63 Astor Dr Harleysville, PA 19438

Estimated Value: $668,000 - $734,000

4

Beds

3

Baths

2,960

Sq Ft

$240/Sq Ft

Est. Value

About This Home

This home is located at 63 Astor Dr, Harleysville, PA 19438 and is currently estimated at $710,920, approximately $240 per square foot. 63 Astor Dr is a home located in Montgomery County with nearby schools including Vernfield Elementary School, Indian Valley Middle School, and Souderton Area Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 30, 2024

Sold by

Dyer Richard C and Dyer Andrea

Bought by

Dyer Andrea and Sanchez Esteban Rafael

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$323,000

Outstanding Balance

$320,757

Interest Rate

6.81%

Mortgage Type

New Conventional

Estimated Equity

$390,163

Purchase Details

Closed on

Jul 14, 2022

Sold by

Dyer Richard C

Bought by

Dyer Richard C and Dyer Andrea

Purchase Details

Closed on

Sep 8, 2014

Sold by

Dyer Richard C and Cragle Janet L

Bought by

Dyer Richard C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$328,000

Interest Rate

4.13%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dyer Andrea | $705,000 | Indian Valley Closing Services | |

| Dyer Richard C | -- | Mullaney & Mullaney Llc | |

| Dyer Richard C | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Dyer Andrea | $323,000 | |

| Previous Owner | Dyer Richard C | $328,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,867 | $265,920 | $65,910 | $200,010 |

| 2024 | $10,867 | $265,920 | $65,910 | $200,010 |

| 2023 | $10,307 | $265,920 | $65,910 | $200,010 |

| 2022 | $9,995 | $265,920 | $65,910 | $200,010 |

| 2021 | $9,847 | $265,920 | $65,910 | $200,010 |

| 2020 | $9,729 | $265,920 | $65,910 | $200,010 |

| 2019 | $9,615 | $265,920 | $65,910 | $200,010 |

| 2018 | $9,616 | $265,920 | $65,910 | $200,010 |

| 2017 | $9,392 | $265,920 | $65,910 | $200,010 |

| 2016 | $9,289 | $265,920 | $65,910 | $200,010 |

| 2015 | $9,120 | $265,920 | $65,910 | $200,010 |

| 2014 | $9,120 | $265,920 | $65,910 | $200,010 |

Source: Public Records

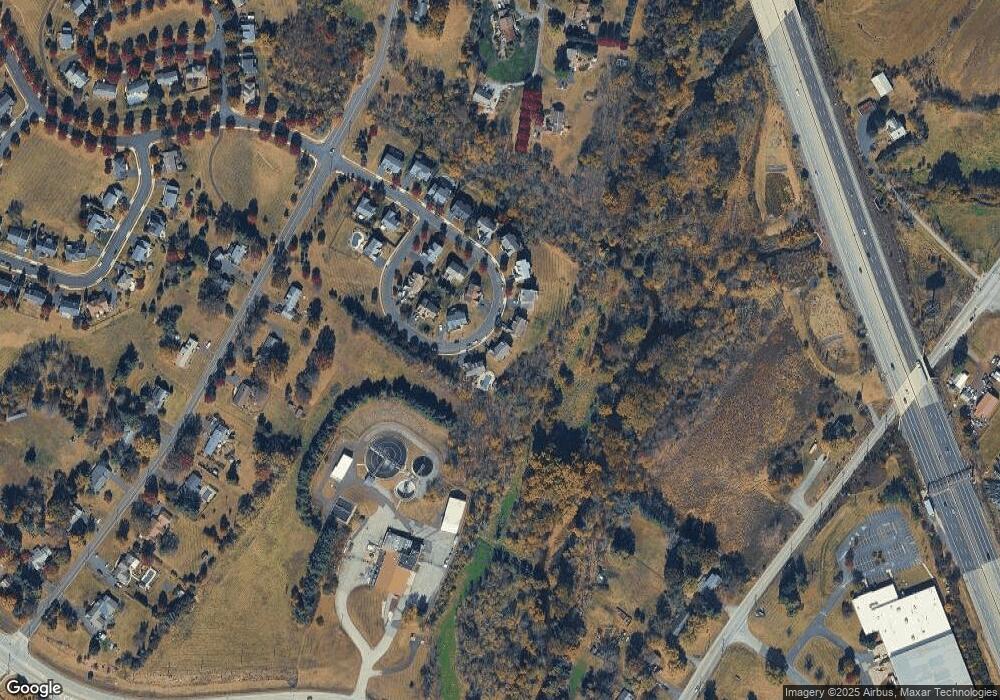

Map

Nearby Homes

- 340 Vanderbilt Ln

- 106 Main St

- 416 Ruth Ct

- 14 Ash Ct

- 11 Elder Ct

- 10 Bentwood Ct W

- 19 Wildbriar Ct

- 30 Greenbriar Ct

- 375 Belcourt Way

- 25 Chestnut Ct E

- 309 Manor Rd

- 271 & 273 Shirley Dr

- 205 Green Bank Way

- 592 Blackmoor Ct

- 506 Clarella Ct

- 244 Sumner Ct

- 24 Newbury Way

- 2 Newbury Way

- 557 Broxton Ct

- 2415 Hillock Ct