6401 Mercer Rd Mendon, OH 45862

Estimated Value: $139,000 - $274,000

3

Beds

2

Baths

1,336

Sq Ft

$160/Sq Ft

Est. Value

About This Home

This home is located at 6401 Mercer Rd, Mendon, OH 45862 and is currently estimated at $213,489, approximately $159 per square foot. 6401 Mercer Rd is a home located in Mercer County with nearby schools including Parkway Elementary School, Parkway Middle School, and Parkway High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 21, 2017

Sold by

Burden David

Bought by

Burden Tiffany

Current Estimated Value

Purchase Details

Closed on

Nov 7, 2014

Sold by

Burden David and Burden Tiffany

Bought by

Roth Joshua R and Roth Lauren K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$78,375

Interest Rate

4.21%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 11, 2012

Sold by

Burden Tiffany A and Burden David

Bought by

Burden David and Burden Tiffany

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$59,500

Interest Rate

3.87%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Burden Tiffany | -- | Attorney | |

| Roth Joshua R | $115,520 | None Available | |

| Burden David | -- | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Roth Joshua R | $78,375 | |

| Closed | Burden David | $59,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,887 | $56,570 | $7,180 | $49,390 |

| 2023 | $1,887 | $56,570 | $7,180 | $49,390 |

| 2022 | $1,703 | $41,520 | $6,830 | $34,690 |

| 2021 | $1,692 | $41,520 | $6,830 | $34,690 |

| 2020 | $859 | $41,520 | $6,830 | $34,690 |

| 2019 | $1,389 | $35,250 | $6,020 | $29,230 |

| 2018 | $1,354 | $35,250 | $6,020 | $29,230 |

| 2017 | $2,644 | $35,250 | $6,020 | $29,230 |

| 2016 | $1,095 | $30,420 | $5,040 | $25,380 |

| 2015 | $1,083 | $30,420 | $5,040 | $25,380 |

| 2014 | $1,069 | $30,420 | $5,040 | $25,380 |

| 2013 | $1,279 | $33,120 | $5,500 | $27,620 |

Source: Public Records

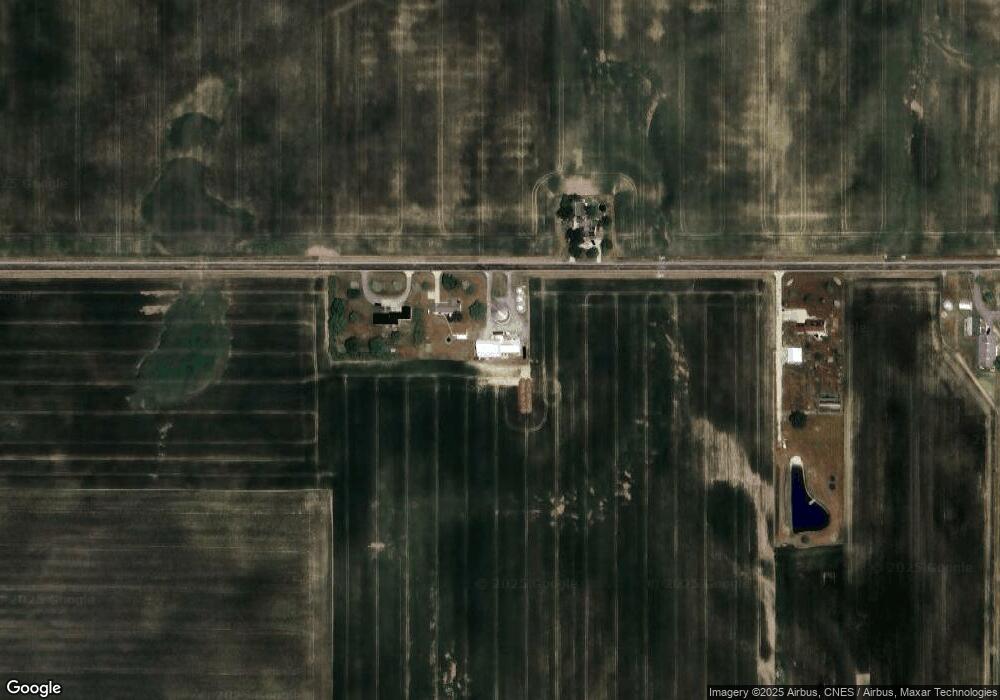

Map

Nearby Homes

- 206 Glenn St

- 0 Drake St

- 8323 Deep Cut Rd

- 9155 Us Route 127

- 12029 Dutton Rd

- 0 Mercer van Wert County Line Rd

- 208 W Pearl St

- 208 Market St

- 0 Wilson Unit 1037059

- 0 Wilson Unit 306333

- 7680 Celina Mendon Rd

- 5062 Mercer van Wert County Line Rd

- 7957 W Bridge St

- 0 Rockford West Rd Unit Lots 14- 28

- 2010 Barnsbury Ct

- 2504 Eaglebrooke Pkwy

- 2409 Eaglebrooke Pkwy

- 1528 Mary Ln

- 8637 U S 33

- 7422 Staeger Rd