6239 W 24th Ave Unit 205 Hialeah, FL 33016

Estimated Value: $232,418 - $251,000

2

Beds

2

Baths

926

Sq Ft

$262/Sq Ft

Est. Value

About This Home

This home is located at 6239 W 24th Ave Unit 205, Hialeah, FL 33016 and is currently estimated at $242,855, approximately $262 per square foot. 6239 W 24th Ave Unit 205 is a home located in Miami-Dade County with nearby schools including Ben Sheppard Elementary School, Palm Springs Middle School, and Hialeah Gardens Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 29, 2025

Sold by

Land Trust No A12000 and Mel Trustees Llc

Bought by

Land Trust and Adventure Truste

Current Estimated Value

Purchase Details

Closed on

May 10, 2021

Sold by

Garbiras Maria Claudia

Bought by

Mel Trustees Llc

Purchase Details

Closed on

Apr 20, 2021

Sold by

Garbiras Maria Claudia

Bought by

Land Trust and Mel Truste

Purchase Details

Closed on

Apr 15, 2005

Sold by

Younis Mohammad and De Luna Pilar

Bought by

Garbiras Maria Claudia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,000

Interest Rate

5.98%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jun 1, 2000

Sold by

Carlos and Suarez Ada E

Bought by

Deluna Pilar and Younis Mohammad

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Land Trust | -- | None Listed On Document | |

| Mel Trustees Llc | $160,000 | Attorney | |

| Land Trust | $160,000 | None Listed On Document | |

| Garbiras Maria Claudia | $145,000 | Florida Title Mgmt Corp | |

| Deluna Pilar | $64,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Garbiras Maria Claudia | $125,000 | |

| Previous Owner | Deluna Pilar | $55,360 | |

| Previous Owner | Deluna Pilar | $12,640 | |

| Previous Owner | Deluna Pilar | $12,640 | |

| Previous Owner | Deluna Pilar | $55,360 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,395 | $190,450 | -- | -- |

| 2024 | $3,221 | $177,265 | -- | -- |

| 2023 | $3,221 | $161,150 | $0 | $0 |

| 2022 | $2,748 | $146,500 | $0 | $0 |

| 2021 | $2,499 | $129,470 | $0 | $0 |

| 2020 | $2,275 | $117,700 | $0 | $0 |

| 2019 | $2,534 | $130,817 | $0 | $0 |

| 2018 | $481 | $51,149 | $0 | $0 |

| 2017 | $480 | $50,097 | $0 | $0 |

| 2016 | $471 | $49,067 | $0 | $0 |

| 2015 | $473 | $48,726 | $0 | $0 |

| 2014 | $474 | $48,340 | $0 | $0 |

Source: Public Records

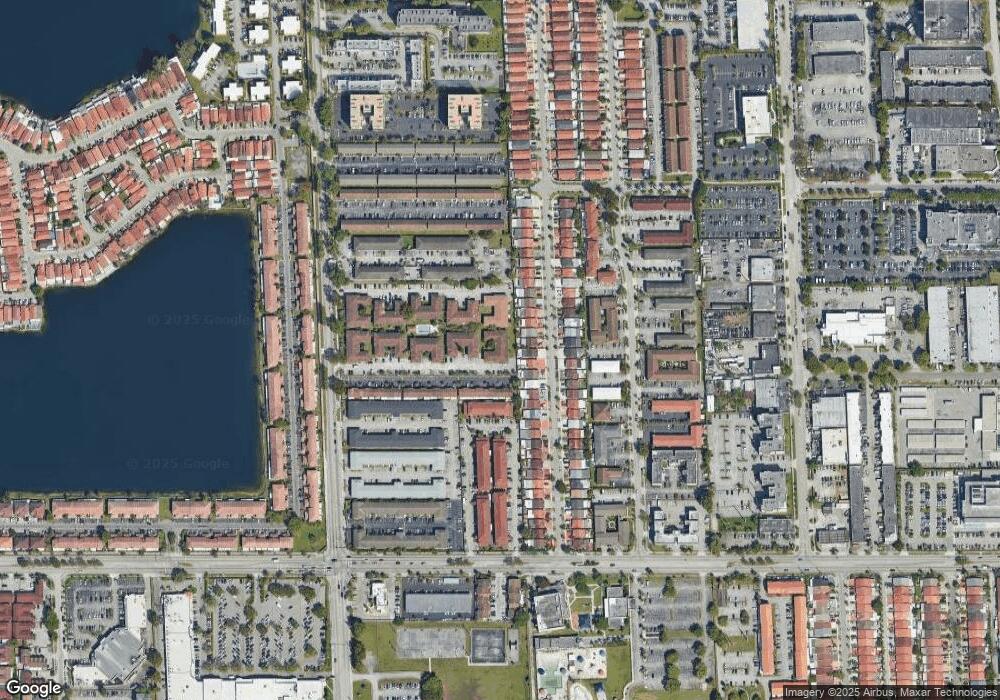

Map

Nearby Homes

- 6283 W 24th Ave Unit 1042

- 6121 W 24th Ave Unit 204

- 6020 W 22nd Ln

- 6091 W 22nd Ct Unit 104

- 2310 W 60th St Unit 7G

- 2310 W 60th St Unit 9G

- 2462 W 65th St

- 6060 W 21st Ct Unit 205

- 6060 W 21st Ct Unit 103

- 2341 W 66th Place Unit 103

- 6590 W 24th Ct

- 2377 W 66th Place Unit 204

- 2531 W 60th Place Unit 10518

- 5987 W 21st Ct

- 2174 W 60th St Unit 17205

- 2178 W 60th St Unit 18112

- 2150 W 60th St Unit 11101

- 2450 W 67th Place Unit 13-12

- 2614 W 65th St

- 6175 W 20th Ave Unit 205

- 6239 W 24th Ave Unit 1

- 6239 W 24th Ave Unit 1031

- 6239 W 24th Ave Unit 2011

- 6239 W 24th Ave Unit 2051

- 6239 W 24th Ave Unit 2021

- 6239 W 24th Ave Unit 2041

- 6239 W 24th Ave Unit 1011

- 6239 W 24th Ave Unit 1051

- 6239 W 24th Ave Unit 1021

- 6239 W 24th Ave Unit 2031

- 6239 W 24th Ave Unit 2061

- 6239 W 24th Ave Unit 1041

- 6239 W 24th Ave Unit 1061

- 6251 W 24 Ave Unit 206-10

- 6207 W 24th Ave Unit 106

- 6231 W 24th Ave Unit 1023

- 6207 W 24th Ave Unit 1029

- 6207 W 24th Ave Unit 2049

- 6207 W 24th Ave Unit 1059