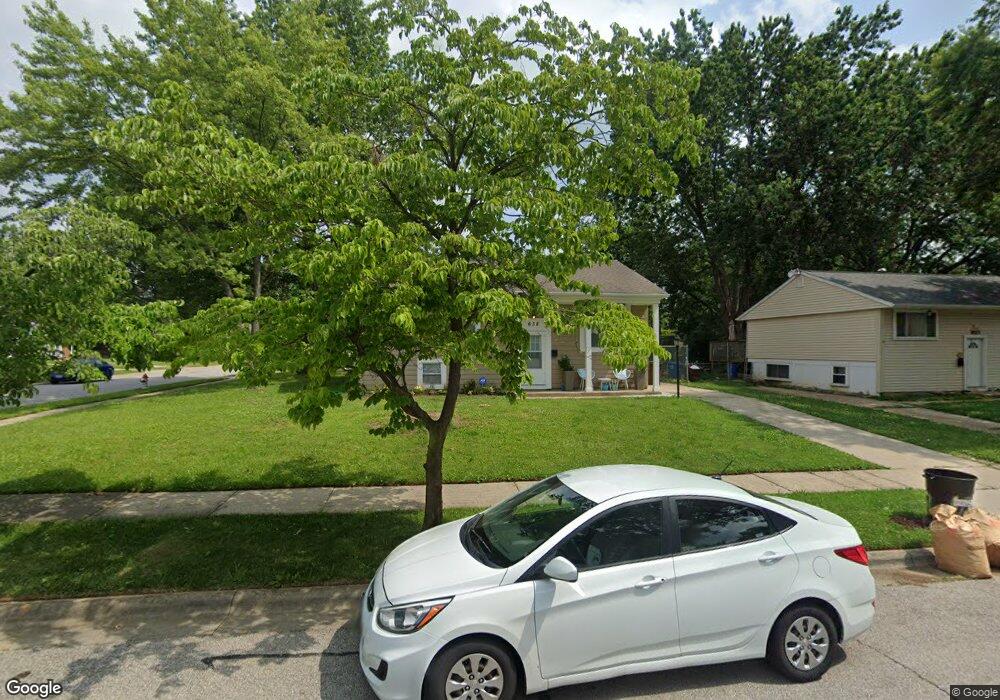

638 Bonnington Way Columbus, OH 43230

Estimated Value: $270,000 - $300,000

2

Beds

2

Baths

1,667

Sq Ft

$170/Sq Ft

Est. Value

About This Home

This home is located at 638 Bonnington Way, Columbus, OH 43230 and is currently estimated at $284,107, approximately $170 per square foot. 638 Bonnington Way is a home located in Franklin County with nearby schools including Royal Manor Elementary School, Gahanna West Middle School, and Lincoln High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 18, 2019

Sold by

Benedict Sigrid

Bought by

K & G Ventures Llc

Current Estimated Value

Purchase Details

Closed on

Sep 10, 2007

Sold by

Palmer John E and Silva Denise

Bought by

Benedict Sigrid

Purchase Details

Closed on

May 18, 2005

Sold by

Hunt James T and Hunt Christina Jane

Bought by

Palmer John E and Silva Denise

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$79,680

Interest Rate

6.05%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Oct 7, 2003

Sold by

Estate Of Irene V Hunt

Bought by

Hunt James T

Purchase Details

Closed on

Jul 18, 1962

Bought by

Hunt Gerald D and Hunt Irene

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| K & G Ventures Llc | $80,000 | Fatco | |

| Benedict Sigrid | $135,000 | New Horizon | |

| Palmer John E | $99,600 | Independent | |

| Hunt James T | -- | -- | |

| Hunt Gerald D | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Palmer John E | $79,680 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,826 | $80,290 | $24,710 | $55,580 |

| 2023 | $4,766 | $80,290 | $24,710 | $55,580 |

| 2022 | $4,148 | $54,430 | $14,810 | $39,620 |

| 2021 | $4,015 | $54,430 | $14,810 | $39,620 |

| 2020 | $3,983 | $54,430 | $14,810 | $39,620 |

| 2019 | $2,625 | $45,330 | $12,360 | $32,970 |

| 2018 | $2,644 | $45,330 | $12,360 | $32,970 |

| 2017 | $2,410 | $45,330 | $12,360 | $32,970 |

| 2016 | $2,678 | $45,780 | $11,620 | $34,160 |

| 2015 | $2,680 | $45,780 | $11,620 | $34,160 |

| 2014 | $2,660 | $45,780 | $11,620 | $34,160 |

| 2013 | $1,321 | $45,780 | $11,620 | $34,160 |

Source: Public Records

Map

Nearby Homes

- 221 Lincolnshire Rd

- 388 Elkwood Place

- 348 Imperial Dr

- 4125 Emerius Dr

- 600 Agler Rd

- 491 Daventry Ln

- 2694 Kantian Dr

- 3888 Agler Rd

- 3784 Armuth Ave

- 2423 Stelzer Rd

- 0 E Minnesota Ave Unit 224018641

- 2275 Stelzer Rd

- 2457 Ashpoint St

- 3832 Emmons Ave

- 0 E Emmons Ave

- 3877 Hines Rd

- 536 Springwood Lake Dr

- 3601 Agler Rd

- 3150 Berkley Pointe Dr

- 638 Thistle Ave

- 632 Bonnington Way

- 280 Triumph Way

- 626 Bonnington Way

- 652 Bonnington Way

- 275 Triumph Way

- 286 Triumph Way

- 637 Bonnington Way

- 283 Triumph Way

- 631 Bonnington Way

- 620 Bonnington Way

- 649 Bonnington Way

- 294 Triumph Way

- 625 Bonnington Way

- 289 Triumph Way

- 655 Bonnington Way

- 664 Bonnington Way

- 276 Lincolnshire Rd

- 619 Bonnington Way

- 614 Bonnington Way

- 302 Triumph Way