622 David Dr Streetsboro, OH 44241

Estimated Value: $194,000 - $248,000

3

Beds

2

Baths

1,656

Sq Ft

$139/Sq Ft

Est. Value

About This Home

This home is located at 622 David Dr, Streetsboro, OH 44241 and is currently estimated at $230,988, approximately $139 per square foot. 622 David Dr is a home located in Portage County with nearby schools including Streetsboro High School, Crossroads Christian Academy, and Seton Catholic Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 29, 2005

Sold by

Hud

Bought by

Lucas James S and Lucas Patricia A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$86,560

Outstanding Balance

$45,740

Interest Rate

6.05%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$185,248

Purchase Details

Closed on

Jan 4, 2005

Sold by

Leblanc Matthew M and Kent Regional Business Allianc

Bought by

Hud

Purchase Details

Closed on

Dec 10, 1998

Sold by

Desatnik Kenneth C and Tonkin Catherine M

Bought by

Leblanc Matthew M and Leblanc Laura L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$129,806

Interest Rate

6.93%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lucas James S | $108,200 | Lakeside Title & Escrow Agen | |

| Hud | $115,000 | -- | |

| Leblanc Matthew M | $129,900 | Approved Statewide Title Age |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lucas James S | $86,560 | |

| Previous Owner | Leblanc Matthew M | $129,806 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,626 | $73,330 | $15,090 | $58,240 |

| 2023 | $1,971 | $48,200 | $15,090 | $33,110 |

| 2022 | $1,994 | $48,200 | $15,090 | $33,110 |

| 2021 | $2,002 | $48,200 | $15,090 | $33,110 |

| 2020 | $2,000 | $44,910 | $15,090 | $29,820 |

| 2019 | $2,018 | $44,910 | $15,090 | $29,820 |

| 2018 | $1,575 | $40,500 | $15,090 | $25,410 |

| 2017 | $1,575 | $40,500 | $15,090 | $25,410 |

| 2016 | $1,577 | $40,500 | $15,090 | $25,410 |

| 2015 | $1,579 | $40,500 | $15,090 | $25,410 |

| 2014 | $1,593 | $40,500 | $15,090 | $25,410 |

| 2013 | $1,586 | $40,500 | $15,090 | $25,410 |

Source: Public Records

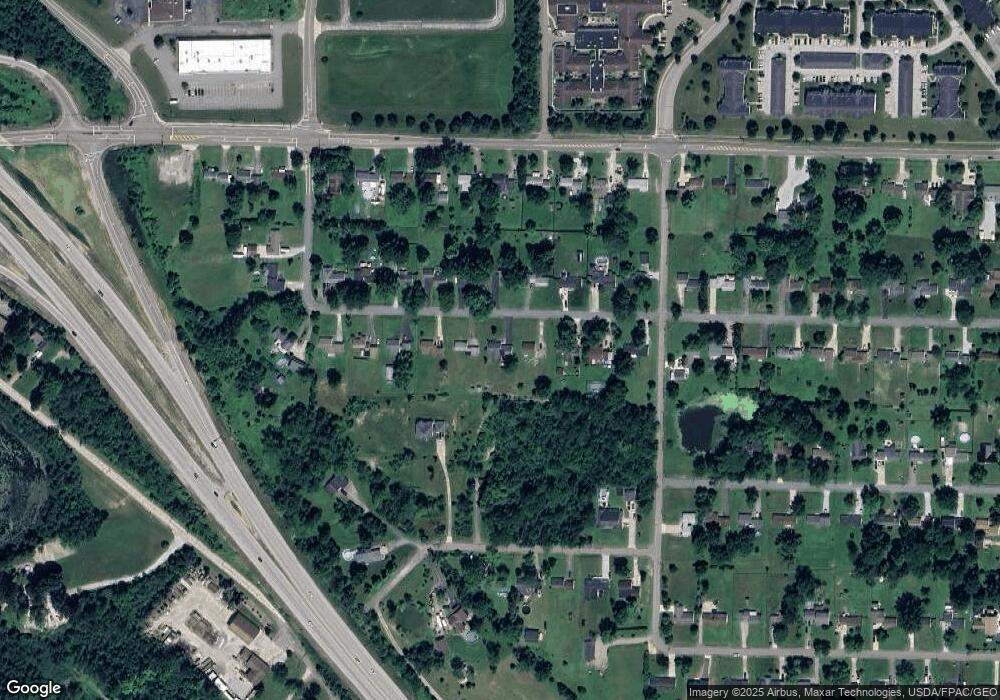

Map

Nearby Homes

- 572 David Dr

- 10045 Brushwood Dr

- 10131 Buckhorn Trail

- 749 Antler Trail

- 805 Hunter Ridge Dr

- 932 Bristol Ln Unit O47

- 955 Bristol Ln

- 1041 Fronek Dr

- 10150 Gloucester Rd

- 9802 S Delmonte Blvd

- 10100 N Delmonte Blvd

- 701 Gold Leaf Ct

- 713 Gold Leaf Ct

- 9381 Hickory Ridge Dr

- 9868 Meldon Dr

- 1159 Shawnee Trail

- 1223 Cherokee Trail

- 9989 Beverly Ln Unit 5E

- 9251 Chestnut Ct

- 1290 Edgewood Ln