63012 Beech Rd Wakarusa, IN 46573

Estimated Value: $334,000 - $420,000

3

Beds

1

Bath

1,556

Sq Ft

$246/Sq Ft

Est. Value

About This Home

This home is located at 63012 Beech Rd, Wakarusa, IN 46573 and is currently estimated at $382,007, approximately $245 per square foot. 63012 Beech Rd is a home located in St. Joseph County with nearby schools including Madison Elementary School, Virgil I. Grissom Middle School, and Penn High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 13, 2018

Sold by

Smith Devon L and Smith Constance A

Bought by

Anglemyer Lyle and Anglemyer Carrie

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,757

Outstanding Balance

$152,000

Interest Rate

4.5%

Mortgage Type

FHA

Estimated Equity

$230,007

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Anglemyer Lyle | $177,514 | None Listed On Document |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Anglemyer Lyle | $175,757 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,029 | $366,500 | $65,700 | $300,800 |

| 2023 | $2,190 | $308,200 | $65,700 | $242,500 |

| 2022 | $2,190 | $252,600 | $65,700 | $186,900 |

| 2021 | $1,811 | $215,600 | $61,800 | $153,800 |

| 2020 | $2,053 | $246,100 | $69,300 | $176,800 |

| 2019 | $1,488 | $186,900 | $52,600 | $134,300 |

| 2018 | $1,587 | $205,800 | $57,400 | $148,400 |

| 2017 | $1,229 | $168,000 | $47,800 | $120,200 |

| 2016 | $1,242 | $168,000 | $47,800 | $120,200 |

| 2014 | $750 | $116,700 | $32,900 | $83,800 |

Source: Public Records

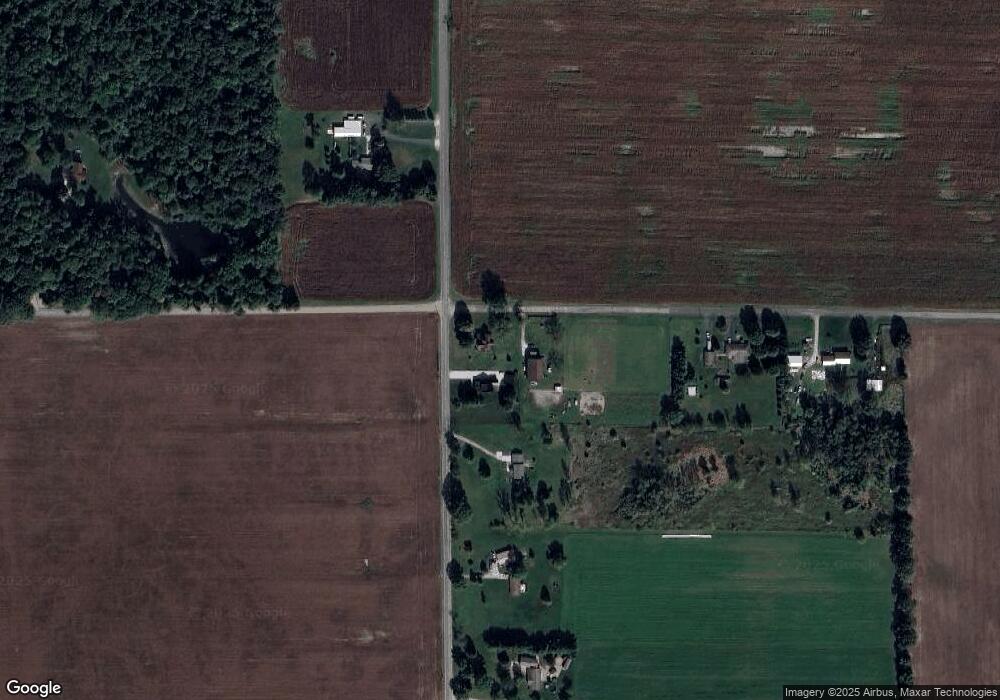

Map

Nearby Homes

- Indiana Ave County Road 1

- 60953 County Road 101

- 11652 Dragoon Trail

- 59412 County Road 1

- Lot 681A Stoneham Dr Unit 681A

- Lot 682A Stoneham Dr Unit 682A

- 317 E Waterford St

- 10076 Heather Lake Dr

- 29591 County Road 22

- 11249 Hemlock Dr

- Lot 619A Stoneham Unit 619

- Lot 683A Stoneham Unit 683

- 58155 Beehler Rd

- 30228 County Road 22

- 11211 Idlewood Dr

- VL Blackberry Rd

- 59309 Edna Rd

- Lot 608A Rosemont Place Unit 608A

- Lot 607A Rosemont Place Unit 607A

- Lot 677A Rosemont Place Unit 677A

- 63040 Beech Rd

- 63078 Beech Rd

- 62945 Beech Rd

- 10850 Madison Rd

- 63140 Beech Rd

- 63200 Beech Rd

- 10770 Madison Rd

- 11185 Madison Rd

- 62751 Beech Rd

- 11255 Madison Rd

- 62650 Beech Rd

- 63376 Beech Rd

- 10650 Madison Rd

- 63501 Beech Rd

- 10905 Martindale Rd

- 10741 Martindale Rd

- 11400 Madison Rd

- 10603 Madison Rd

- 10501 Martindale Rd

- 10601 Martindale Rd