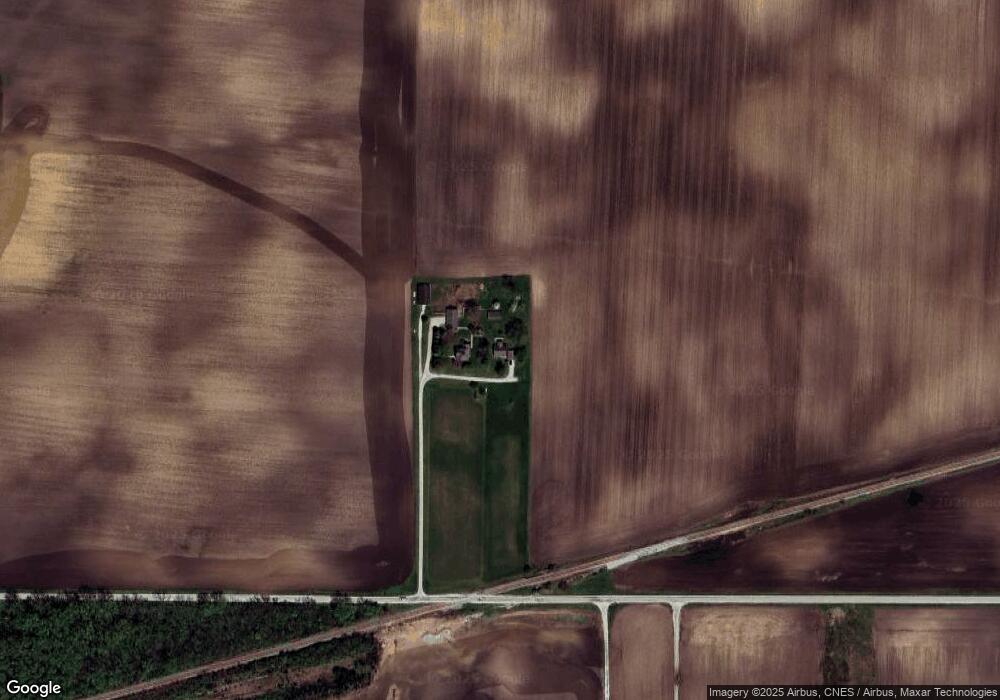

6485 W 700 S Fowler, IN 47944

Estimated Value: $147,000 - $219,000

3

Beds

1

Bath

1,740

Sq Ft

$105/Sq Ft

Est. Value

About This Home

This home is located at 6485 W 700 S, Fowler, IN 47944 and is currently estimated at $182,577, approximately $104 per square foot. 6485 W 700 S is a home located in Benton County with nearby schools including Benton Central Junior/Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 26, 2023

Sold by

Emery Ralph

Bought by

Lawlyes Eric K and Lawlyes Angela K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$149,150

Outstanding Balance

$144,453

Interest Rate

6.31%

Mortgage Type

New Conventional

Estimated Equity

$38,124

Purchase Details

Closed on

Feb 18, 2009

Sold by

Sheriff Of Benton County

Bought by

Wells Fargo Bank N A Succes

Purchase Details

Closed on

Sep 19, 2008

Sold by

Wells Fargo Bank N A Succes

Bought by

The Sec Of Housing & U

Purchase Details

Closed on

Jul 31, 1996

Sold by

Not Provided

Bought by

Not Provided

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lawlyes Eric K | $157,000 | -- | |

| Wells Fargo Bank N A Succes | $85,638 | Unterberg & Associates P C | |

| The Sec Of Housing & U | $85,638 | Unterberg & Associates P C | |

| Not Provided | $66,300 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lawlyes Eric K | $149,150 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $645 | $125,600 | $27,400 | $98,200 |

| 2023 | $506 | $107,800 | $23,900 | $83,900 |

| 2022 | $1,402 | $106,400 | $23,900 | $82,500 |

| 2021 | $1,311 | $99,000 | $23,900 | $75,100 |

| 2020 | $966 | $82,000 | $23,900 | $58,100 |

| 2019 | $815 | $83,300 | $23,900 | $59,400 |

| 2018 | $869 | $83,900 | $23,900 | $60,000 |

| 2017 | $780 | $81,400 | $23,900 | $57,500 |

| 2016 | $772 | $81,500 | $23,900 | $57,600 |

| 2014 | $237 | $88,000 | $26,400 | $61,600 |

| 2013 | $237 | $89,700 | $26,900 | $62,800 |

Source: Public Records

Map

Nearby Homes

- lot 4 N Stokes St Unit 1-20

- 0 N Stokes St Unit 1-20 202530107

- lot 2 N Stokes St Unit 2

- 108 S Smith St

- 407 S Center St

- 308 N Center St

- lot 20 E North St Unit 20

- 1024 W State Road 352

- 6862 Jackson St

- 470 W State Road 18

- 206 S Van Buren Ave

- 205 W 3rd St

- 202 N Washington Ave

- 703 W 2nd St

- Lot 9 W 2nd St

- 665 W 2nd St

- Lot 12 W 2nd St

- Lot 10 W 2nd St

- 653 W 2nd St

- 501 E 7th St