6203 Catalina Dr Unit 1322 The Havens North Myrtle Beach, SC 29582

Barefoot NeighborhoodEstimated Value: $230,827 - $239,000

2

Beds

2

Baths

1,050

Sq Ft

$223/Sq Ft

Est. Value

About This Home

This home is located at 6203 Catalina Dr Unit 1322 The Havens, North Myrtle Beach, SC 29582 and is currently estimated at $233,957, approximately $222 per square foot. 6203 Catalina Dr Unit 1322 The Havens is a home located in Horry County with nearby schools including Ocean Drive Elementary School, North Myrtle Beach Middle School, and North Myrtle Beach High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 17, 2017

Sold by

Federal National Mortgage Association

Bought by

Hill John Edward

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$76,500

Outstanding Balance

$51,743

Interest Rate

3.97%

Mortgage Type

New Conventional

Estimated Equity

$182,214

Purchase Details

Closed on

Nov 10, 2006

Sold by

Exchange Property 060812 Llc

Bought by

Cullop Carl W and Cullop Brenda L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$134,000

Interest Rate

6.31%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 31, 2006

Sold by

Centex Homes

Bought by

Exchange Property 060812 Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$68,362

Interest Rate

6.58%

Mortgage Type

Stand Alone Second

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hill John Edward | $102,000 | -- | |

| Cullop Carl W | $206,362 | None Available | |

| Exchange Property 060812 Llc | $201,800 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hill John Edward | $76,500 | |

| Previous Owner | Cullop Carl W | $134,000 | |

| Previous Owner | Exchange Property 060812 Llc | $68,362 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,939 | $15,360 | $0 | $15,360 |

| 2023 | $1,939 | $13,650 | $0 | $13,650 |

| 2021 | $1,765 | $13,650 | $0 | $13,650 |

| 2020 | $1,746 | $13,650 | $0 | $13,650 |

| 2019 | $1,684 | $13,650 | $0 | $13,650 |

| 2018 | $1,579 | $12,075 | $0 | $12,075 |

| 2017 | $1,565 | $6,900 | $0 | $6,900 |

| 2016 | -- | $6,900 | $0 | $6,900 |

| 2015 | $1,551 | $12,075 | $0 | $12,075 |

| 2014 | $1,501 | $6,900 | $0 | $6,900 |

Source: Public Records

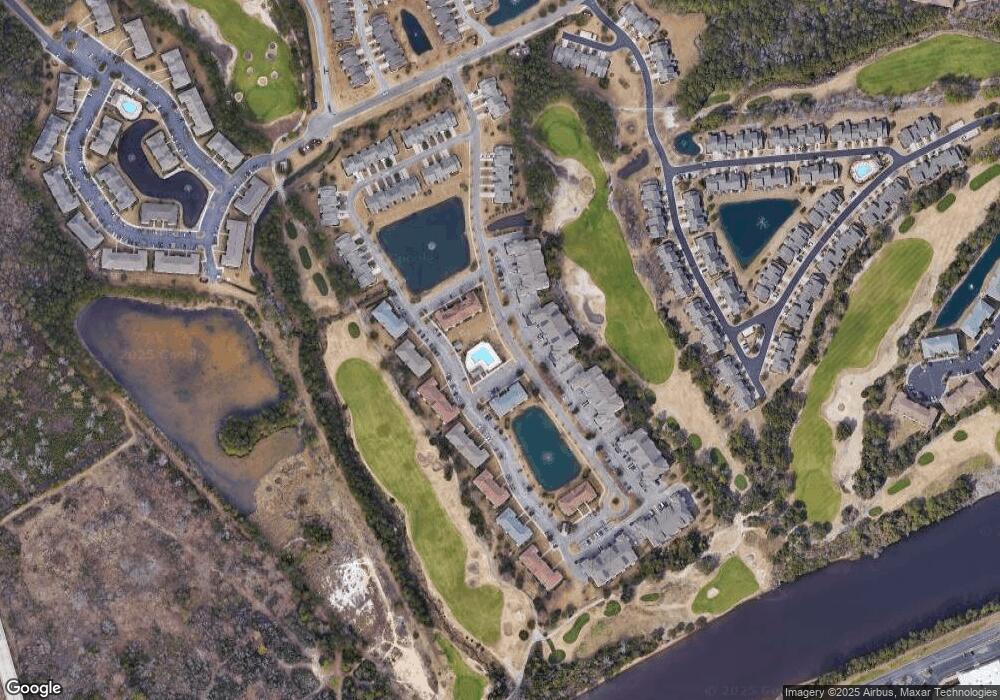

Map

Nearby Homes

- 6203 Catalina Dr Unit 114

- 6203 Catalina Dr Unit 534

- 6203 Catalina Dr Unit 1133

- 6203 Catalina Dr Unit 433

- 6203 Catalina Dr Unit 927

- 6203 Catalina Dr Unit 1137

- 6095 Catalina Dr Unit 1815

- 6095 Catalina Dr Unit 415

- 6095 Catalina Dr Unit 616

- 5801 Oyster Catcher Dr Unit 712

- 5801 Oyster Catcher Dr Unit 1624

- 5801 Oyster Catcher Dr Unit 1822

- 5801 Oyster Catcher Dr Unit 1923

- 5801 Oyster Catcher Dr Unit 313

- 5801 Oyster Catcher Dr Unit 1332

- 5801 Oyster Catcher Dr Unit 1721

- 5801 Oyster Catcher Dr Unit 533

- 5801 Oyster Catcher Dr Unit 332

- 5801 Oyster Catcher Dr Unit 432

- 5801 Oyster Catcher Dr Unit 413

- 6203 Catalina Dr Unit 1712

- 6203 Catalina Dr Unit 525

- 6203 Catalina Dr Unit 533

- 6203 Catalina Dr Unit 1822

- 6203 Catalina Dr Unit 1222

- 6203 Catalina Dr Unit 523

- 6203 Catalina Dr Unit 1722

- 6203 Catalina Dr Unit The Havens Building

- 6203 Catalina Dr Unit 1812 The Havens

- 6203 Catalina Dr Unit 531 The Havens

- 6203 Catalina Dr Unit 1821 The Havens@Bar

- 6203 Catalina Dr Unit The Havens 423

- 6203 Catalina Dr Unit 1321 The Havens

- 6203 Catalina Dr Unit 325 The Havens

- 6203 Catalina Dr Unit 1621 The Havens

- 6203 Catalina Dr Unit 1711 The Havens

- 6203 Catalina Dr Unit 1631 The Havens

- 6203 Catalina Dr Unit The Havens Building

- 6203 Catalina Dr Unit Havens 431

- 6203 Catalina Dr Unit 1114 The Havens