63 Eb Rd Unit 1 Cleveland, GA 30528

Estimated Value: $323,399 - $350,000

3

Beds

2

Baths

1,148

Sq Ft

$294/Sq Ft

Est. Value

About This Home

This home is located at 63 Eb Rd Unit 1, Cleveland, GA 30528 and is currently estimated at $337,600, approximately $294 per square foot. 63 Eb Rd Unit 1 is a home located in White County with nearby schools including Mossy Creek Elementary School, White County 9th Grade Academy, and White County Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 23, 2022

Sold by

Trump Michael W

Bought by

Matuska Michael S and Bryant Destiny L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$281,325

Outstanding Balance

$269,406

Interest Rate

5.55%

Mortgage Type

VA

Estimated Equity

$68,194

Purchase Details

Closed on

Dec 8, 2017

Sold by

Taylor Caleb M

Bought by

Trump Michael W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,303

Interest Rate

3.9%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 3, 2013

Sold by

Us Bank National Associati

Bought by

Taylor Caleb M and Taylor Lara M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$85,714

Interest Rate

3.56%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 2, 2012

Sold by

Mitchell Timothy

Bought by

Us Bank National Association T

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Matuska Michael S | $275,000 | -- | |

| Trump Michael W | $138,900 | -- | |

| Taylor Caleb M | $84,000 | -- | |

| Us Bank National Association T | $67,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Matuska Michael S | $281,325 | |

| Previous Owner | Trump Michael W | $140,303 | |

| Previous Owner | Taylor Caleb M | $85,714 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,159 | $116,232 | $26,400 | $89,832 |

| 2024 | $2,187 | $116,232 | $26,400 | $89,832 |

| 2023 | $2,132 | $93,984 | $17,600 | $76,384 |

| 2022 | $1,730 | $72,900 | $16,000 | $56,900 |

| 2021 | $1,538 | $57,348 | $11,200 | $46,148 |

| 2020 | $1,470 | $52,224 | $11,200 | $41,024 |

| 2019 | $1,474 | $52,224 | $11,200 | $41,024 |

| 2018 | $1,472 | $52,148 | $11,200 | $40,948 |

| 2017 | $1,370 | $48,976 | $11,200 | $37,776 |

| 2016 | $1,090 | $38,940 | $11,200 | $27,740 |

| 2015 | $1,040 | $97,350 | $11,200 | $27,740 |

| 2014 | $899 | $84,000 | $0 | $0 |

Source: Public Records

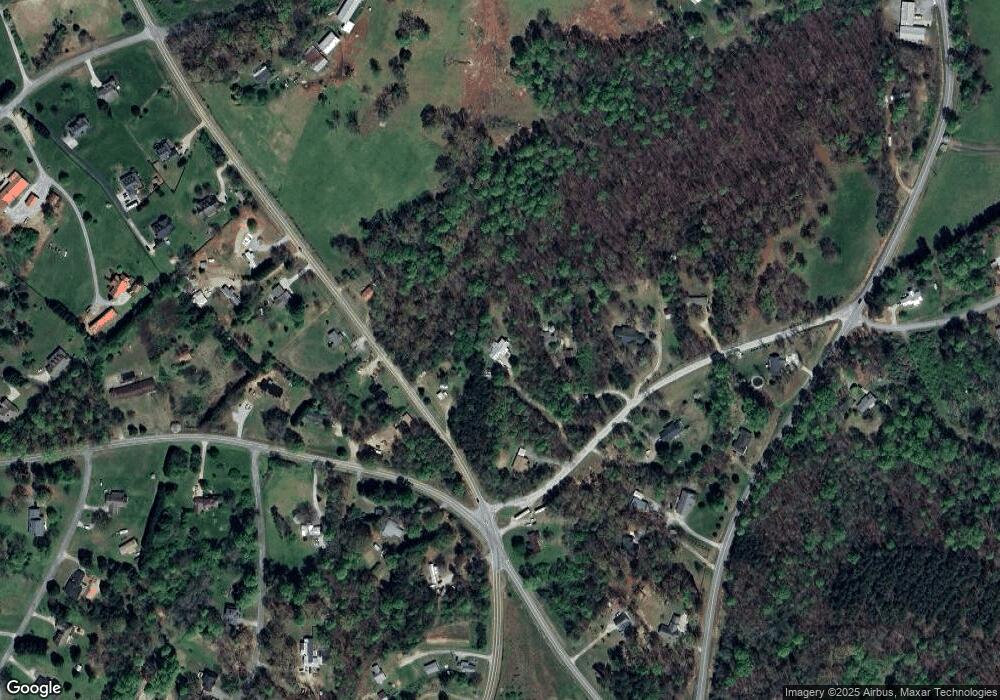

Map

Nearby Homes

- 3454 Highway 254

- 44 Quail Knoll Ln

- 2301 Highway 254

- 2459 New Bridge Rd

- 234 Mossy Creek Church Rd

- 330 Davidson Rd

- 3781 New Bridge Rd

- 3532 New Bridge Rd

- 96 Joyce Dr Unit (OFF AIRPORT ROAD)

- 96 Joyce Dr

- 0 Holiness Campground Rd Unit 10675385

- 82 Tom Teague Rd

- 320 Hickory Ridge Dr

- 265 Maple Ridge Dr

- 79 Hampton Hills Ln

- 185 Walnut Ridge Dr

- 196 Westmoreland Meadows Dr

- 0 Duncan Bridge Rd Unit 10660634

- 0 Duncan Bridge Rd Unit 10645363

- 176 Westmoreland Meadows Dr

Your Personal Tour Guide

Ask me questions while you tour the home.