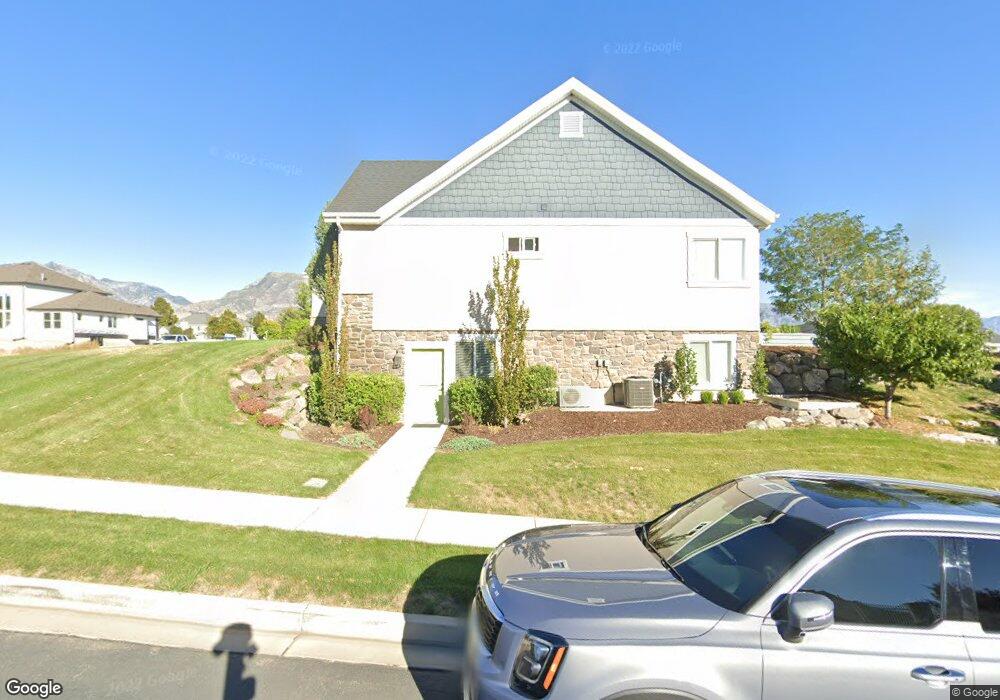

635 W 800 N Unit 1 American Fork, UT 84003

Estimated Value: $738,000 - $1,101,000

3

Beds

4

Baths

2,140

Sq Ft

$446/Sq Ft

Est. Value

About This Home

This home is located at 635 W 800 N Unit 1, American Fork, UT 84003 and is currently estimated at $955,482, approximately $446 per square foot. 635 W 800 N Unit 1 is a home located in Utah County with nearby schools including Shelley Elementary School, American Fork Junior High School, and American Fork High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 2, 2012

Sold by

Aa Development Inc

Bought by

Francis James and Francis Wendy

Current Estimated Value

Purchase Details

Closed on

Oct 6, 2011

Sold by

Wesr Radc Venture 2010-2 Llc

Bought by

Aa Development Inc

Purchase Details

Closed on

Sep 13, 2011

Sold by

Brookwood Construction & Design Inc

Bought by

Utah West Radc Llc

Purchase Details

Closed on

Mar 4, 2009

Sold by

Parker Heights Llc

Bought by

Brookwood Construction & Design Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Francis James | -- | None Available | |

| Aa Development Inc | -- | None Available | |

| West Radc Venture 2010-2 Llc | -- | Advanced Title | |

| Utah West Radc Llc | -- | Advanced Title | |

| Brookwood Construction & Design Inc | -- | First American American F |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Brookwood Construction & Design Inc | $0 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,637 | $461,120 | $304,900 | $533,500 |

| 2024 | $3,637 | $404,140 | $0 | $0 |

| 2023 | $3,384 | $398,585 | $0 | $0 |

| 2022 | $3,508 | $407,770 | $0 | $0 |

| 2021 | $2,927 | $531,500 | $213,500 | $318,000 |

| 2020 | $2,843 | $500,600 | $197,700 | $302,900 |

| 2019 | $2,716 | $494,700 | $197,700 | $297,000 |

| 2018 | $2,797 | $487,100 | $190,100 | $297,000 |

| 2017 | $2,179 | $204,820 | $0 | $0 |

| 2016 | $2,198 | $191,950 | $0 | $0 |

| 2015 | $2,282 | $189,145 | $0 | $0 |

| 2014 | $2,152 | $175,945 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 602 W 860 N

- 962 N 780 St W Unit 508

- 974 N 780 St W Unit 509

- 916 N 780 St W Unit 501

- 822 W 800 St N Unit LOT319

- 822 N 860 W Unit 317

- 641 N 420 W

- 987 N 410 W

- 914 N 400 W Unit A

- 3935 W 1000 N Unit 438

- 3983 W 1000 N Unit 442

- 4007 W 1000 N

- 3947 W 1000 N Unit 439

- 3959 W 1000 N

- 471 W 1040 N

- 3889 W 950 Cir N Unit 366

- 901 N Lakota Rd

- 777 W State Rd

- 425 W 1120 N

- 984 N 300 W

- 623 W 800 N

- 623 W 800 N Unit 2

- 632 W 750 N Unit 5

- 632 W 750 N

- 628 W 750 N

- 628 W 750 N Unit 6

- 672 W 750 N

- 611 W 800 N Unit 3

- 616 W 750 N Unit 7

- 599 W 800 N Unit 4

- 633 W 750 N

- 831 N 600 W

- 621 W 750 N

- 594 W 750 N Unit 8

- 594 W 750 N

- 806 N 600 W

- 745 N 600 W

- 966 W 800 N Unit 748

- 966 W 800 N

- 828 N 600 St W