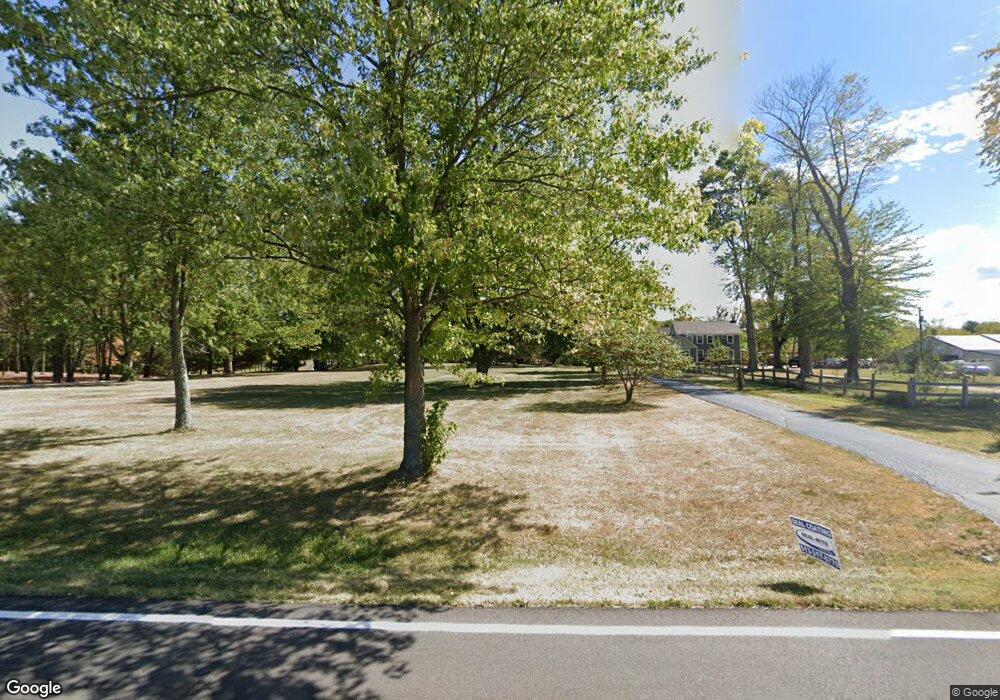

6498 Olive Branch Rd Oregonia, OH 45054

Estimated Value: $532,983 - $673,000

4

Beds

4

Baths

3,086

Sq Ft

$192/Sq Ft

Est. Value

About This Home

This home is located at 6498 Olive Branch Rd, Oregonia, OH 45054 and is currently estimated at $591,996, approximately $191 per square foot. 6498 Olive Branch Rd is a home located in Warren County with nearby schools including Clinton-Massie Elementary School, Clinton-Massie Middle School, and Clinton-Massie High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 26, 2010

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Stowe Mark and Stowe Rachel

Current Estimated Value

Purchase Details

Closed on

Feb 1, 2010

Sold by

Towson Norman L

Bought by

Federal Home Loan Mortgage Corp

Purchase Details

Closed on

Oct 12, 2004

Sold by

Mccandless Paul and Mccandless Tina

Bought by

Towson Norman L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$280,000

Interest Rate

4.75%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 9, 1988

Bought by

Mccandless and Mccandless Paul

Purchase Details

Closed on

Aug 18, 1978

Sold by

Amburgy Amburgy and Amburgy Bob C

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stowe Mark | -- | None Available | |

| Federal Home Loan Mortgage Corp | $220,000 | None Available | |

| Towson Norman L | $350,000 | Mid America Land Title | |

| Mccandless | $6,000 | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Towson Norman L | $280,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,764 | $127,960 | $40,680 | $87,280 |

| 2023 | $3,151 | $102,336 | $25,252 | $77,084 |

| 2022 | $3,105 | $102,337 | $25,253 | $77,084 |

| 2021 | $2,762 | $102,337 | $25,253 | $77,084 |

| 2020 | $3,234 | $104,206 | $24,154 | $80,052 |

| 2019 | $3,294 | $104,206 | $24,154 | $80,052 |

| 2018 | $3,403 | $104,206 | $24,154 | $80,052 |

| 2017 | $3,035 | $90,762 | $20,430 | $70,333 |

| 2016 | $3,124 | $90,762 | $20,430 | $70,333 |

| 2015 | $3,124 | $90,762 | $20,430 | $70,333 |

| 2014 | $3,029 | $85,650 | $19,920 | $65,730 |

| 2013 | $2,933 | $99,980 | $21,350 | $78,630 |

Source: Public Records

Map

Nearby Homes

- 6500 Olive Branch Rd

- 6037 Oregonia Rd

- 304 High St

- 6487 Flint Trail

- 702 Middleboro Rd

- 5654 Wilmington Rd

- 1 Corwin Rd

- 732 Settlemyre Rd

- 8784 Wilmington Rd

- 767 Settlemyre Rd

- 600 Ward-Koebel Rd

- 600 Ward Koebel Rd

- 9029 Arrowcreek Dr

- 9255 Arrowcreek Dr

- 0 Wilmington Rd Unit 1856179

- 0 Wilmington Rd Unit 1856534

- Lot B Blazing Trail

- Lot C Blazing Trail

- 945 S Nixon Camp Rd

- 339 S Nixon Camp Rd

- 6480 Olive Branch Rd

- 6450 Olive Branch Rd

- N/A Olive Branch Rd

- 5ac Olive Branch Rd

- 5800 Olive Branch Rd

- 7 Olive Branch Rd Unit 7

- 3 Olive Branch Rd Unit 3

- 1458 Olive Branch Rd Unit 1458

- 2 Olive Branch Rd Unit 2

- 6600 Olive Branch Rd

- 6622 Olive Branch Rd

- 6577 Olive Branch Rd

- 6640 Olive Branch Rd

- 0 Gard Rd Unit 1811548

- 0 Gard Rd Unit 915322

- 0 Gard Rd Unit 31 ac 1759669

- 0 Gard Rd Unit 11.1ac 1756272

- 0 Gard Rd Unit 11 ac 1755256

- 0 Gard Rd Unit 20 ac 1755255

- 0 Gard Rd Unit 5.1ac 1749978