6435 E 10th Ave Unit 39643 Anchorage, AK 99504

Northeast Anchorage NeighborhoodEstimated Value: $166,000 - $350,000

3

Beds

3

Baths

1,650

Sq Ft

$168/Sq Ft

Est. Value

About This Home

This home is located at 6435 E 10th Ave Unit 39643, Anchorage, AK 99504 and is currently estimated at $276,598, approximately $167 per square foot. 6435 E 10th Ave Unit 39643 is a home located in Anchorage Municipality with nearby schools including Ptarmigan Elementary School, Clark Middle School, and Bartlett High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 26, 2017

Sold by

Taylor Corey C D and Taylor Tameka D

Bought by

Coughlin Cody Allen

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$230,743

Outstanding Balance

$190,494

Interest Rate

3.75%

Mortgage Type

FHA

Estimated Equity

$86,104

Purchase Details

Closed on

Jul 28, 2006

Sold by

Cope Judith C

Bought by

Taylor Corey C D and Taylor Tameka D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$234,434

Interest Rate

6.57%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Coughlin Cody Allen | -- | Utg | |

| Taylor Corey C D | -- | Security Title Agency Ak Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Coughlin Cody Allen | $230,743 | |

| Previous Owner | Taylor Corey C D | $234,434 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $664 | $329,600 | -- | $329,600 |

| 2024 | $664 | $266,100 | $0 | $266,100 |

| 2023 | $4,450 | $261,300 | $0 | $261,300 |

| 2022 | $3,989 | $236,900 | $0 | $236,900 |

| 2021 | $4,141 | $229,800 | $0 | $229,800 |

| 2020 | $3,035 | $223,500 | $0 | $223,500 |

| 2019 | $2,921 | $223,200 | $0 | $223,200 |

| 2018 | $3,608 | $220,000 | $0 | $220,000 |

| 2017 | $3,655 | $233,400 | $0 | $233,400 |

| 2016 | $3,220 | $236,200 | $0 | $236,200 |

| 2015 | $3,220 | $222,900 | $0 | $222,900 |

| 2014 | $3,220 | $217,600 | $0 | $217,600 |

Source: Public Records

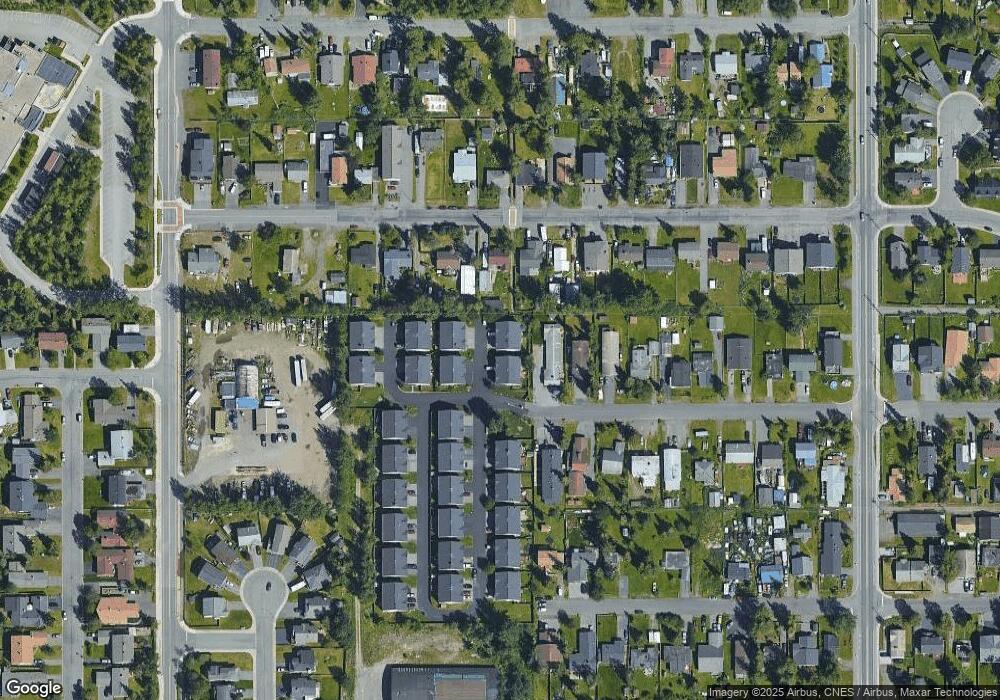

Map

Nearby Homes

- 1101 Bentree Cir

- 6229 Winding Way Unit 6

- 6600 Donna Dr

- 6119 E 12th Ave

- 6110 E 12th Ave Unit 3B

- 6038 E 12th Ave

- 706 Winter Haven St

- 6030 Staedem Dr

- 6109 Debarr Rd Unit 210

- Tr E Debarr Rd

- 420 Peppertree Loop

- 1265 Norman St Unit 18

- 1500 Marten St

- 1507 Elmendorf Dr

- L2 Skwentna Landing

- 1415 Twining Dr

- 324 Shageluk St

- 302 Shageluk St Unit 116

- 6314 Whispering Loop Unit 30A

- 286 Shageluk St Unit 114

- 6435 E 10th Ave Unit 39-6435

- 6435 E 10th Ave Unit 39

- 6437 E 10th Ave Unit 40643

- 6437 E 10th Ave Unit 40-6437

- 6437 E 10th Ave Unit 40

- 6433 E 10th Ave Unit 38643

- 6431 E 10th Ave Unit 37643

- 6431 E 10th Ave Unit 37

- 6501 E 10th Ave

- 6501 E 10th Ave Unit B

- 6427 E 10th Ave Unit 36642

- 6425 E 10th Ave Unit 35642

- 6423 E 10th Ave Unit 34642

- 6421 E 10th Ave Unit 33642

- 6421 E 10th Ave Unit 6421

- 6421 E 10th Ave Unit 33-6421

- 6423 E 10th Ave Unit 6423

- 6423 E 10th Ave Unit 34-6423

- 6423 E 10th Ave Unit 34

- 6440 E 9th Ave

Your Personal Tour Guide

Ask me questions while you tour the home.