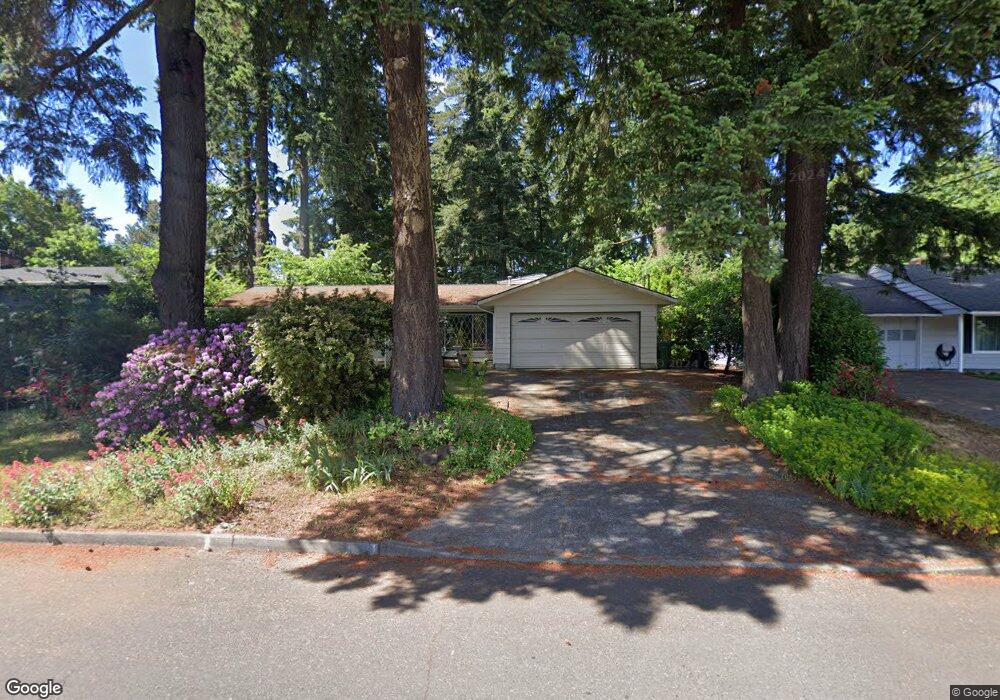

6375 Dawn Ave Lake Oswego, OR 97035

Rosewood NeighborhoodEstimated Value: $671,541 - $716,000

3

Beds

2

Baths

1,840

Sq Ft

$377/Sq Ft

Est. Value

About This Home

This home is located at 6375 Dawn Ave, Lake Oswego, OR 97035 and is currently estimated at $694,135, approximately $377 per square foot. 6375 Dawn Ave is a home located in Clackamas County with nearby schools including River Grove Elementary School, Lakeridge Middle School, and Lakeridge High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 3, 2025

Sold by

Nichols Donald A and Fredrickson Kathryn I

Bought by

Secretary Of Housing And Urban Development

Current Estimated Value

Purchase Details

Closed on

Dec 17, 2002

Sold by

Nichols Donald A and Nichols Gay R

Bought by

Nichols Donald A and Nichols Gay R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$158,500

Interest Rate

6.03%

Purchase Details

Closed on

Sep 1, 1995

Sold by

Andrews Betty A

Bought by

Nichols Donald A and Nichols Gay R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,900

Interest Rate

7.88%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Secretary Of Housing And Urban Development | $716,013 | None Listed On Document | |

| Nichols Donald A | -- | Ticor Title | |

| Nichols Donald A | $149,900 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Nichols Donald A | $158,500 | |

| Previous Owner | Nichols Donald A | $119,900 | |

| Closed | Nichols Donald A | $30,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,239 | $298,168 | -- | -- |

| 2023 | $5,239 | $289,484 | $0 | $0 |

| 2022 | $4,946 | $281,053 | $0 | $0 |

| 2021 | $4,537 | $272,867 | $0 | $0 |

| 2020 | $4,425 | $264,920 | $0 | $0 |

| 2019 | $4,318 | $257,204 | $0 | $0 |

| 2018 | $4,156 | $249,713 | $0 | $0 |

| 2017 | $4,008 | $242,440 | $0 | $0 |

| 2016 | $3,617 | $235,379 | $0 | $0 |

| 2015 | $3,484 | $228,523 | $0 | $0 |

| 2014 | $3,433 | $221,867 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 6401 Mcewan Rd

- 18543 Don Lee Way

- 18411 Longfellow Ave

- 18515 Kristi Way

- 5455 Childs Rd

- 19368 Riverwood Ln

- 5650 Lakeview Blvd

- 18581 Timbergrove Ct

- 18021 Tualata Ave

- 7151 SW Sagert St Unit 101

- 7165 SW Sagert St Unit 107

- 7143 SW Sagert St Unit 104

- 19778 SW 68th Ave

- 5225 Jean Rd Unit 307

- 5225 Jean Rd Unit 606

- 19685 SW 68th Ave

- 19787 SW 67th Ave

- 19130 SW 51st Ave

- 0 SW Washo Ct

- 18863 Indian Springs Rd