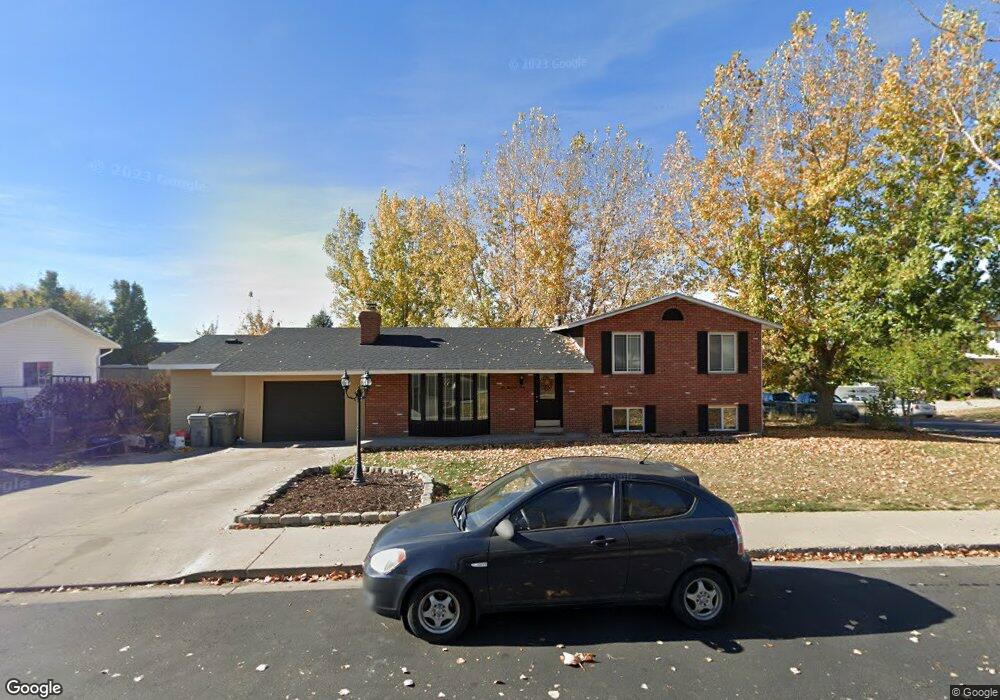

640 Mohawk Ave Pleasant Grove, UT 84062

Estimated Value: $545,000 - $598,000

6

Beds

2

Baths

2,550

Sq Ft

$222/Sq Ft

Est. Value

About This Home

This home is located at 640 Mohawk Ave, Pleasant Grove, UT 84062 and is currently estimated at $565,229, approximately $221 per square foot. 640 Mohawk Ave is a home located in Utah County with nearby schools including Valley View Elementary, Central Elementary School, and Oak Canyon Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 15, 2019

Sold by

Tremblay Bruno and Tremblay Kimberly A

Bought by

Tremblay Bruno C and Tremblay Kimberly A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$264,500

Outstanding Balance

$232,226

Interest Rate

3.5%

Mortgage Type

New Conventional

Estimated Equity

$333,003

Purchase Details

Closed on

Dec 28, 2018

Sold by

Tremblay Bruno

Bought by

Tremblay Bruno and Tremblay Kimberly A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$259,182

Interest Rate

4.75%

Mortgage Type

FHA

Purchase Details

Closed on

Feb 27, 2017

Sold by

Turner Tyson

Bought by

Tremblay Bruno

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$11,420

Interest Rate

4.12%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

Feb 17, 2017

Sold by

Tremblay Brvno

Bought by

Tremblay Bruno and Tremblay Kimberly

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$11,420

Interest Rate

4.12%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

Oct 19, 2010

Sold by

Hsbc Bank Usa National Association

Bought by

Turner Tyson

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$157,874

Interest Rate

4.9%

Mortgage Type

FHA

Purchase Details

Closed on

Apr 2, 2010

Sold by

Conrad Jc and Conrad Jennie

Bought by

Hsbc Bank Usa National Association

Purchase Details

Closed on

Oct 26, 2006

Sold by

Baker John L and Baker Kathleen E

Bought by

Conrad Jc and Conrad Jennie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$188,800

Interest Rate

8.32%

Mortgage Type

Balloon

Purchase Details

Closed on

Sep 23, 1998

Sold by

Walker Brent L and Walker Deborah L

Bought by

Baker John L and Baker Kathleen E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,000

Interest Rate

6.61%

Purchase Details

Closed on

Aug 26, 1998

Sold by

Walker Brent L and Walker Deborah L

Bought by

Baker John L and Baker Kathleen E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,000

Interest Rate

6.61%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tremblay Bruno C | -- | Oasis Title Llc | |

| Tremblay Bruno | -- | Title Guarantee | |

| Tremblay Bruno | -- | Title Guarantee | |

| Tremblay Bruno | -- | Greembrier Title Ins Age | |

| Tremblay Bruno | -- | Gateway Title Ins Agency Llc | |

| Turner Tyson | -- | Greenbrier Title Insurance | |

| Hsbc Bank Usa National Association | $169,000 | Etitle Insurance Agency | |

| Conrad Jc | -- | Advanced Title | |

| Baker John L | -- | Action Title Company Inc | |

| Baker John L | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Tremblay Bruno C | $264,500 | |

| Closed | Tremblay Bruno | $259,182 | |

| Closed | Tremblay Bruno | $11,420 | |

| Closed | Tremblay Bruno | $247,435 | |

| Closed | Turner Tyson | $157,874 | |

| Previous Owner | Conrad Jc | $188,800 | |

| Previous Owner | Baker John L | $125,000 | |

| Previous Owner | Baker John L | $125,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,022 | $259,270 | $214,900 | $256,500 |

| 2024 | $2,022 | $241,340 | $0 | $0 |

| 2023 | $1,994 | $243,650 | $0 | $0 |

| 2022 | $1,925 | $234,025 | $0 | $0 |

| 2021 | $1,657 | $306,700 | $135,000 | $171,700 |

| 2020 | $1,517 | $275,200 | $120,500 | $154,700 |

| 2019 | $1,391 | $261,000 | $106,300 | $154,700 |

| 2018 | $1,363 | $241,900 | $99,200 | $142,700 |

| 2017 | $1,238 | $116,985 | $0 | $0 |

| 2016 | $1,239 | $113,025 | $0 | $0 |

| 2015 | $1,151 | $99,440 | $0 | $0 |

| 2014 | $1,130 | $96,690 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 1172 E Murdock Dr

- 1515 E 720 S

- 745 S 1500 St E

- 935 S 1500 E

- 650 S 1600 E

- 778 S 1100 E

- 521 S 1660 E

- 286 S 1150 E

- 177 S 1150 E

- 630 S Loader Dr

- 897 Cherokee Dr

- Prelude Plan at Blossom Hill

- Treble Plan at Blossom Hill

- Browning Plan at Blossom Hill

- Cantata Plan at Blossom Hill

- 176 S 1150 E

- Accord Plan at Blossom Hill

- Canon Plan at Blossom Hill

- Trio Plan at Blossom Hill

- Harrison Plan at Blossom Hill