621 W 1460 S Spanish Fork, UT 84660

Estimated Value: $734,000 - $946,000

3

Beds

3

Baths

4,552

Sq Ft

$185/Sq Ft

Est. Value

About This Home

This home is located at 621 W 1460 S, Spanish Fork, UT 84660 and is currently estimated at $843,526, approximately $185 per square foot. 621 W 1460 S is a home located in Utah County with nearby schools including Riverview Elementary School, Spanish Fork Jr High School, and Spanish Fork High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 20, 2024

Sold by

Gillette Janet Rae

Bought by

Janet Rae Gillette Living Trust and Gillette

Current Estimated Value

Purchase Details

Closed on

Dec 19, 2018

Sold by

Settler Development Llc

Bought by

Gillette Kenneth Scott and Gillette Janet Rae

Purchase Details

Closed on

Feb 15, 2018

Sold by

Old Mill Capital Llc

Bought by

Settler Development Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$81,595

Interest Rate

4.04%

Mortgage Type

Commercial

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Janet Rae Gillette Living Trust | -- | None Listed On Document | |

| Gillette Kenneth Scott | -- | Mountain View Title | |

| Settler Development Llc | -- | Cottonwood Title Ins Ag |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Settler Development Llc | $81,595 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,951 | $441,870 | $286,400 | $517,000 |

| 2024 | $3,951 | $407,220 | $0 | $0 |

| 2023 | $4,059 | $418,880 | $0 | $0 |

| 2022 | $4,134 | $418,385 | $0 | $0 |

| 2021 | $3,539 | $573,000 | $171,100 | $401,900 |

| 2020 | $3,257 | $512,700 | $155,500 | $357,200 |

| 2019 | $2,845 | $471,200 | $147,000 | $324,200 |

| 2018 | $1,431 | $126,000 | $126,000 | $0 |

Source: Public Records

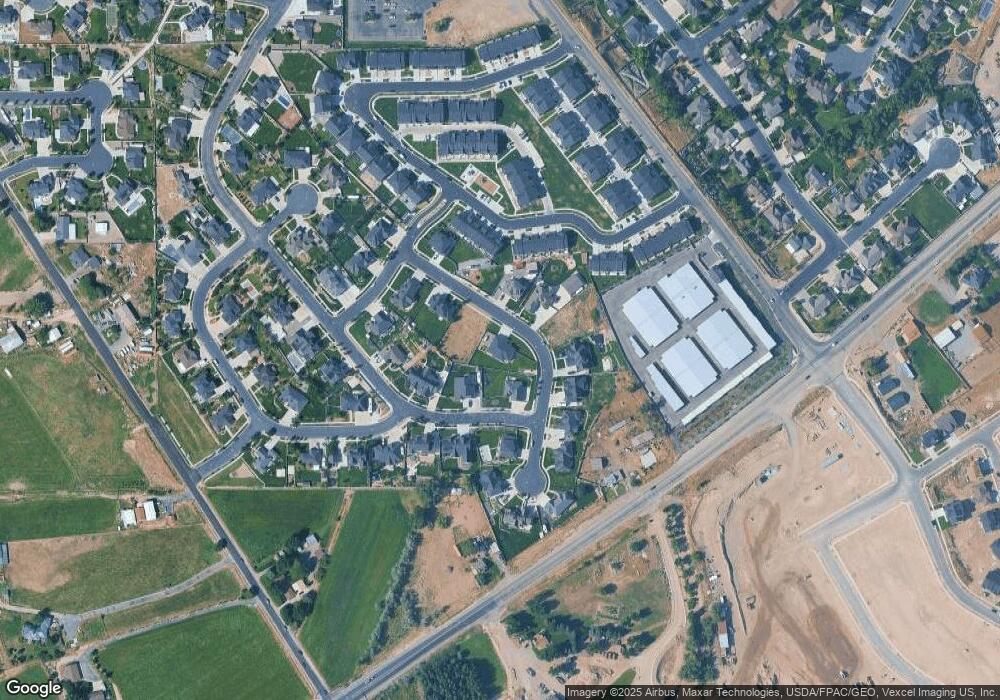

Map

Nearby Homes

- 632 W 1460 S

- 668 W 1370 S

- Orchard Plan at Skye Meadows

- Savannah Plan at Skye Meadows

- Ash Plan at Skye Meadows

- Hazel Plan at Skye Meadows

- Pasture Plan at Skye Meadows

- Grassland Plan at Skye Meadows

- Woodland Plan at Skye Meadows

- Willow Plan at Skye Meadows

- Blossom Plan at Skye Meadows

- 1611 S Del Monte Rd

- Meadow Plan at Skye Meadows

- Tundra Plan at Skye Meadows

- Birch Plan at Skye Meadows

- 286 W Hillcrest Dr Unit 4

- 264 W Hillcrest Dr

- 924 W 1390 S

- 242 W Hillcrest Dr Unit 6

- 1667 Del Monte Rd Unit 25

- 618 W 1550 S

- 652 W 1550 S

- 608 W 1460 S

- 632 W 1460 S Unit LOT 45

- 661 W 1460 S

- 1539 S 600 W

- 1515 S 600 W Unit 48

- 1537 S Barley Dr

- 1537 S 600 W Unit 49

- 1566 S 600 W

- 1553 S 600 W

- 611 W 1420 S

- 653 W 1550 S Unit 42

- 1418 S Castillo Rd

- 609 W 1420 S

- 1517 S Barley Dr Unit 35

- 1416 S Castillo Rd Unit 219

- 603 W 1420 S

- 1463 S Wheatfield Ln

- 668 W 1460 S