620 Rr 1 Haskell, OK 74436

Estimated Value: $272,000 - $294,145

2

Beds

1

Bath

1,320

Sq Ft

$212/Sq Ft

Est. Value

About This Home

This home is located at 620 Rr 1, Haskell, OK 74436 and is currently estimated at $280,048, approximately $212 per square foot. 620 Rr 1 is a home located in Muskogee County with nearby schools including Mary White Elementary School, Haskell Middle School, and Haskell High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 30, 2020

Sold by

Grider Don and Grider Wanda

Bought by

Grider Don

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$138,000

Outstanding Balance

$122,861

Interest Rate

2.7%

Mortgage Type

New Conventional

Estimated Equity

$157,187

Purchase Details

Closed on

Nov 12, 2014

Bought by

Grider Don and Grider Wanda

Purchase Details

Closed on

Nov 10, 2014

Purchase Details

Closed on

Feb 2, 2009

Sold by

Bryce Tommy Joe and Bryce Lesllie

Bought by

Durrett Heath

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$62,165

Interest Rate

5.09%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Grider Don | -- | Pioneer Abstract & Title Co | |

| Grider Don | -- | None Available | |

| Grider Don | $36,000 | -- | |

| -- | -- | -- | |

| Durrett Heath | $63,000 | Pioneer Abstract & Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Grider Don | $138,000 | |

| Previous Owner | Durrett Heath | $62,165 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,819 | $16,059 | $4,079 | $11,980 |

| 2023 | $1,755 | $15,294 | $3,761 | $11,533 |

| 2022 | $1,345 | $14,566 | $3,754 | $10,812 |

| 2021 | $1,335 | $13,211 | $3,740 | $9,471 |

| 2020 | $1,355 | $13,211 | $3,740 | $9,471 |

| 2019 | $1,330 | $13,212 | $3,740 | $9,472 |

| 2018 | $1,372 | $13,461 | $3,740 | $9,721 |

| 2017 | $399 | $3,960 | $3,740 | $220 |

| 2016 | $376 | $3,960 | $3,740 | $220 |

| 2015 | $382 | $3,960 | $3,740 | $220 |

| 2014 | $1 | $1,870 | $1,650 | $220 |

Source: Public Records

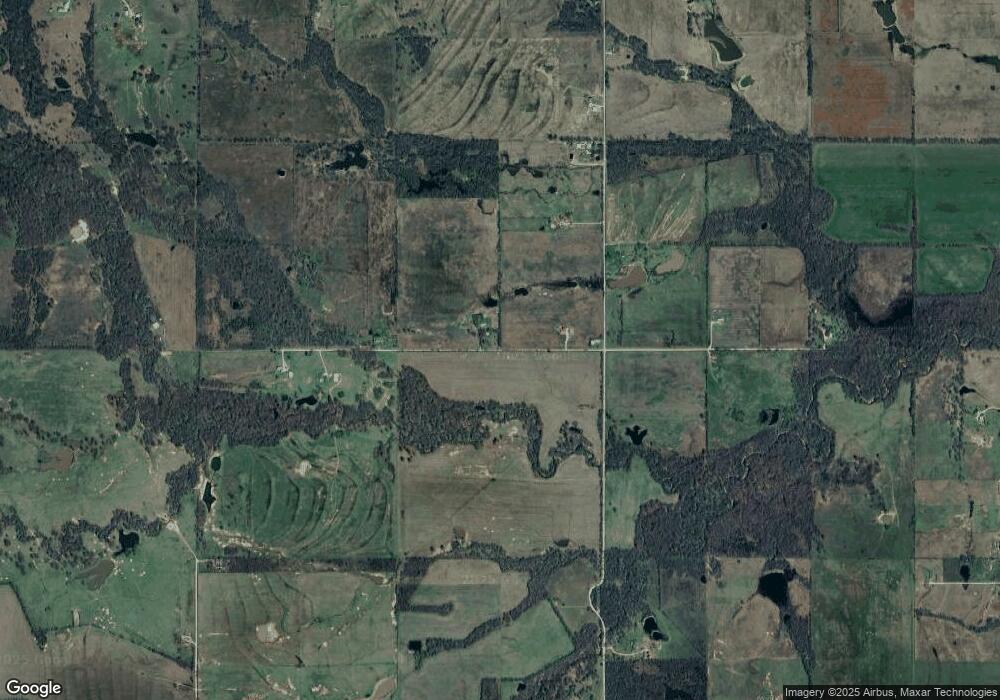

Map

Nearby Homes

- RC Foster II Plan at Cedar Village

- RC Franklin Plan at Cedar Village

- RC Ross Plan at Cedar Village

- RC Morgan Plan at Cedar Village

- RC Carson Plan at Cedar Village

- RC Coleman Plan at Cedar Village

- RC Fenway Plan at Cedar Village

- RC Clark Plan at Cedar Village

- RC Keswick Plan at Cedar Village

- 749 S Cherokee Ave

- 754 S Cherokee Ave

- 762 S Cherokee Ave

- 415 E Holly

- 511 S Creek Ave

- 766 S Cherokee Ave

- 420 E Holly St E

- 408 S Creek Ave

- 0 S Seminole Ave

- 0 S Osage Ave

- 0001 Highway 16