6434 Terrell Dr Pearland, TX 77584

Estimated Value: $416,000 - $564,521

4

Beds

2

Baths

2,552

Sq Ft

$187/Sq Ft

Est. Value

About This Home

This home is located at 6434 Terrell Dr, Pearland, TX 77584 and is currently estimated at $477,380, approximately $187 per square foot. 6434 Terrell Dr is a home located in Brazoria County with nearby schools including Massey Ranch Elementary School, Pearland Junior High School South, and Sam Jamison Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 18, 2022

Sold by

Ruiz Ruth Isela

Bought by

Los Andes Development Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$553,800

Outstanding Balance

$515,110

Interest Rate

3.69%

Mortgage Type

New Conventional

Estimated Equity

-$37,730

Purchase Details

Closed on

Oct 9, 2020

Sold by

Ruiz Carlos

Bought by

Ruiz Ruth Isela

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$240,000

Interest Rate

2.8%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 4, 2013

Sold by

Jeans Wesley Eugene and Jeans Jessica

Bought by

Ruiz Carlos and Rutz Ruth I

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,000

Interest Rate

4.54%

Mortgage Type

Commercial

Purchase Details

Closed on

Nov 30, 2012

Sold by

Jeans Wesley Eugene

Bought by

Jeans Wesley Eugene

Purchase Details

Closed on

Aug 19, 2005

Sold by

Jeans Stanley Eugean

Bought by

Jeans Stanley Eugean

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Los Andes Development Llc | -- | Capital Title | |

| Ruiz Ruth Isela | -- | None Listed On Document | |

| Ruiz Carlos | -- | Stewart Title | |

| Jeans Wesley Eugene | -- | None Available | |

| Jeans Stanley Eugean | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Los Andes Development Llc | $553,800 | |

| Previous Owner | Ruiz Ruth Isela | $240,000 | |

| Previous Owner | Ruiz Carlos | $112,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,323 | $511,470 | $238,010 | $273,460 |

| 2023 | $12,323 | $563,520 | $277,680 | $285,840 |

| 2022 | $10,067 | $418,470 | $172,990 | $245,480 |

| 2021 | $10,082 | $427,690 | $172,990 | $254,700 |

| 2020 | $9,598 | $368,840 | $148,280 | $220,560 |

| 2019 | $8,728 | $323,400 | $135,920 | $187,480 |

| 2018 | $8,061 | $300,000 | $164,760 | $135,240 |

| 2017 | $4,820 | $178,490 | $178,490 | $0 |

| 2016 | $2,790 | $103,330 | $102,190 | $1,140 |

| 2015 | $5,247 | $188,230 | $78,600 | $109,630 |

| 2014 | $5,247 | $188,570 | $86,460 | $102,110 |

Source: Public Records

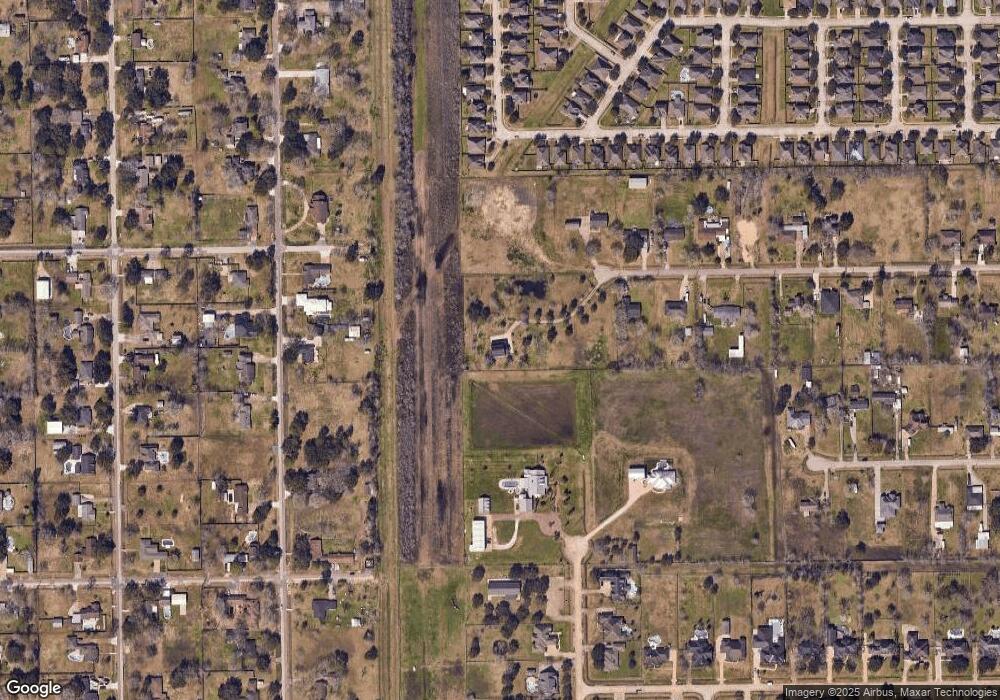

Map

Nearby Homes

- 6504 Patridge Dr

- 6406 Patridge Dr

- 3902 Bluebird Way

- 3610 Kale St

- 6301 Larrycrest Dr

- 6407 Hillock Ln

- 6618 Heron Ln

- 4009 Ravencrest Ct

- 3818 Wingtail Way

- 6112 Tomorrow Cir

- 3510 Dorsey Ln

- 7110 W Mockingbird Ln

- 3902 Basil Ct

- 5806 Wilton St

- 7123 Elgin St

- 3638 Manvel Rd

- 0 Bailey Rd Masters Rd Unit 38179222

- 4139 County Road 101

- 6706 Paigetree Ln

- 3218 W Oaks Blvd

- 6437 Terrell Dr

- 6430 Terrell Dr

- 6414 Terrell Dr

- 6425 Terrell Dr

- 6506 Patridge Dr

- 6508 Patridge Dr

- 6417 Terrell Dr

- 6502 Patridge Dr

- 6418 Patridge Dr

- 3821 Bluebird Way

- 6416 Patridge Dr

- 6410 Terrell Dr

- 3811 Bluebird Way

- 6401 Terrell Dr

- 3710 Mahogany Trail

- 6414 Patridge Dr

- 3801 Bluebird Way

- 6423 Larrycrest Dr

- 6412 Patridge Dr

- 6410 Patridge Dr