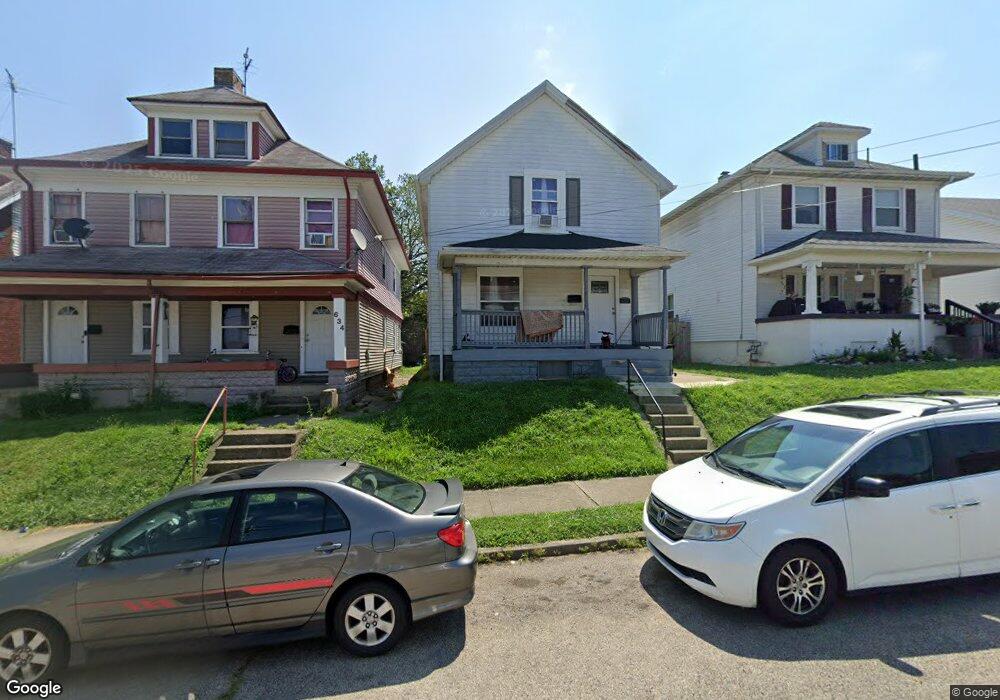

636 Pritz Ave Dayton, OH 45410

Linden Heights NeighborhoodEstimated Value: $133,000 - $151,000

3

Beds

2

Baths

1,457

Sq Ft

$99/Sq Ft

Est. Value

About This Home

This home is located at 636 Pritz Ave, Dayton, OH 45410 and is currently estimated at $143,937, approximately $98 per square foot. 636 Pritz Ave is a home located in Montgomery County with nearby schools including Cleveland Elementary School, Horace Mann Elementary School, and Eastmont Elementary.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 10, 2019

Sold by

Cci Oh Reo Llc

Bought by

Paragon Solutions Construction Llc

Current Estimated Value

Purchase Details

Closed on

Jan 22, 2019

Sold by

Tax Ease Funding 2016 1 Reo Llc

Bought by

Cc1 Oh Reo Llc

Purchase Details

Closed on

Sep 4, 2018

Sold by

Tax Ease Ohio Llc

Bought by

Tax Ease Funding 2016 1 Reo Llc

Purchase Details

Closed on

Jun 11, 2018

Sold by

Svoboda David F

Bought by

Tax Ease Ohio Llc

Purchase Details

Closed on

Sep 23, 2008

Sold by

Bt Investments Llc

Bought by

Svoboda David F

Purchase Details

Closed on

Dec 8, 2004

Sold by

Sexton William Vincent

Bought by

Bt Investments Llc

Purchase Details

Closed on

Jan 24, 2001

Sold by

Sexton Juanita Karen

Bought by

Sexton William Vincent

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Paragon Solutions Construction Llc | $16,000 | Fidelity Lawyers Ttl Agcy Ll | |

| Cc1 Oh Reo Llc | -- | None Available | |

| Tax Ease Funding 2016 1 Reo Llc | -- | None Available | |

| Tax Ease Ohio Llc | -- | None Available | |

| Svoboda David F | $1,100 | Multiple | |

| Bt Investments Llc | $30,100 | None Available | |

| Sexton William Vincent | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,241 | $38,910 | $6,880 | $32,030 |

| 2023 | $2,241 | $38,910 | $6,880 | $32,030 |

| 2022 | $1,911 | $25,610 | $4,530 | $21,080 |

| 2021 | $1,900 | $25,610 | $4,530 | $21,080 |

| 2020 | $1,897 | $25,610 | $4,530 | $21,080 |

| 2019 | $2,467 | $20,030 | $3,240 | $16,790 |

| 2018 | $1,646 | $20,030 | $3,240 | $16,790 |

| 2017 | $1,634 | $20,030 | $3,240 | $16,790 |

| 2016 | $1,603 | $19,190 | $3,240 | $15,950 |

| 2015 | $1,516 | $19,190 | $3,240 | $15,950 |

| 2014 | $1,516 | $19,190 | $3,240 | $15,950 |

| 2012 | -- | $16,150 | $5,040 | $11,110 |

Source: Public Records

Map

Nearby Homes

- 624 Pritz Ave

- 708 Saint Nicholas Ave

- 722 Saint Nicholas Ave

- 621 Creighton Ave

- 1018 Haviland Ave

- 1024 Haviland Ave

- 1609 Xenia Ave

- 626 Creighton Ave

- 630 Hulbert St

- 607 Carlisle Ave

- 1000 Xenia Ave

- 1708 Xenia Ave

- 523 Carlisle Ave

- 630 Carlisle Ave

- 662 Carlisle Ave

- 800 Linden Ave

- 2012 Saint Charles Ave

- 853 Carlisle Ave

- 716 Hodapp Ave

- 914 Linden Ave

- 640 Pritz Ave

- 634 Pritz Ave

- 632 Pritz Ave

- 648 Pritz Ave

- 630 Pritz Ave

- 650 Pritz Ave

- 654 Pritz Ave

- 1625 Tacoma St

- 635 Pritz Ave Unit 635 Pritz Ave

- 658 Pritz Ave

- 622 Pritz Ave

- 633 Pritz Ave

- 639 Pritz Ave

- 643 Pritz Ave

- 618 Pritz Ave Unit TOP

- 618 Pritz Ave

- 647 Pritz Ave

- 651 Pritz Ave

- 612 Pritz Ave

- 639 Saint Nicholas Ave