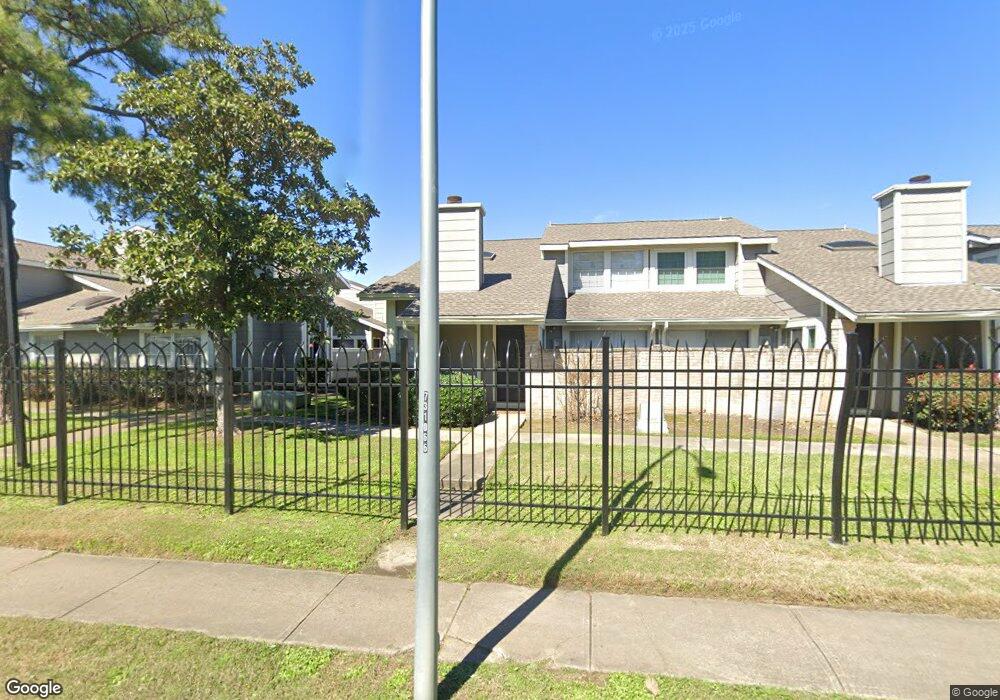

6334 W Airport Blvd Unit 633 Houston, TX 77035

Brays Oaks NeighborhoodEstimated Value: $117,000 - $213,000

3

Beds

2

Baths

1,196

Sq Ft

$123/Sq Ft

Est. Value

About This Home

This home is located at 6334 W Airport Blvd Unit 633, Houston, TX 77035 and is currently estimated at $147,013, approximately $122 per square foot. 6334 W Airport Blvd Unit 633 is a home located in Harris County with nearby schools including Anderson Elementary School, Fondren Middle School, and Westbury High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 31, 2021

Sold by

Rapini Luis and Brand Patricia

Bought by

Rapini & Brand Properties Llc

Current Estimated Value

Purchase Details

Closed on

Feb 7, 2015

Sold by

Ohiku Uwa and Ohiku Sophia U

Bought by

Rapini Luis and Brand Patricia

Purchase Details

Closed on

Sep 12, 2005

Sold by

Neal Ajibolade Carolyn and Ajibolade Ibikunle

Bought by

Ohiku Uwa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$26,950

Interest Rate

5.76%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Oct 21, 2003

Sold by

Suggs Robert O and Suggs Bonnie

Bought by

Ajibolade Ibikunle and Neal Ajibolade Carolyn

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rapini & Brand Properties Llc | -- | Concierge Title | |

| Rapini Luis | -- | American Title Co | |

| Ohiku Uwa | -- | -- | |

| Ajibolade Ibikunle | -- | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ohiku Uwa | $26,950 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,380 | $129,408 | $31,986 | $97,422 |

| 2024 | $2,380 | $113,730 | $26,655 | $87,075 |

| 2023 | $2,380 | $109,528 | $21,324 | $88,204 |

| 2022 | $2,341 | $101,695 | $10,662 | $91,033 |

| 2021 | $1,833 | $78,658 | $10,662 | $67,996 |

| 2020 | $1,665 | $66,012 | $10,662 | $55,350 |

| 2019 | $1,642 | $62,409 | $5,064 | $57,345 |

| 2018 | $1,273 | $50,318 | $5,064 | $45,254 |

| 2017 | $1,323 | $50,318 | $5,064 | $45,254 |

| 2016 | $1,117 | $42,510 | $5,064 | $37,446 |

| 2015 | $790 | $42,510 | $5,064 | $37,446 |

| 2014 | $790 | $30,718 | $5,064 | $25,654 |

Source: Public Records

Map

Nearby Homes

- 12227 Sandpiper Dr Unit 122

- 12225 Sandpiper Dr Unit 122

- 12235 Lemon Ridge Ln Unit 122

- 6324 Shadow Tree Dr Unit 632

- 12123 Lemon Ridge Ln Unit 121

- 12111 Lemon Ridge Ln Unit 121

- 12232 Bob White Dr Unit 122

- 6317 Peacock Hills Dr

- 12380 Sandpiper Dr Unit 810

- 12380 Sandpiper Dr Unit 405

- 6383 Dryad Dr Unit 638

- 6305 Dryad Dr Unit 630

- 6202 W Airport Blvd

- 12102 Bob White Dr Unit 121

- 6172 W Airport Blvd

- 6633 W Airport Blvd Unit 704

- 6633 W Airport Blvd Unit 1111

- 6633 W Airport Blvd Unit 1106

- 6633 W Airport Blvd Unit 514

- 6633 W Airport Blvd Unit 1208

- 6332 W Airport Blvd Unit 633

- 6346 W Airport Blvd Unit 634

- 6344 W Airport Blvd Unit 634

- 6330 W Airport Blvd Unit 633

- 6342 W Airport Blvd Unit 634

- 6342 W Airport Blvd Unit 6342

- 12255 Sandpiper Dr Unit 122

- 12253 Sandpiper Dr Unit 122

- 6340 W Airport Blvd Unit 634

- 12251 Sandpiper Dr Unit 122

- 6338 W Airport Blvd Unit 633

- 6326 W Airport Blvd Unit 632

- 6326 W Airport Blvd

- 12249 Sandpiper Dr Unit 122

- 12247 Sandpiper Dr Unit 122

- 12247 Sandpiper Dr Unit 47

- 6336 W Airport Blvd Unit 633

- 12245 Sandpiper Dr Unit 122

- 6345 Shadow Tree Dr

- 6343 Shadow Tree Dr