6211 Stove Prairie Rd Bellvue, CO 80512

Estimated Value: $670,000 - $820,000

3

Beds

2

Baths

1,350

Sq Ft

$545/Sq Ft

Est. Value

About This Home

This home is located at 6211 Stove Prairie Rd, Bellvue, CO 80512 and is currently estimated at $735,858, approximately $545 per square foot. 6211 Stove Prairie Rd is a home located in Larimer County with nearby schools including Stove Prairie Elementary School, Cache La Poudre Middle School, and Poudre High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 2, 2025

Sold by

Collins Shaun D

Bought by

Collins Shaun Duane and Collins Terry Jeanette

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$413,399

Outstanding Balance

$413,399

Interest Rate

6.72%

Mortgage Type

New Conventional

Estimated Equity

$322,459

Purchase Details

Closed on

May 16, 2005

Sold by

Davidson Linda L

Bought by

Collins Shaun D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$216,000

Interest Rate

5.92%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jan 1, 1991

Bought by

Davidson Linda L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Collins Shaun Duane | -- | Chicago Title | |

| Collins Shaun D | $270,000 | Fahtco | |

| Davidson Linda L | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Collins Shaun Duane | $413,399 | |

| Previous Owner | Collins Shaun D | $216,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,264 | $48,783 | $15,075 | $33,708 |

| 2024 | $2,989 | $47,583 | $15,075 | $32,508 |

| 2022 | $1,981 | $30,677 | $9,730 | $20,947 |

| 2021 | $1,997 | $31,560 | $10,010 | $21,550 |

| 2020 | $1,517 | $25,511 | $4,004 | $21,507 |

| 2019 | $1,524 | $25,511 | $4,004 | $21,507 |

| 2018 | $1,044 | $20,218 | $2,448 | $17,770 |

| 2017 | $1,040 | $20,218 | $2,448 | $17,770 |

| 2016 | $555 | $13,818 | $2,706 | $11,112 |

| 2015 | $312 | $3,920 | $2,710 | $1,210 |

| 2014 | $261 | $3,250 | $2,990 | $260 |

Source: Public Records

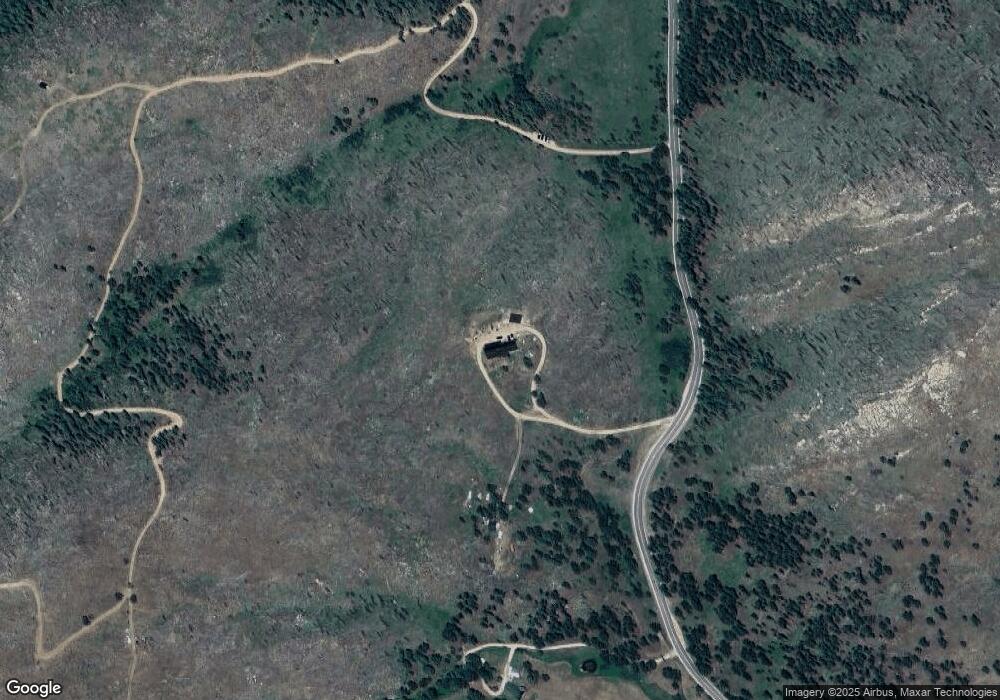

Map

Nearby Homes

- 0 Tbd Old Flowers Rd

- 9200 Old Flowers Rd

- 552 Blue Grouse Ln

- 0 Tbd Stratton Park Rd Lot 3

- 14884 Rist Canyon Rd

- 45 Bull Rock Ct

- 151 Black Mountain Ct

- 598 Mount McConnell Dr

- 107 Mount Audubon Way

- 743 Horse Mountain Dr

- 112 Rabbit Ears Ct

- 0 Tip Top Rd

- 0 Davis Ranch Rd Unit 1048176

- 0 Falls Creek Dr Unit 1048302

- 42 Smokey Mountain Ct

- 232 Red Mountain Ct

- 200 Falls Creek Dr

- 113 Purple Mountain Ct

- 0 Old Flowers Rd Unit 1032544

- 38 Carson Peak Ct