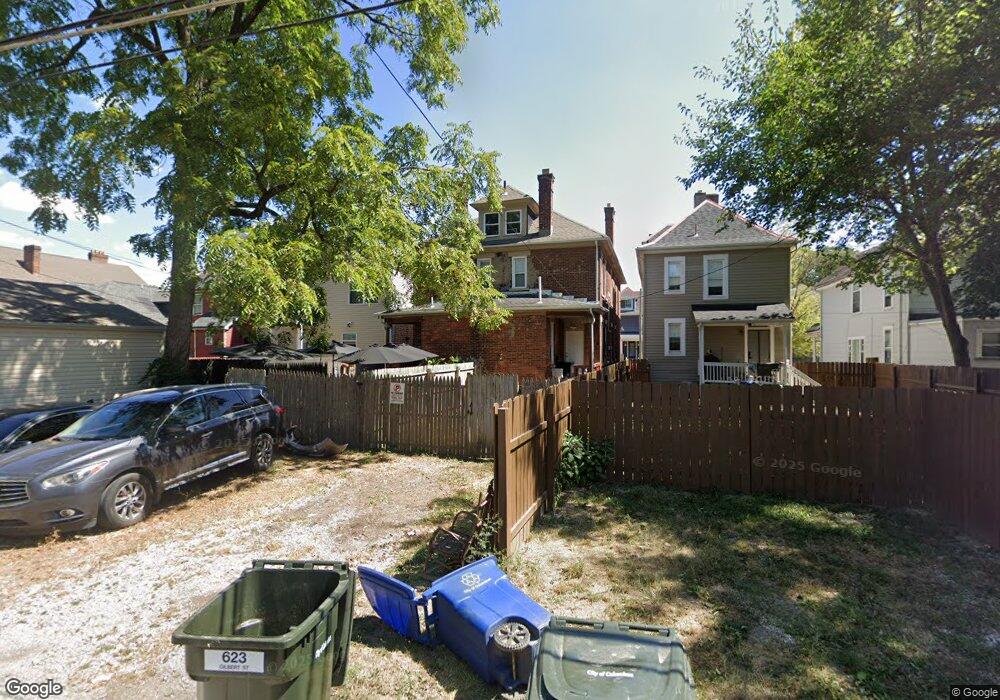

621-623 Gilbert St Columbus, OH 43205

Livingston Park NeighborhoodEstimated Value: $352,000 - $553,000

6

Beds

2

Baths

3,004

Sq Ft

$149/Sq Ft

Est. Value

About This Home

This home is located at 621-623 Gilbert St, Columbus, OH 43205 and is currently estimated at $448,855, approximately $149 per square foot. 621-623 Gilbert St is a home located in Franklin County with nearby schools including Livingston Elementary School, South High School, and Capital Collegiate Preparatory Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 2, 2017

Sold by

Sp For Better Living Llc

Bought by

Laurel Investments Llc

Current Estimated Value

Purchase Details

Closed on

Sep 27, 2013

Sold by

Bmi Federal Credit Union

Bought by

Sp For Better Living Trust

Purchase Details

Closed on

Nov 19, 2010

Sold by

Parker Shawn and Cooper Joseph A

Bought by

Bmi Federal Credit Union

Purchase Details

Closed on

Jul 13, 2007

Sold by

First Magnus Financial Corp

Bought by

Cooper Joseph

Purchase Details

Closed on

May 21, 2007

Sold by

Bird Richard

Bought by

First Magnus Financial Corp

Purchase Details

Closed on

Mar 19, 2002

Sold by

Beneficial Asset Management Llc

Bought by

Bird Richard

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$61,600

Interest Rate

6.87%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 19, 2001

Sold by

U S Bank Trust National Assn

Bought by

Beneficial Asset Management Llc

Purchase Details

Closed on

Jul 9, 2001

Sold by

Gibson Edwin

Bought by

Us Bank Trust National Assn and First Trust Bank National Assn

Purchase Details

Closed on

May 28, 1997

Sold by

Longstreth Craig A

Bought by

Gibson Edwin and Gibson Beth A

Purchase Details

Closed on

Aug 1, 1986

Purchase Details

Closed on

Sep 1, 1979

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Laurel Investments Llc | $137,000 | None Available | |

| Sp For Better Living Trust | $28,000 | None Available | |

| Bmi Federal Credit Union | $43,200 | Chase Title | |

| Cooper Joseph | $23,000 | None Available | |

| First Magnus Financial Corp | $20,000 | None Available | |

| Bird Richard | $61,600 | Amerititle Mill Run | |

| Beneficial Asset Management Llc | $25,000 | Amerititle Mill Run | |

| Us Bank Trust National Assn | $22,600 | Amerititle Mill Run | |

| Gibson Edwin | $49,000 | Ohio Title | |

| -- | $27,400 | -- | |

| -- | $6,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Bird Richard | $61,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,272 | $136,860 | $27,620 | $109,240 |

| 2023 | $6,194 | $136,850 | $27,615 | $109,235 |

| 2022 | $2,558 | $48,130 | $4,830 | $43,300 |

| 2021 | $2,562 | $48,130 | $4,830 | $43,300 |

| 2020 | $2,566 | $48,130 | $4,830 | $43,300 |

| 2019 | $2,495 | $40,120 | $4,030 | $36,090 |

| 2018 | $1,927 | $40,120 | $4,030 | $36,090 |

| 2017 | $2,059 | $33,120 | $4,030 | $29,090 |

| 2016 | $1,499 | $22,060 | $3,750 | $18,310 |

| 2015 | $1,364 | $22,060 | $3,750 | $18,310 |

| 2014 | $1,368 | $22,060 | $3,750 | $18,310 |

| 2013 | $711 | $23,240 | $3,955 | $19,285 |

Source: Public Records

Map

Nearby Homes

- 665 S 22nd St

- 669 S 22nd St

- 662 S 22nd St Unit 664

- 618 S 22nd St

- 575 Gilbert St

- 571 Gilbert St

- 674 S Ohio Ave

- 338 S Ohio Ave

- 903 E Livingston Ave

- 688 S Ohio Ave

- 712 S Ohio Ave

- 1036 Newton St Unit 38

- 631-633 S Champion Ave

- 785 Gilbert St

- 730 S Champion Ave

- 786 S Ohio Ave

- 1095 E Sycamore St

- 791-793 S Champion Ave

- 800 Carpenter St

- 0 Carpenter St

- 621 Gilbert St Unit 623

- 617 Gilbert St

- 623 Gilbert St

- 613 Gilbert St

- 631 Gilbert St

- 609 Gilbert St

- 637 Gilbert St

- 603-605 Gilbert St

- 603 Gilbert St

- 603- 605 Gilbert St

- 618 Carpenter St

- 622 Gilbert St

- 622 Carpenter St

- 618 Gilbert St

- 628 Carpenter St

- 608 Carpenter St Unit 610

- 626 Gilbert St

- 612 Carpenter St Unit 614

- 630 Gilbert St

- 632 Carpenter St