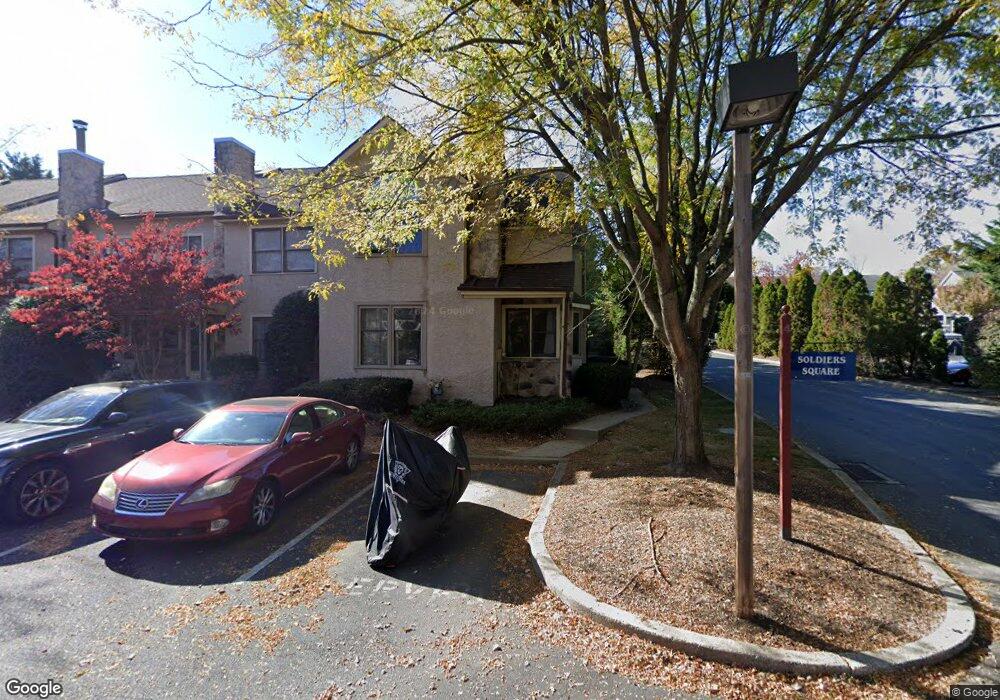

63 Soldiers Square Unit 63 Chesterbrook, PA 19087

Estimated Value: $561,000 - $614,000

3

Beds

3

Baths

2,602

Sq Ft

$223/Sq Ft

Est. Value

About This Home

This home is located at 63 Soldiers Square Unit 63, Chesterbrook, PA 19087 and is currently estimated at $580,255, approximately $223 per square foot. 63 Soldiers Square Unit 63 is a home located in Chester County with nearby schools including Valley Forge Elementary School, Valley Forge Middle School, and Conestoga Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 9, 2009

Sold by

Waldman Carol H

Bought by

Cuthbert Christian R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$315,800

Outstanding Balance

$201,338

Interest Rate

5.18%

Mortgage Type

FHA

Estimated Equity

$378,917

Purchase Details

Closed on

Jul 19, 2004

Sold by

Mccreesh Joseph A

Bought by

Waldman Carol H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$270,000

Interest Rate

6.28%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 5, 1997

Sold by

Dingman Bernard J and Dingman Michele L

Bought by

Mcfadden Patrick John and Mcfadden Matilde Valls

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,000

Interest Rate

7.19%

Mortgage Type

Balloon

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cuthbert Christian R | $344,900 | First American Title Ins Co | |

| Waldman Carol H | $300,000 | -- | |

| Mcfadden Patrick John | $170,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cuthbert Christian R | $315,800 | |

| Previous Owner | Waldman Carol H | $270,000 | |

| Previous Owner | Mcfadden Patrick John | $50,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,726 | $162,550 | $42,280 | $120,270 |

| 2024 | $5,726 | $162,550 | $42,280 | $120,270 |

| 2023 | $5,378 | $162,550 | $42,280 | $120,270 |

| 2022 | $5,239 | $162,550 | $42,280 | $120,270 |

| 2021 | $5,140 | $162,550 | $42,280 | $120,270 |

| 2020 | $4,998 | $162,550 | $42,280 | $120,270 |

| 2019 | $4,840 | $162,550 | $42,280 | $120,270 |

| 2018 | $4,744 | $162,550 | $42,280 | $120,270 |

| 2017 | $4,631 | $162,550 | $42,280 | $120,270 |

| 2016 | -- | $162,550 | $42,280 | $120,270 |

| 2015 | -- | $162,550 | $42,280 | $120,270 |

| 2014 | -- | $162,550 | $42,280 | $120,270 |

Source: Public Records

Map

Nearby Homes

- 107 Reveille Rd

- 620 Washington Place Unit 20

- 1410 Washington Place Unit 10

- 108 Valley Stream Cir Unit 108A

- 32 Main St

- 413 Cannon Ct Unit 413

- 19 Painters Ln

- 307 Cheswold Ct Unit 307

- 68 Amity Dr

- 1250 Swedesford Rd

- 793 Tory Hollow Rd

- 202 Shoreline Dr

- 1586 Salomon Ln

- 204 Camsten Ct

- 4 Hope Ln

- 170, 200, 220 Old State Rd

- 560 Clothier Springs Rd

- 387 Devonshire Rd

- 211 Wooded Way

- 306 Devonshire Rd

- 65 Soldiers Square Unit 11

- 61 Soldiers Square

- 59 Soldiers Square

- 57 Soldiers Square

- 91 Bunker Hill Ct

- 19 Lantern Ln

- 17 Lantern Ln

- 124 Reveille Rd

- 123 Reveille Rd Unit 123

- 122 Reveille Rd Unit 122

- 121 Reveille Rd

- 120 Reveille Rd

- 119 Reveille Rd Unit 119

- 118 Reveille Rd Unit 118

- 117 Reveille Rd

- 116 Reveille Rd

- 115 Reveille Rd Unit 115

- 114 Reveille Rd

- 113 Reveille Rd Unit 113

- 112 Reveille Rd Unit 117