Estimated Value: $1,667,000 - $2,555,000

4

Beds

4

Baths

4,068

Sq Ft

$531/Sq Ft

Est. Value

About This Home

This home is located at 63731 Johnson Rd, Bend, OR 97701 and is currently estimated at $2,159,015, approximately $530 per square foot. 63731 Johnson Rd is a home located in Deschutes County with nearby schools including North Star Elementary School, Pacific Crest Middle School, and Summit High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 14, 2022

Sold by

Shannon James L

Bought by

Jim And Robbi Shannon Joint Trust

Current Estimated Value

Purchase Details

Closed on

Sep 23, 2009

Sold by

Craig Hilary W and Craig Michael O

Bought by

Shannon James L and Shannon Roberta A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$256,600

Interest Rate

5.25%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 30, 2004

Sold by

Bell John C

Bought by

Craig Hilary and Craig Michael O

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$600,000

Interest Rate

5.95%

Mortgage Type

Credit Line Revolving

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jim And Robbi Shannon Joint Trust | $98,000 | None Listed On Document | |

| Shannon James L | $320,794 | Amerititle | |

| Craig Hilary | $750,000 | Amerititle |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Shannon James L | $256,600 | |

| Previous Owner | Craig Hilary | $600,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,118 | $768,040 | -- | -- |

| 2024 | $9,683 | $745,680 | -- | -- |

| 2023 | $9,116 | $723,970 | $0 | $0 |

| 2022 | $8,409 | $682,430 | $0 | $0 |

| 2021 | $8,462 | $662,560 | $0 | $0 |

| 2020 | $7,994 | $662,560 | $0 | $0 |

| 2019 | $7,770 | $562,000 | $0 | $0 |

| 2018 | $7,545 | $545,640 | $0 | $0 |

| 2017 | $4,831 | $346,700 | $0 | $0 |

Source: Public Records

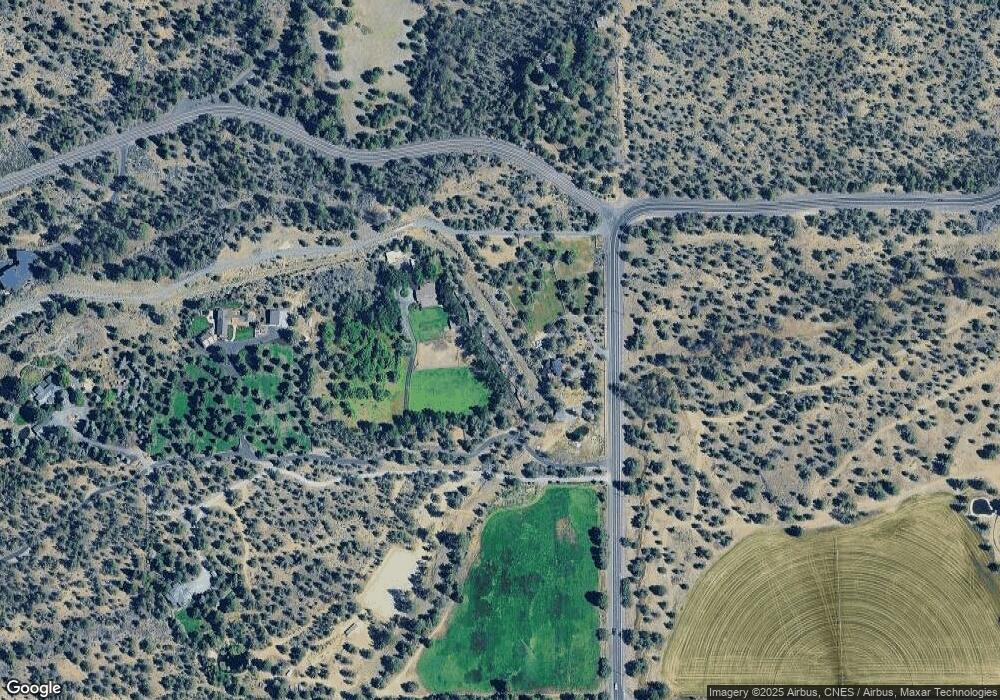

Map

Nearby Homes

- 19436 Klippel Rd

- 63420 Shoreline Dr

- 3038 NW Butte View Dr

- 19365 Rim View Ct

- 63280 Palla Ln

- 63204 NW Red Butte Ct

- 63220 Johnson Rd

- 3965 NW Rocher Way

- 3955 NW Rocher Way

- 64495 Quail Dr

- 3500 NW Mccready Dr

- 3563 NW Mccready Dr

- 3493 NW Conrad Dr

- 3496 NW Mccready Dr

- 3307 NW Massey Dr

- 2279 NW Putnam Rd

- 0 Concannon Dr Unit Lot 42

- 0 Concannon Dr Unit Lot 41

- 0 Concannon Dr Unit Lot 43

- 3437 NW Braid Dr

Your Personal Tour Guide

Ask me questions while you tour the home.