6222 Illahee Rd NE Bremerton, WA 98311

Estimated Value: $565,000 - $663,000

2

Beds

2

Baths

1,358

Sq Ft

$443/Sq Ft

Est. Value

About This Home

This home is located at 6222 Illahee Rd NE, Bremerton, WA 98311 and is currently estimated at $601,307, approximately $442 per square foot. 6222 Illahee Rd NE is a home located in Kitsap County with nearby schools including View Ridge Elementary School, Mountain View Middle School, and Bremerton High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 22, 2024

Sold by

Grow Robert D and Grow Margaret E

Bought by

Robert And Margaret Grow Family Trust and Grow

Current Estimated Value

Purchase Details

Closed on

Dec 2, 2009

Sold by

Spearman John F

Bought by

Grow Robert D and Grow Margaret E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$256,000

Interest Rate

5.01%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 16, 2009

Sold by

Spearman John F and Spearman Kathleen L

Bought by

Spearman John F

Purchase Details

Closed on

Jul 21, 2005

Sold by

Spearman John F and Spearman Kathleen L

Bought by

Spearman John F and Spearman Kathleen L

Purchase Details

Closed on

Nov 3, 2003

Sold by

Groth C Dean

Bought by

Spearman John F and Spearman Kathleen L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$205,600

Interest Rate

4.87%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Robert And Margaret Grow Family Trust | $313 | None Listed On Document | |

| Grow Robert D | $320,280 | Land Title | |

| Spearman John F | -- | None Available | |

| Spearman John F | -- | None Available | |

| Spearman John F | $257,000 | Transnation Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Grow Robert D | $256,000 | |

| Previous Owner | Spearman John F | $205,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $5,247 | $533,910 | $280,110 | $253,800 |

| 2025 | $5,247 | $533,910 | $280,110 | $253,800 |

| 2024 | $5,068 | $533,910 | $280,110 | $253,800 |

| 2023 | $4,862 | $510,020 | $266,870 | $243,150 |

| 2022 | $4,583 | $425,330 | $220,550 | $204,780 |

| 2021 | $4,409 | $384,170 | $210,980 | $173,190 |

| 2020 | $3,907 | $351,310 | $191,930 | $159,380 |

| 2019 | $3,578 | $319,300 | $172,870 | $146,430 |

| 2018 | $4,147 | $268,650 | $142,930 | $125,720 |

| 2017 | $3,609 | $268,650 | $142,930 | $125,720 |

| 2016 | $3,640 | $257,520 | $136,120 | $121,400 |

| 2015 | $3,653 | $264,880 | $161,650 | $103,230 |

| 2014 | -- | $243,190 | $147,280 | $95,910 |

| 2013 | -- | $243,190 | $147,280 | $95,910 |

Source: Public Records

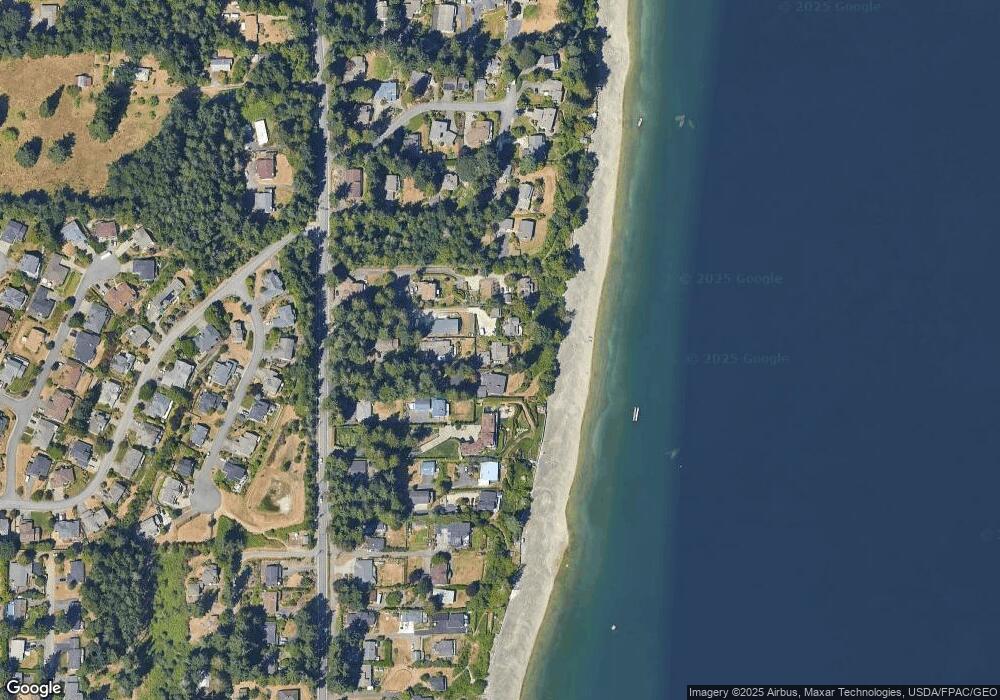

Map

Nearby Homes

- 4005 NE Derek Dr

- 3532 NE Shore Cliff St

- 3840 NE Ambleside Ln

- 3 Illahee Rd NE

- 6305 Rest Place NE

- 3744 NE Trout Brook Ln

- 5503 Fern Ave NE

- 3703 NE Trout Brook Ln

- 3380 NE 3rd St N Unit 29

- 5208 Illahee Rd NE

- 3709 NE Liverpool Dr

- 3060 NE Mcwilliams Rd Unit 104

- 3060 NE Mcwilliams Rd Unit 9

- 0 University Point Cir NE

- 2940 Osiris Ct NE

- 7550 Varsity Ln NE

- 4808 Charmont Ln NE

- 6957 Crystal Springs Dr NE

- 6371 Illahee Rd NE

- 7265 Thasos Ave NE

- 6232 Illahee Rd NE

- 6130 Illahee Rd NE

- 6244 Illahee Rd NE

- 6224 Illahee Rd NE

- 6228 Illahee Rd NE

- 6078 Illahee Rd NE

- 6112 Illahee Rd NE

- 6240 Illahee Rd NE

- 6272 Illahee Rd NE

- 6054 Illahee Rd NE

- 6226 Illahee Rd NE

- 6050 Illahee Rd NE

- 6106 Illahee Rd NE

- 6106 Illahee Unit 16

- 6364 Illahee Rd NE

- 6238 Illahee Rd NE

- 6362 Illahee Rd NE

- 6030 Illahee Rd NE

- 6056 Illahee Rd NE

- 6350 Illahee Rd NE