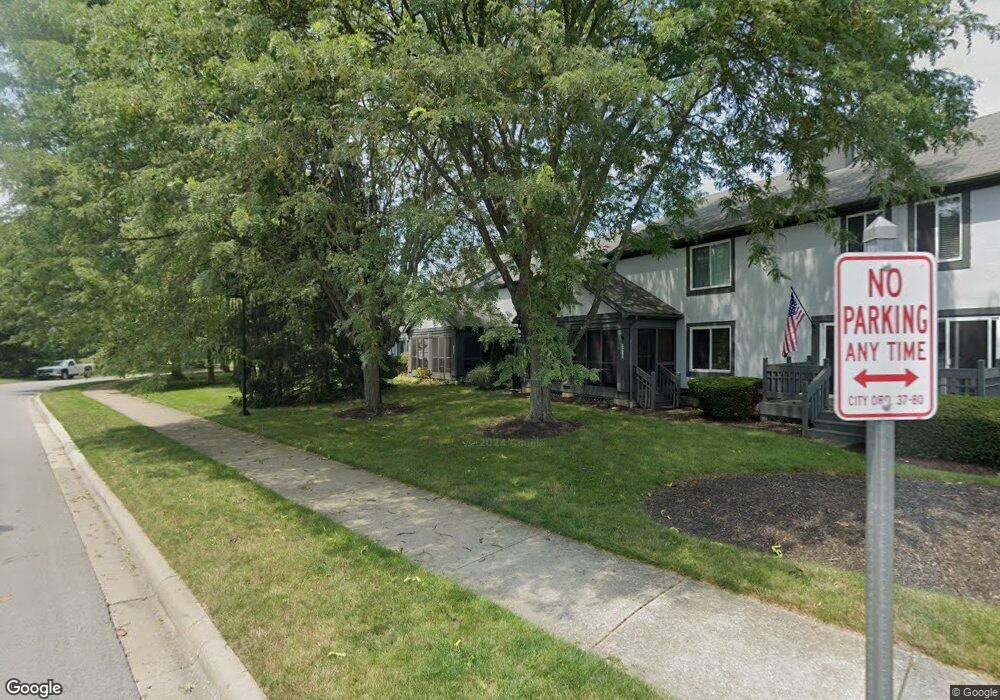

6282 Hyland Dr Dublin, OH 43017

Estimated Value: $306,177 - $318,000

2

Beds

2

Baths

1,280

Sq Ft

$244/Sq Ft

Est. Value

About This Home

This home is located at 6282 Hyland Dr, Dublin, OH 43017 and is currently estimated at $312,294, approximately $243 per square foot. 6282 Hyland Dr is a home located in Franklin County with nearby schools including Scottish Corners Elementary School, Henry Karrer Middle School, and Dublin Coffman High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 24, 2025

Sold by

Douglas Gretchen and Hagarman Gretchen L

Bought by

Gretchen L Hagarman Family Trust and Hagarman

Current Estimated Value

Purchase Details

Closed on

Jun 5, 2014

Sold by

Douglas Brian J and Douglas Gretchen L

Bought by

Douglas Gretchen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$114,750

Interest Rate

4.18%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 31, 2005

Sold by

I/M Development Co

Bought by

Douglas Brian J and Douglas Gretchen L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,100

Interest Rate

5.91%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 20, 1985

Bought by

I/M Development Co

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gretchen L Hagarman Family Trust | -- | None Listed On Document | |

| Douglas Gretchen | -- | Clean Title | |

| Douglas Brian J | $148,500 | Hummel Titl | |

| I/M Development Co | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Douglas Gretchen | $114,750 | |

| Previous Owner | Douglas Brian J | $126,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,446 | $83,830 | $18,200 | $65,630 |

| 2023 | $5,371 | $83,825 | $18,200 | $65,625 |

| 2022 | $4,151 | $59,230 | $12,080 | $47,150 |

| 2021 | $4,162 | $59,230 | $12,080 | $47,150 |

| 2020 | $4,196 | $59,230 | $12,080 | $47,150 |

| 2019 | $4,124 | $51,490 | $10,500 | $40,990 |

| 2018 | $4,127 | $51,490 | $10,500 | $40,990 |

| 2017 | $3,962 | $51,490 | $10,500 | $40,990 |

| 2016 | $4,085 | $51,450 | $10,500 | $40,950 |

| 2015 | $4,111 | $51,450 | $10,500 | $40,950 |

| 2014 | $4,116 | $51,450 | $10,500 | $40,950 |

| 2013 | $2,094 | $51,450 | $10,500 | $40,950 |

Source: Public Records

Map

Nearby Homes

- 6987 Dublin Village Dr

- 6956 Avery Rd

- 9786 Mesquite Ct

- 6937 Dublin Village Dr

- 6282 Twonotch Ct

- 7246 Sundown Ct

- 6088 Holywell Dr

- 7326 Pueblo Ct

- 6345 Angeles Dr

- 6369 Angeles Dr

- 6363 Phoenix Park Dr

- 7199 Achill Dr

- 5912 Tara Hill Dr

- 6992 Beery Ln

- 7307 Tullymore Dr

- 7470 Tullymore Dr

- 7168 Innisfree Ct

- 5735 McNeven Ct

- 7689 Johntimm Ct

- 6117 Craughwell Ln