641 Wyngate Pointe Ln Draper, UT 84020

Estimated Value: $501,000 - $619,000

4

Beds

3

Baths

2,684

Sq Ft

$211/Sq Ft

Est. Value

About This Home

This home is located at 641 Wyngate Pointe Ln, Draper, UT 84020 and is currently estimated at $565,244, approximately $210 per square foot. 641 Wyngate Pointe Ln is a home located in Salt Lake County with nearby schools including Sprucewood School, St John the Baptist Catholic Elementary School, and St. John the Baptist Catholic Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 12, 2024

Sold by

Edmonds Robert

Bought by

Robert M Edmonds Iii Trust and Edmonds

Current Estimated Value

Purchase Details

Closed on

Feb 2, 2024

Sold by

Kelley Family Property Trust

Bought by

Edmonds Robert

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$464,000

Interest Rate

6.61%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 28, 2023

Sold by

Kelley Marion R

Bought by

Kelley Family Property Trust and Kelley

Purchase Details

Closed on

Jan 28, 2008

Sold by

Wyngate Commons Llc

Bought by

Kelley Robert Eugene and Kelley Marion R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$239,200

Interest Rate

6.09%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Robert M Edmonds Iii Trust | -- | None Listed On Document | |

| Edmonds Robert | -- | Meridian Title Company | |

| Kelley Family Property Trust | -- | None Listed On Document | |

| Kelley Robert Eugene | -- | Fidelity Land & Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Edmonds Robert | $464,000 | |

| Previous Owner | Kelley Robert Eugene | $239,200 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,518 | $555,100 | $64,900 | $490,200 |

| 2024 | $2,518 | $481,000 | $62,500 | $418,500 |

| 2023 | $2,487 | $471,600 | $61,000 | $410,600 |

| 2022 | $2,624 | $480,600 | $59,900 | $420,700 |

| 2021 | $2,250 | $352,100 | $56,400 | $295,700 |

| 2020 | $2,155 | $319,600 | $51,000 | $268,600 |

| 2019 | $2,120 | $307,300 | $51,000 | $256,300 |

| 2016 | $2,076 | $286,300 | $108,000 | $178,300 |

Source: Public Records

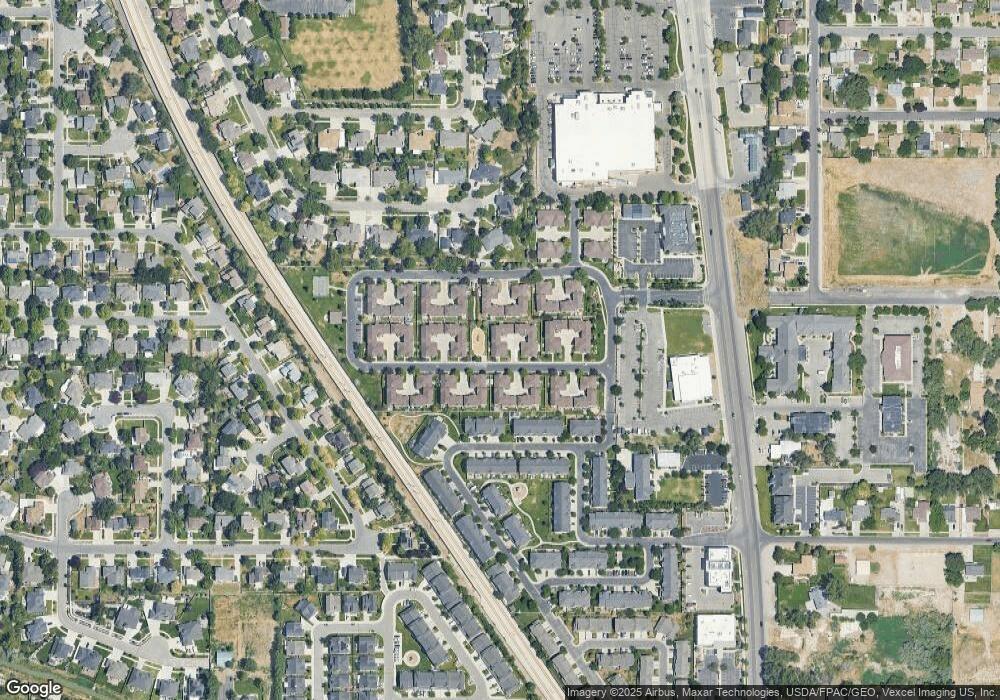

Map

Nearby Homes

- 654 Wyngate Pointe Ln

- 622 Wyngate Pointe Ln

- 11685 S Auburn Fields Way

- 11737 S Nigel Peak Ln

- 11743 S 700 E

- 8858 S Willow Wood Dr

- 11270 S Farnsworth Ln

- 678 E Moray Hill Ct

- 11533 S Berryknoll Cir

- 735 E Dusty Creek Ave

- 11275 Sandy Gulch Rd

- 262 Hidden View Dr Unit 94

- 11313 S 265 E

- 11310 S 265 E Unit 217

- 168 Harvest Berry Place

- 11290 S 265 E Unit 212

- 11085 S Grape Arbor Place Unit 102

- 1052 E 11780 S

- 244 E Crescent Park Way Unit 206

- 11062 Sandy Dunes Dr

- 641 Wyngate Pointe Ln Unit 57

- 639 Wyngate Pointe Ln

- 639 Wyngate Pointe Ln Unit 58

- 637 E Wyngate Pointe Ln

- 637 Wyngate Pointe Ln

- 637 Wyngate Pointe Ln Unit 59

- 645 Wyngate Pointe Ln

- 645 Wyngate Pointe Ln Unit 61

- 648 Wyngate Pointe Ln

- 648 Wyngate Pointe Ln Unit 69

- 643 Wyngate Pointe Ln

- 643 Wyngate Pointe Ln Unit 60

- 647 Wyngate Pointe Ln

- 647 Wyngate Pointe Ln Unit 62

- 643 E Wyngate Pointe Ln

- 648 E Wyngate Pointe Ln

- 626 Wyngate Pointe Ln

- 626 E Wyngate Pointe Ln Unit 56

- 645 E Wyngate Pointe Ln Unit 61

- 634 E Normandy Loop Ln Unit 18