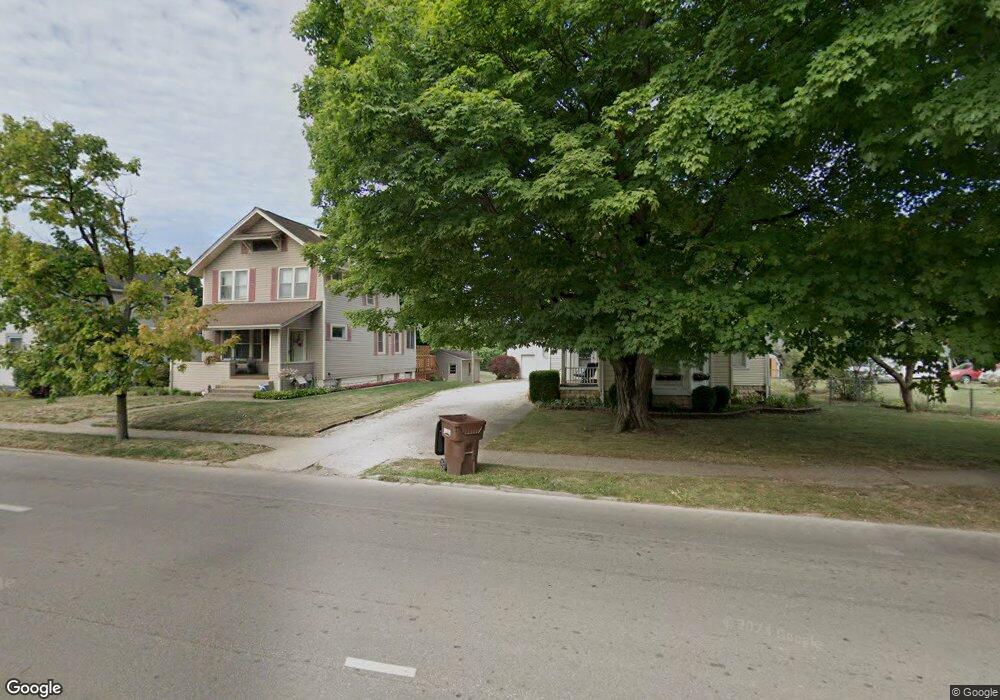

639 N Court St Circleville, OH 43113

Estimated Value: $231,797 - $295,000

3

Beds

2

Baths

1,624

Sq Ft

$161/Sq Ft

Est. Value

About This Home

This home is located at 639 N Court St, Circleville, OH 43113 and is currently estimated at $261,199, approximately $160 per square foot. 639 N Court St is a home located in Pickaway County with nearby schools including Circleville Elementary School, Circleville High School, and New Hope Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 14, 2007

Sold by

Jeffery Arthur A and Jeffery Lorraine E

Bought by

Snyder James R and Hedrick Elizabeth M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$131,500

Outstanding Balance

$79,639

Interest Rate

6.27%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$181,560

Purchase Details

Closed on

Jan 2, 2002

Sold by

Bircher Tyler L

Bought by

Loraine Jeffery Arthur A and Loraine Jeffery E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$72,900

Interest Rate

6.87%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 2, 1996

Sold by

Mikel W Mills

Bought by

Bircher Tyler L and Bircher Katherine L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,050

Interest Rate

7.63%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 1, 1990

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Snyder James R | $131,500 | Clt | |

| Loraine Jeffery Arthur A | $112,900 | -- | |

| Bircher Tyler L | $79,000 | -- | |

| -- | $52,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Snyder James R | $131,500 | |

| Previous Owner | Loraine Jeffery Arthur A | $72,900 | |

| Previous Owner | Bircher Tyler L | $75,050 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | -- | $61,360 | $14,030 | $47,330 |

| 2023 | $2,212 | $61,360 | $14,030 | $47,330 |

| 2022 | $2,308 | $50,850 | $11,750 | $39,100 |

| 2021 | $2,322 | $50,850 | $11,750 | $39,100 |

| 2020 | $2,322 | $50,850 | $11,750 | $39,100 |

| 2019 | $2,100 | $42,620 | $11,750 | $30,870 |

| 2018 | $2,138 | $42,620 | $11,750 | $30,870 |

| 2017 | $2,122 | $42,620 | $11,750 | $30,870 |

| 2016 | $2,091 | $41,350 | $12,330 | $29,020 |

| 2015 | $2,093 | $41,350 | $12,330 | $29,020 |

| 2014 | $2,085 | $41,350 | $12,330 | $29,020 |

| 2013 | $2,190 | $42,770 | $12,330 | $30,440 |

Source: Public Records

Map

Nearby Homes

- 609 N Court St

- 127 Collins Ct

- 528 N Court St

- 556 N Pickaway St

- 118 Pleasant St

- 842 Pershing Dr

- 1040 Sunshine St

- 386 Lawnwood Dr

- 156 W High St

- 308 Wedgewood Ct

- 590 Garden Pkwy

- 152 Pinckney St

- 1520 Georgia Rd

- 137 Villa Dr

- 0 Morris Rd

- 452 Stella Ave

- 1235 Dunhurst St

- 456 Edwards Rd

- 200 Island Rd

- 382 E Franklin St