6352 Upper Rd Cincinnati, OH 45233

Cotillion Village NeighborhoodEstimated Value: $201,930 - $243,000

2

Beds

2

Baths

1,116

Sq Ft

$198/Sq Ft

Est. Value

About This Home

This home is located at 6352 Upper Rd, Cincinnati, OH 45233 and is currently estimated at $220,983, approximately $198 per square foot. 6352 Upper Rd is a home located in Hamilton County with nearby schools including John Foster Dulles Elementary School, Rapid Run Middle School, and Oak Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 19, 2002

Sold by

King Donald K and Miller Bobbie J

Bought by

Lonneman Patrick J and Lonneman Judith K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$84,350

Outstanding Balance

$34,517

Interest Rate

6.63%

Estimated Equity

$186,466

Purchase Details

Closed on

Dec 19, 2001

Sold by

Kristy Espelage and Kristy Wayne L

Bought by

King Donald K and Miller Bobbie J

Purchase Details

Closed on

Oct 9, 1998

Sold by

Kaeser John and Kaeser Angela

Bought by

Espelage Kristy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$86,810

Interest Rate

6.72%

Mortgage Type

FHA

Purchase Details

Closed on

May 9, 1996

Sold by

Winchester William and Winchester Sharon D

Bought by

Kaeser John and Kaeser Angela

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$15,200

Interest Rate

7.86%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lonneman Patrick J | $114,000 | Title First Agency Inc | |

| King Donald K | $106,500 | -- | |

| Espelage Kristy | $86,900 | -- | |

| Kaeser John | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lonneman Patrick J | $84,350 | |

| Closed | Espelage Kristy | $86,810 | |

| Previous Owner | Kaeser John | $15,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,868 | $41,553 | $18,981 | $22,572 |

| 2024 | $1,830 | $41,553 | $18,981 | $22,572 |

| 2023 | $1,882 | $41,553 | $18,981 | $22,572 |

| 2022 | $1,647 | $33,947 | $17,609 | $16,338 |

| 2021 | $1,605 | $33,947 | $17,609 | $16,338 |

| 2020 | $1,639 | $33,947 | $17,609 | $16,338 |

| 2019 | $1,482 | $29,264 | $15,180 | $14,084 |

| 2018 | $1,484 | $29,264 | $15,180 | $14,084 |

| 2017 | $1,334 | $29,264 | $15,180 | $14,084 |

| 2016 | $1,766 | $36,026 | $15,218 | $20,808 |

| 2015 | $1,774 | $36,026 | $15,218 | $20,808 |

| 2014 | $1,777 | $36,026 | $15,218 | $20,808 |

| 2013 | $1,838 | $38,735 | $16,363 | $22,372 |

Source: Public Records

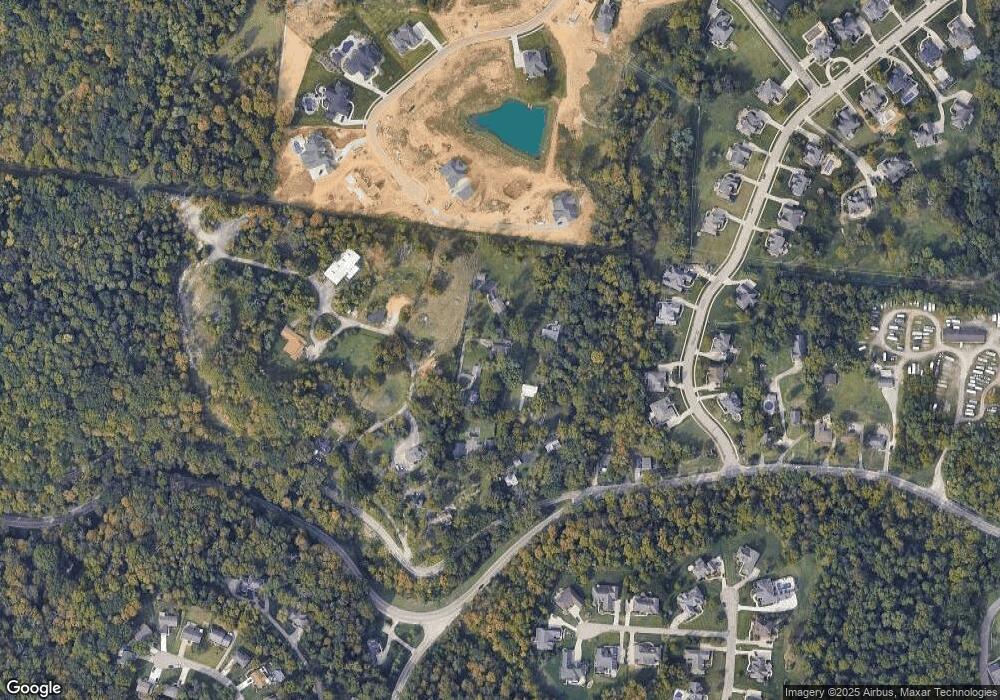

Map

Nearby Homes

- 1259 Wexford Ln

- 1342 Wexford Ln

- 1287 Heather Ridge

- 6443 Timberhill Ct

- 6419 Timberhill Ct

- 6278 Gardenlake Ct

- 6201 Rapid Run Rd

- 1696 Devils Backbone Rd Unit 2

- 6035 Rapid Run Rd

- 767 Sundance Dr

- 6942 Cleves Warsaw Pike

- 665 Fox Trails Way

- 2223 van Blaricum Rd

- 6331 Starridge Ct

- 2659 Devils Backbone Rd

- 6721 Hillside Ave

- 6378 Hillside Ave

- 5749 Beech Grove Ln

- 5789 Juvene Way

- 6723 Daniels Walk

- 6354 Upper Rd

- 6350 Upper Rd

- 6344 Upper Rd

- 6356 Upper Rd

- 6334 Upper Rd

- 6340 Upper Rd

- 1740 Ballymore Ln

- 6296 Cleves Warsaw Pike

- 1734 Ballymore Ln

- 6390 Upper Rd

- 6440 Upper Rd

- 6414 Upper Rd

- 1275 Wexford Ln

- 1275 Wexford Ln Unit 3

- 1746 Ballymore Ln

- 1267 Wexford Ln

- 1287 Wexford Ln

- 6290 Cleves Warsaw Pike

- 1295 Wexford Ln

- 1295 Wexford Ln Unit 5