated at $1,178,191, approximately $323 per square foot. 62 Hidden Fields Rd is a home located in Towns County with nearby schools including Towns County Elementary School, Towns County Middle School, and Towns County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 8, 2021

Sold by

Carter Ralph T

Bought by

Carter Ralph Thomas and Carter Teresa Ann

Current Estimated Value

Purchase Details

Closed on

May 1, 2013

Sold by

Ralph G and Ralph Sandra M

Bought by

Carter Ralph T and Carter Teresa A

Purchase Details

Closed on

Nov 17, 2011

Sold by

Turner Todd

Bought by

Turner Ralph G and Turner Sandra M

Purchase Details

Closed on

Sep 1, 2005

Sold by

Simon Carol

Bought by

Turner Todd and Turner Ralph

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$241,395

Interest Rate

5.77%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 13, 2002

Sold by

4 Evers Inc

Bought by

Simon Carol and Simon Bearse

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Carter Ralph Thomas | -- | -- | |

| Carter Ralph T | $300,000 | -- | |

| Turner Ralph G | -- | -- | |

| Turner Todd | $232,500 | -- | |

| Turner Todd | $232,500 | -- | |

| Simon Carol | $275,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Turner Todd | $241,395 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,852 | $358,716 | $140,000 | $218,716 |

| 2023 | $3,824 | $326,314 | $130,000 | $196,314 |

| 2022 | $3,681 | $314,135 | $130,000 | $184,135 |

| 2021 | $3,206 | $265,866 | $120,000 | $145,866 |

| 2020 | $3,102 | $242,061 | $110,000 | $132,061 |

| 2019 | $3,070 | $235,692 | $110,000 | $125,692 |

| 2018 | $3,100 | $232,189 | $110,000 | $122,189 |

| 2017 | $2,966 | $214,476 | $90,000 | $124,476 |

| 2016 | $2,967 | $214,476 | $90,000 | $124,476 |

| 2015 | $3,005 | $214,476 | $90,000 | $124,476 |

| 2014 | $1,401 | $99,177 | $90,000 | $9,177 |

| 2013 | -- | $90,000 | $90,000 | $0 |

Source: Public Records

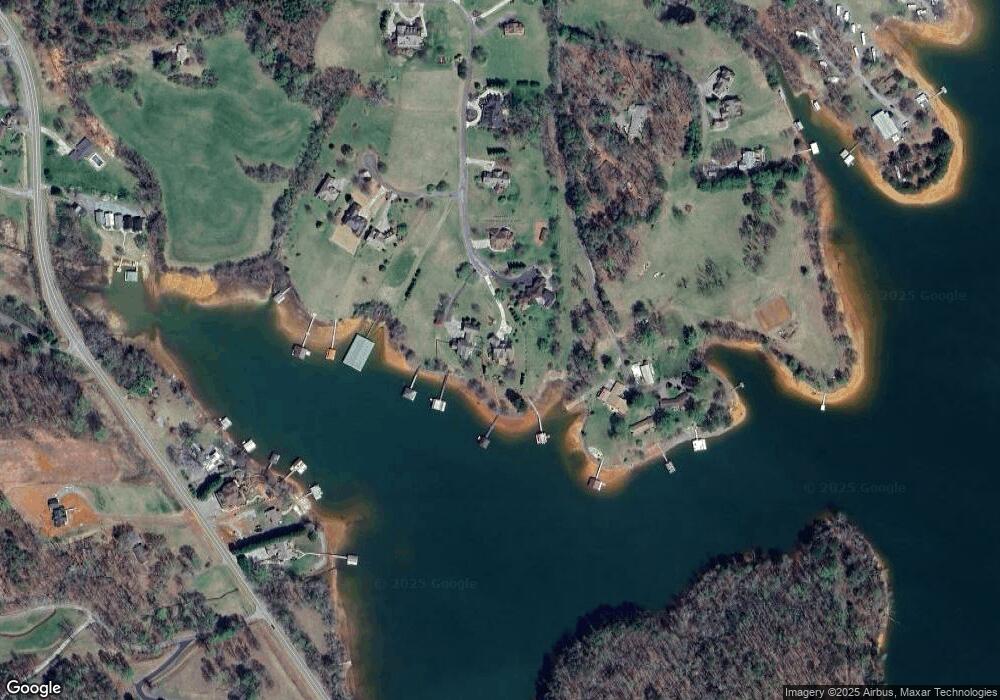

Map

Nearby Homes

- 1586 Us Hwy 76

- #2A & 2B Tranquil Pointe

- 903 Village Rd

- Lot 19 The Highlands

- Lot 3A/B Tranquil Pointe Ln

- 259 Tranquil Pointe Ln

- 2038 Highway 76

- 2038 U S 76

- 1404 Holly Point Dr

- 1481 Phillips Cove Dr

- 1507 Cedar View Ln

- 223 Red Bud Ln

- 1529 Cedar View Ct

- 1526 Cedar View Ln

- 1444 Kelley Way

- 1370 Heathers Cove Cir

- 2327 Ridgecrest Cir

- 1803 Chatuge Hills Rd

- 2145 Ridgecrest Cir

- 1951 Island View Dr

- 61 Hidden Fields Rd Unit 18

- 61 Hidden Fields Rd

- 63 Hidden Fields Rd

- 52 Hidden Fields Rd

- 59 Hidden Fields Rd

- 65 Hidden Fields Rd Unit 20

- 65 Hidden Fields Rd

- 41 Hidden Fields Ln

- 67 Hidden Fields Rd

- 55 Hidden Fields Rd

- 57 Hidden Fields Rd

- 60 Hidden Fields Rd

- 51 Hidden Fields Rd

- 51 Hidden Fields Rd Unit 13

- 879 Waldroup Rd

- 7 Tara Ln

- Lot #43 Hidden Fields Rd

- LOT 14 Hidden Fields Rd

- LT 16 Hidden Fields Rd

- #4 Hidden Fields Rd