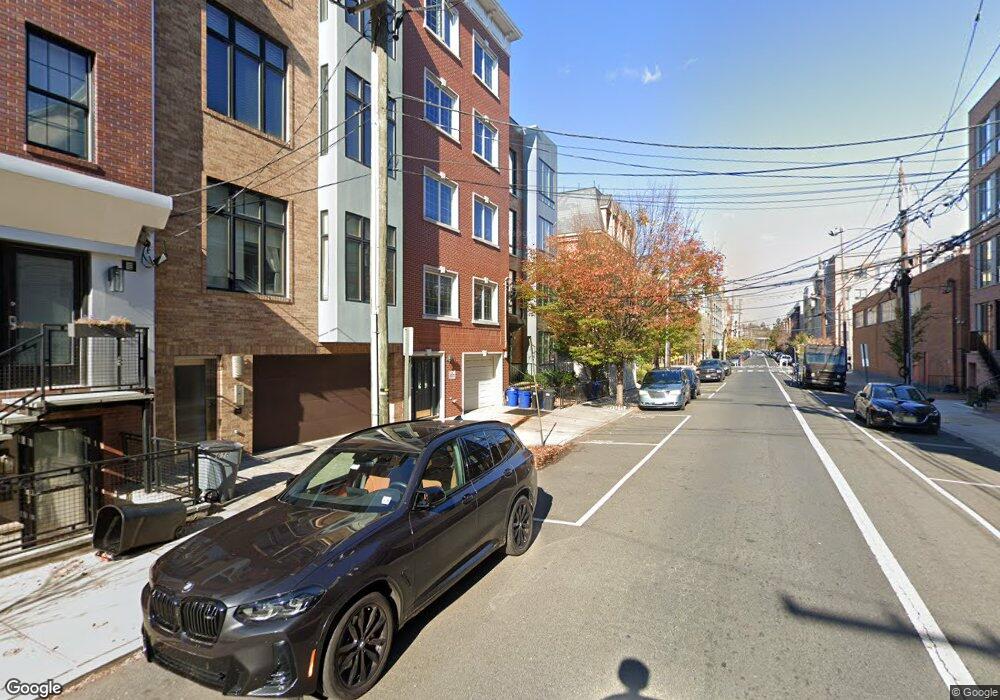

624 Monroe St Unit 626 Hoboken, NJ 07030

Estimated Value: $957,000 - $1,027,000

2

Beds

--

Bath

1,170

Sq Ft

$837/Sq Ft

Est. Value

About This Home

This home is located at 624 Monroe St Unit 626, Hoboken, NJ 07030 and is currently estimated at $979,826, approximately $837 per square foot. 624 Monroe St Unit 626 is a home located in Hudson County with nearby schools including Hoboken High School, Hoboken Catholic Academy, and Mustard Seed School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 12, 2020

Sold by

Jones Matthew Brenden and Jones Jami Daniele

Bought by

Scordo Alicia Irene and Rivera Hasche Andre

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$616,000

Outstanding Balance

$545,416

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$434,410

Purchase Details

Closed on

Mar 17, 2014

Sold by

Lynch Sean and Lynch Lauren

Bought by

Jones Matthew Brendan and Jones Jami Daniele

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$543,600

Interest Rate

3.37%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Sep 13, 2007

Sold by

Simeone Thomas A and Simeone Isabel C

Bought by

Sullivan Patrick

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$492,000

Interest Rate

6.59%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Scordo Alicia Irene | $770,000 | Guardian Title Services Llc | |

| Jones Matthew Brendan | $604,000 | Stewart Title Insurance Co | |

| Sullivan Patrick | $615,000 | Lt National Title Services |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Scordo Alicia Irene | $616,000 | |

| Previous Owner | Jones Matthew Brendan | $543,600 | |

| Previous Owner | Sullivan Patrick | $492,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,489 | $537,300 | $187,200 | $350,100 |

| 2024 | $8,753 | $537,300 | $187,200 | $350,100 |

| 2023 | $8,753 | $537,300 | $187,200 | $350,100 |

| 2022 | $8,602 | $537,300 | $187,200 | $350,100 |

| 2021 | $8,597 | $537,300 | $187,200 | $350,100 |

| 2020 | $8,656 | $537,300 | $187,200 | $350,100 |

| 2019 | $8,591 | $537,300 | $187,200 | $350,100 |

| 2018 | $8,489 | $537,300 | $187,200 | $350,100 |

| 2017 | $8,554 | $537,300 | $187,200 | $350,100 |

| 2016 | $8,334 | $537,300 | $187,200 | $350,100 |

| 2015 | $8,043 | $537,300 | $187,200 | $350,100 |

| 2014 | $7,423 | $537,300 | $187,200 | $350,100 |

Source: Public Records

Map

Nearby Homes

- 635 6th St Unit 2C

- 518 Monroe St Unit 2B

- 510 Monroe St Unit 408

- 523 Jefferson St Unit 3

- 418 Monroe St Unit 201

- 422 Madison St Unit 3L

- 502 Jefferson St Unit 1

- 528 Adams St Unit 2

- 412 Monroe St Unit 8

- 413 Monroe St Unit 500

- 800 Jackson St Unit 604

- 401 Ogden Ave Unit 1

- 401 Ogden Ave

- 401 Ogden Ave Unit 2

- 407 Monroe St Unit 2C

- 734 Adams St Unit 4D

- 717 Adams St Unit 4R

- 1 Congress St Unit C4

- 719 Adams St Unit 2R

- 413 Jefferson St Unit 1

- 624 Monroe St Unit 626

- 624 Monroe St Unit 626

- 624 Monroe St Unit 626

- 624 Monroe St Unit 626

- 624 Monroe St Unit 626

- 624 Monroe St Unit 626

- 624 Monroe St Unit 626

- 624 Monroe St Unit 5A

- 624 Monroe St Unit 3A

- 624 Monroe St Unit 5B

- 624 Monroe St Unit 2B

- 624 Monroe St Unit 3B

- 624 Monroe St Unit 4A

- 624 Monroe St Unit 2A

- 622 Monroe St

- 622 Monroe St Unit 2

- 622 Monroe St Unit 2nd Flr

- 622 Monroe St Unit 2nd Floor

- 620 Monroe St

- 620 Monroe St Unit 1