6330 Crested Moss Dr Alpharetta, GA 30004

Estimated Value: $446,426 - $516,000

3

Beds

3

Baths

1,846

Sq Ft

$262/Sq Ft

Est. Value

About This Home

This home is located at 6330 Crested Moss Dr, Alpharetta, GA 30004 and is currently estimated at $482,857, approximately $261 per square foot. 6330 Crested Moss Dr is a home located in Forsyth County with nearby schools including Midway Elementary School, DeSana Middle School, and Denmark High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 12, 2016

Sold by

Dickinson Tara

Bought by

Qahhaar Muhammad and Roundtree Brittany D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$236,634

Outstanding Balance

$190,651

Interest Rate

3.87%

Mortgage Type

FHA

Estimated Equity

$292,206

Purchase Details

Closed on

Sep 30, 2015

Sold by

Medler Tyler S

Bought by

Newton Tara Dickinson

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$190,000

Interest Rate

3.93%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 5, 2013

Sold by

Rosewood Park Builders Llc

Bought by

Medler Tyler S and Medler Crystal

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,716

Interest Rate

3.4%

Mortgage Type

FHA

Purchase Details

Closed on

Apr 5, 2013

Sold by

Yost Communities At Mcfarl

Bought by

Rosewood Park Builders Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Qahhaar Muhammad | $241,000 | -- | |

| Newton Tara Dickinson | $220,000 | -- | |

| Medler Tyler S | $184,050 | -- | |

| Rosewood Park Builders Llc | $69,660 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Qahhaar Muhammad | $236,634 | |

| Previous Owner | Newton Tara Dickinson | $190,000 | |

| Previous Owner | Medler Tyler S | $180,716 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,755 | $202,384 | $78,000 | $124,384 |

| 2024 | $3,755 | $186,836 | $66,000 | $120,836 |

| 2023 | $3,002 | $163,924 | $56,000 | $107,924 |

| 2022 | $3,360 | $116,928 | $40,000 | $76,928 |

| 2021 | $2,921 | $116,928 | $40,000 | $76,928 |

| 2020 | $2,850 | $113,496 | $40,000 | $73,496 |

| 2019 | $2,785 | $110,624 | $40,000 | $70,624 |

| 2018 | $2,541 | $98,436 | $32,000 | $66,436 |

| 2017 | $2,362 | $89,500 | $32,000 | $57,500 |

| 2016 | $2,337 | $84,220 | $24,000 | $60,220 |

| 2015 | $2,079 | $74,780 | $20,000 | $54,780 |

| 2014 | $1,803 | $68,100 | $0 | $0 |

Source: Public Records

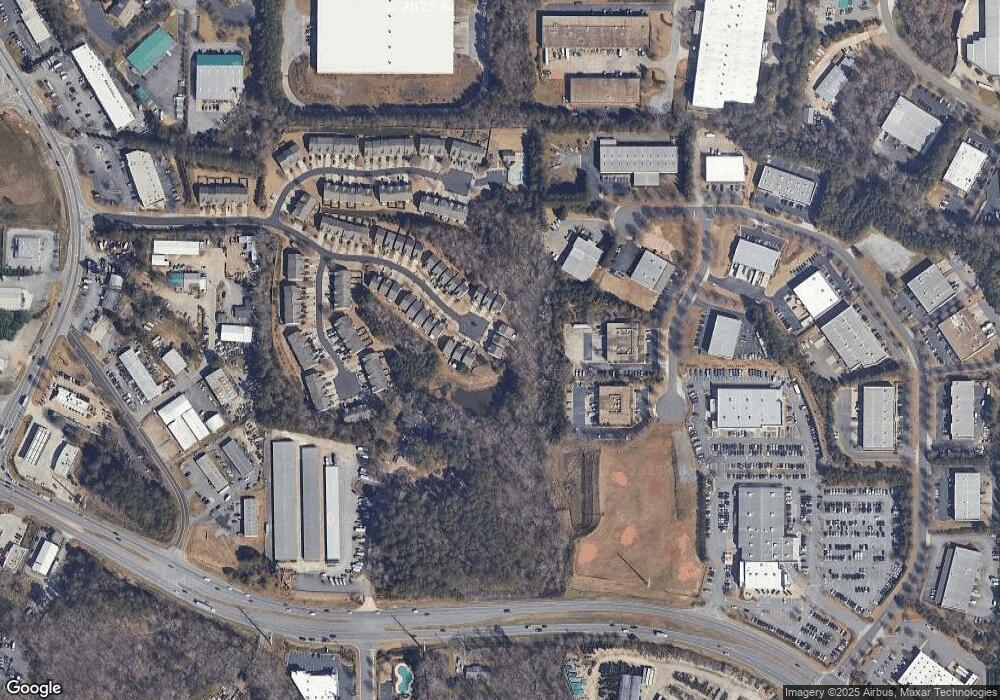

Map

Nearby Homes

- 5512 Atlanta Hwy

- 5880 Atlanta Hwy

- 5878A Atlanta Hwy

- 5878 Atlanta Hwy

- 6140 Cameo Ln

- 6215 Merrill View Ln

- 353 Grayson Way

- 368 Grayson Way

- 419 Grayson Way

- 472 Grayson Way

- 409 Windstone Trail

- 6660 Tulip Plantation Rd

- 1550 Township Cir

- 406 Weatherstone Place

- 255 White Pines Dr

- 465 Majestic Cove

- 125 Hopewell Grove Dr

- 6340 Crested Moss Dr

- 6350 Crested Moss Dr

- 6320 Crested Moss Dr

- 6310 Crested Moss Dr

- 6305 Crested Moss Dr

- 6205 Crested Moss Dr

- 6190 Crested Moss Dr

- 5965 Atlanta Hwy

- 5975 Crested Moss Dr

- 5975 Crested Moss Dr Unit 127

- 5977 Crested Moss Dr

- 5977 Crested Moss Dr Unit 128

- 5979 Crested Moss Dr Unit 129

- 5981 Crested Moss Dr Unit 130

- 5983 Crested Moss Dr Unit 131

- 5983 Crested Moss Dr

- 5985 Crested Moss Dr Unit 132

- 168 Creamer Dr

- 6010 Apple Rose Dr

- 6010 Apple Rose Dr Unit 42