6287 Royal Tern Crossing Unit 50-628 Columbus, OH 43230

Preserve South NeighborhoodEstimated Value: $225,000 - $234,098

2

Beds

2

Baths

1,485

Sq Ft

$155/Sq Ft

Est. Value

About This Home

This home is located at 6287 Royal Tern Crossing Unit 50-628, Columbus, OH 43230 and is currently estimated at $229,775, approximately $154 per square foot. 6287 Royal Tern Crossing Unit 50-628 is a home located in Franklin County with nearby schools including Avalon Elementary School, Northgate Intermediate, and Woodward Park Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 18, 2019

Sold by

Oliver V Charles M and Oliver Emily C

Bought by

Paisley Krystal L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$138,710

Outstanding Balance

$121,713

Interest Rate

4%

Mortgage Type

New Conventional

Estimated Equity

$108,062

Purchase Details

Closed on

May 10, 2016

Sold by

Amburgey Rikki

Bought by

Oliver V Charles M and Oliver Emily C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,700

Interest Rate

3.71%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 18, 2014

Sold by

Smith William L

Bought by

Amburgey Rikki

Purchase Details

Closed on

Jul 9, 2007

Sold by

Preserve Crossing Ltd

Bought by

Smith William L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$118,563

Interest Rate

6.66%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Paisley Krystal L | $143,000 | None Available | |

| Oliver V Charles M | $106,000 | None Available | |

| Amburgey Rikki | $103,000 | First Ohio Title Ins Box | |

| Smith William L | $119,500 | Connor Land |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Paisley Krystal L | $138,710 | |

| Previous Owner | Oliver V Charles M | $100,700 | |

| Previous Owner | Smith William L | $118,563 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,182 | $70,910 | $16,800 | $54,110 |

| 2023 | $3,142 | $70,910 | $16,800 | $54,110 |

| 2022 | $2,465 | $47,530 | $12,250 | $35,280 |

| 2021 | $2,470 | $47,530 | $12,250 | $35,280 |

| 2020 | $2,473 | $47,530 | $12,250 | $35,280 |

| 2019 | $2,733 | $45,050 | $9,800 | $35,250 |

| 2018 | $1,364 | $45,050 | $9,800 | $35,250 |

| 2017 | $2,675 | $45,050 | $9,800 | $35,250 |

| 2016 | $2,618 | $39,520 | $6,410 | $33,110 |

| 2015 | $2,376 | $39,520 | $6,410 | $33,110 |

| 2014 | $2,382 | $39,520 | $6,410 | $33,110 |

| 2013 | $191 | $6,405 | $6,405 | $0 |

Source: Public Records

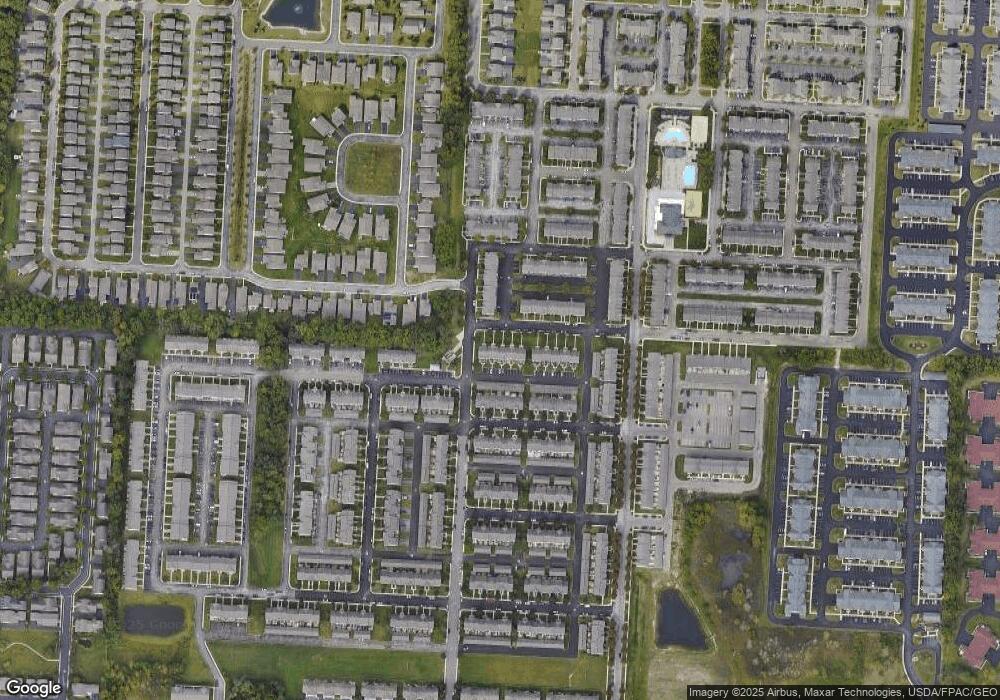

Map

Nearby Homes

- 6335 Hares Ear Dr Unit 30

- 6169 Needletail Rd

- 6200 Downwing Ln Unit 20

- 4654 Collingville Way Unit 21

- 4636 Collingville Way Unit 22

- 4135 Aumbrey Ct Unit 33

- 4143 Aumbrey Ct Unit 31

- 774 Windward Ln Unit 25774

- 4651 E Johnstown Rd

- 1270 Windward Way W Unit 22

- 4185 Windsor Bridge Place Unit 44185

- 4590 E Johnstown Rd

- 3725 Prestwould Close

- 4331 Bridgeside Place

- 5786 Thompson Rd

- 3685 Prestwould Close

- 685 Wilke Place Unit 2504

- 676 Grove Cir Unit 2204

- 855 Ludwig Dr

- 6439 Lake Mathias Dr

- 6287 Royal Tern Crossing

- 6283 Royal Tern Crossing Unit 50-628

- 6283 Royal Tern Crossing

- 6295 Royal Tern Crossing Unit 50-629

- 6291 Royal Tern Crossing Unit 50-629

- 6291 Royal Tern Crossing

- 6279 Royal Tern Crossing Unit 50

- 6279 Royal Tern Crossing

- 6271 Royal Tern Crossing

- 6299 Royal Tern Crossing Unit 50-629

- 6275 Royal Tern Crossing

- 6303 Royal Tern Crossing

- 6303 Royal Tern Crossing Unit 50-630

- 6307 Royal Tern Crossing

- 6315 Royal Tern Crossing Unit 49-631

- 6315 Royal Tern Crossing

- 6319 Royal Tern Crossing Unit 6319

- 6319 Royal Tern Crossing

- 6319 Royal Tern Crossing Unit 9-6319

- 6294 Marsh Wren Dr Unit 45-629