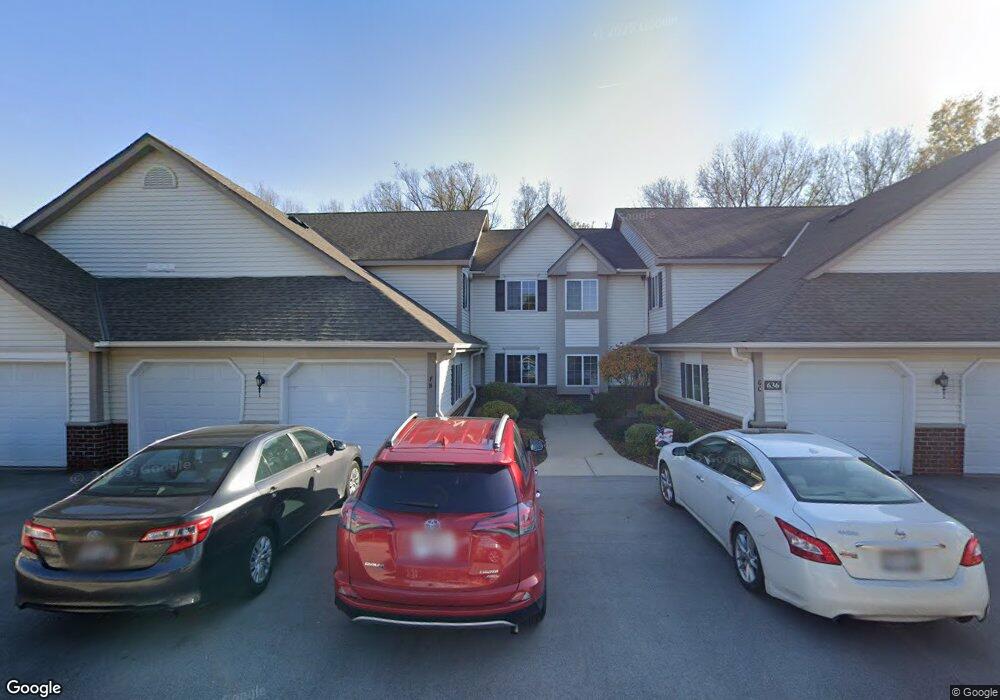

636 Pewaukee Rd Unit B Pewaukee, WI 53072

Estimated Value: $286,000 - $289,000

--

Bed

--

Bath

--

Sq Ft

1

Acres

About This Home

This home is located at 636 Pewaukee Rd Unit B, Pewaukee, WI 53072 and is currently estimated at $287,713. 636 Pewaukee Rd Unit B is a home located in Waukesha County with nearby schools including Pewaukee Lake Elementary School, Asa Clark Middle School, and Pewaukee High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 6, 2013

Sold by

Dorothy A Schmit Revocable Trust

Bought by

Juhnke Mary C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$30,000

Outstanding Balance

$22,010

Interest Rate

3.75%

Mortgage Type

Adjustable Rate Mortgage/ARM

Estimated Equity

$265,703

Purchase Details

Closed on

Jul 9, 2002

Sold by

Schmit Eugene R and Schmit Dorothy A

Bought by

Dorothy A Schmit Revocable Trust

Purchase Details

Closed on

Sep 28, 1998

Sold by

Kelsey Brian S and Boerst Sherri L

Bought by

Schmit Eugene R and Schmit Dorothy A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$81,500

Interest Rate

6.41%

Purchase Details

Closed on

Sep 22, 1997

Sold by

Fairfield Place Inc

Bought by

Kelsey Brian S and Boerst Sherri L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$91,000

Interest Rate

7.62%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Juhnke Mary C | $120,000 | None Available | |

| Dorothy A Schmit Revocable Trust | -- | -- | |

| Schmit Eugene R | $102,900 | -- | |

| Kelsey Brian S | $95,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Juhnke Mary C | $30,000 | |

| Previous Owner | Schmit Eugene R | $81,500 | |

| Previous Owner | Kelsey Brian S | $91,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,688 | $235,600 | $18,000 | $217,600 |

| 2023 | $2,720 | $220,400 | $15,000 | $205,400 |

| 2022 | $2,501 | $198,900 | $10,000 | $188,900 |

| 2021 | $2,408 | $181,500 | $10,000 | $171,500 |

| 2020 | $2,096 | $145,600 | $10,000 | $135,600 |

| 2019 | $1,994 | $145,600 | $10,000 | $135,600 |

| 2018 | $1,774 | $130,500 | $10,000 | $120,500 |

| 2017 | $1,842 | $130,500 | $10,000 | $120,500 |

| 2016 | $1,812 | $115,500 | $10,000 | $105,500 |

| 2015 | $1,827 | $115,500 | $10,000 | $105,500 |

| 2014 | $1,915 | $115,500 | $10,000 | $105,500 |

| 2013 | $1,915 | $105,900 | $10,000 | $95,900 |

Source: Public Records

Map

Nearby Homes

- 636 Pewaukee Rd Unit H

- 353 Westfield Way

- 509 Westfield Way Unit F

- 602 Ole Dairy Rd

- 1339 Hillwood Blvd Unit D

- 1023 Waterstone Ct

- 368 Park Hill Dr Unit H

- W250N5015 William Dr

- N44W25902 Lindsay Rd

- 339 Park Hill Dr Unit H

- 680 Brandt Ct

- 1002 Lilac Ln

- N35W23701 Auburn Ct Unit 1

- 411 Sandy Cir

- W226N1933 Cedar Court Ct Unit 202

- W226N2020 Cedar Lane Ln Unit 1002

- 1114 Oxbow Ct

- W226N2020 Cedar Lane Ln Unit 1004

- W226N2020 Cedar Lane Ln Unit 1001

- W226N2020 Cedar Lane Ln Unit 1003

- 636 Pewaukee Rd Unit D

- 636 Pewaukee Rd Unit C

- 636 Pewaukee Rd Unit F

- 636 Pewaukee Rd Unit E

- 636 Pewaukee Rd Unit G

- 636 Pewaukee Rd Unit A

- 608 Pewaukee Rd Unit F

- 608 Pewaukee Rd Unit G

- 608 Pewaukee Rd Unit D

- 608 Pewaukee Rd Unit A

- 608 Pewaukee Rd Unit B

- 608 Pewaukee Rd Unit E

- 608 Pewaukee Rd Unit C

- 608 Pewaukee Rd Unit A

- 608 Pewaukee Rd Unit 608

- 608 Pewaukee Rd

- 678 Pewaukee Rd Unit G

- 678 Pewaukee Rd Unit C

- 678 Pewaukee Rd Unit B

- 678 Pewaukee Rd Unit H