6404 SE Brandywine Ct Unit 1201 Stuart, FL 34997

Estimated Value: $426,000 - $454,000

3

Beds

2

Baths

1,675

Sq Ft

$260/Sq Ft

Est. Value

About This Home

This home is located at 6404 SE Brandywine Ct Unit 1201, Stuart, FL 34997 and is currently estimated at $436,281, approximately $260 per square foot. 6404 SE Brandywine Ct Unit 1201 is a home located in Martin County with nearby schools including Sea Wind Elementary School, Murray Middle School, and South Fork High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 14, 2022

Sold by

Soto Raymond and Soto Kathleen F

Bought by

Joyce David E and Joyce Jane B

Current Estimated Value

Purchase Details

Closed on

Jun 20, 2017

Sold by

Zareski David

Bought by

Soto Raymod and Soto Akthleen F

Purchase Details

Closed on

Mar 15, 2016

Sold by

Ryan Denis J and Ryan Muriel

Bought by

Zareski David

Purchase Details

Closed on

Dec 2, 2013

Sold by

Flanagan John M and Flanagan Brenda

Bought by

Ryan Denis J and Ryan Muriel

Purchase Details

Closed on

Apr 1, 2009

Sold by

Helmus Bradford

Bought by

Flanagan John M and Flanagan Brenda

Purchase Details

Closed on

Dec 28, 2000

Sold by

Judy J Faxton Tr

Bought by

Helmus Christian

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,000

Interest Rate

7.72%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 5, 1997

Sold by

Morrissette Jacqueline D

Bought by

Paxton Judy J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,000

Interest Rate

7.61%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 15, 1993

Sold by

White Francis M and White Jean H

Bought by

Morrissette Jacqueline D

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Joyce David E | $350,000 | -- | |

| Soto Raymod | $194,800 | Attorney | |

| Zareski David | $200,000 | Attorney | |

| Ryan Denis J | $165,000 | Attorney | |

| Flanagan John M | $168,000 | Universal Land Title Inc | |

| Helmus Christian | $159,000 | -- | |

| Paxton Judy J | $155,000 | -- | |

| Morrissette Jacqueline D | $150,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Paxton Judy J | $140,000 | |

| Previous Owner | Paxton Judy J | $112,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,063 | $333,360 | -- | $333,360 |

| 2024 | $4,775 | $308,490 | $308,490 | $308,490 |

| 2023 | $4,775 | $286,380 | $286,380 | $286,380 |

| 2022 | $2,397 | $185,040 | $0 | $185,040 |

| 2021 | $3,218 | $186,000 | $0 | $186,000 |

| 2020 | $3,106 | $178,000 | $0 | $0 |

| 2019 | $2,910 | $166,000 | $0 | $0 |

| 2018 | $2,626 | $150,000 | $0 | $0 |

| 2017 | $2,439 | $145,000 | $0 | $0 |

| 2016 | $1,954 | $115,000 | $0 | $115,000 |

| 2015 | $1,560 | $107,000 | $0 | $107,000 |

| 2014 | $1,560 | $95,000 | $0 | $95,000 |

Source: Public Records

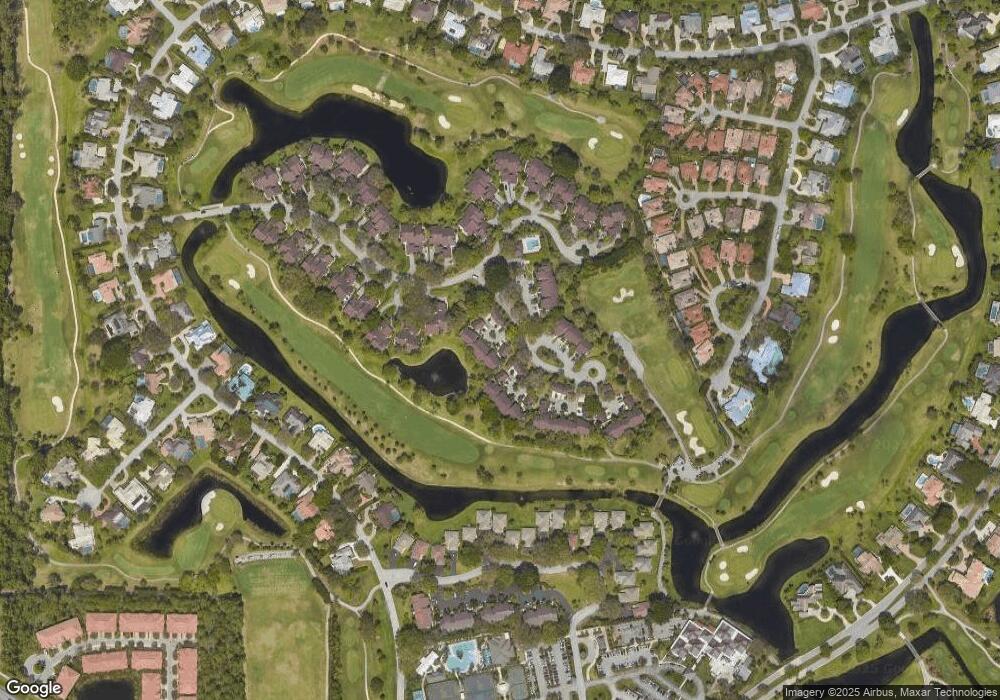

Map

Nearby Homes

- 6403 SE Brandywine Ct Unit 223

- 6433 SE Brandywine Ct Unit 219

- 5311 SE Brandywine Way Unit 28

- 5011 SE Brandywine Way

- 5071 SE Brandywine Way Unit 8

- 5143 SE Club Way

- 5382 SE Meredith Terrace

- 5253 SE Club Way

- 5152 SE Club Way Unit 104

- 5011 SE Burning Tree Cir

- 5402 SE Meredith Terrace

- 5061 SE Burning Tree Cir

- 5361 SE Merion Way

- 5081 SE Burning Tree Cir

- 5101 SE Burning Tree Cir

- 5220 SE Burning Tree Cir

- 6675 SE Woodmill Pond Ln

- 5151 SE Burning Tree Cir

- 6693 SE Woodmill Pond Ln Unit 5

- 5201 SE Burning Tree Cir

- 6404 SE Brandywine Ct Unit 203

- 6404 SE Brandywine Ct Unit 103

- 6404 SE Brandywine Ct Unit 102

- 6403 SE Brandywine Ct

- 6404 SE Brandywine Ct Unit 122

- 6403 SE Brandywine Ct Unit 124

- 6403 SE Brandywine Ct Unit 224

- 6404 SE Brandywine Ct

- 6404 SE Brandywine Ct Unit 202

- 6403 SE Brandywine Ct Unit 222

- 6403 SE Brandywine Ct Unit 122

- 6404 SE Brandywine Ct Unit 101

- 6404 SE Brandywine Ct Unit 204

- 6403 SE Brandywine Ct Unit 121

- 6404 SE Brandywine Ct Unit 201

- 6404 SE Brandywine Ct Unit 104

- 6404 SE Brandywine Ct Unit 1203

- 6404 SE Brandywine Ct Unit 1101

- 6403 SE Brandywine Ct Unit 6122

- 6403 SE Brandywine Ct Unit 6222