6500 S 145th West Ave Sapulpa, OK 74066

Estimated Value: $442,000 - $698,000

5

Beds

3

Baths

3,911

Sq Ft

$151/Sq Ft

Est. Value

About This Home

This home is located at 6500 S 145th West Ave, Sapulpa, OK 74066 and is currently estimated at $590,209, approximately $150 per square foot. 6500 S 145th West Ave is a home located in Creek County with nearby schools including Pretty Water Public School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 17, 2008

Sold by

Janeway Kenneth D and Janeway Tonya R

Bought by

Toynton M Lea

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$365,750

Outstanding Balance

$233,919

Interest Rate

6.07%

Mortgage Type

New Conventional

Estimated Equity

$356,290

Purchase Details

Closed on

Jun 13, 2008

Sold by

Janeway Kenneth D and Janeway Tonya R

Bought by

Toynton M Lea

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$365,750

Outstanding Balance

$233,919

Interest Rate

6.07%

Mortgage Type

New Conventional

Estimated Equity

$356,290

Purchase Details

Closed on

May 9, 1994

Sold by

Gorman Ralph

Purchase Details

Closed on

Sep 21, 1992

Sold by

Darrell Overholt and Darrell Arbara

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Toynton M Lea | $385,000 | First American Title & Abstr | |

| Toynton M Lea | $385,000 | First American Title & Abstr | |

| -- | $165,000 | -- | |

| -- | $35,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Toynton M Lea | $365,750 | |

| Closed | Toynton M Lea | $365,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,163 | $45,747 | $2,199 | $43,548 |

| 2024 | $4,019 | $44,414 | $2,199 | $42,215 |

| 2023 | $4,019 | $43,121 | $2,199 | $40,922 |

| 2022 | $3,610 | $41,865 | $2,199 | $39,666 |

| 2021 | $3,546 | $40,646 | $2,199 | $38,447 |

| 2020 | $4,116 | $45,969 | $2,199 | $43,770 |

| 2019 | $4,014 | $47,342 | $2,199 | $45,143 |

| 2018 | $3,967 | $45,963 | $6,874 | $39,089 |

| 2017 | $3,986 | $45,963 | $6,874 | $39,089 |

| 2016 | $4,038 | $45,963 | $6,874 | $39,089 |

| 2015 | -- | $45,963 | $6,874 | $39,089 |

| 2014 | -- | $45,963 | $6,874 | $39,089 |

Source: Public Records

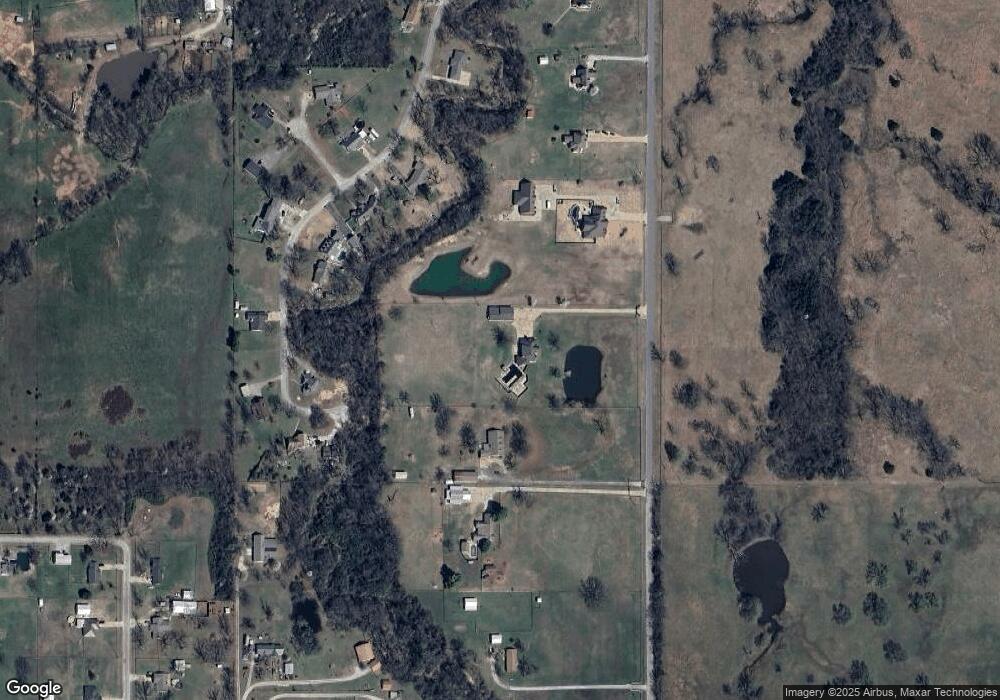

Map

Nearby Homes

- 6202 S 155th West Ave

- 6006 S 155th West Ave

- 12710 W 68th St S

- 0 S 167th West Ave

- 16902 W 59th St S

- 17011 W 60th St S

- 1 S 165th West Ave

- 8228 S 145th Ave W Unit Tract 2

- 738 W 54th St

- 001 W 51st St

- 413 W 54th St

- 16401 W Coyote Trail

- 5420 S Redbud Place

- 8420 S 145th West Ave

- 5109 S Nassau Ave

- 5307 Redbud Place

- 5410 Skylane Dr

- 5101 S Spruce Dr

- 5317 Skylane Dr

- 5320 S Walnut Creek Place

- 6584 S 145th West Ave

- 6901 S 151st West Ave

- 6464 S 145th West Ave

- 6604 S 145th West Ave

- 6205 Davidson Dr

- 6209 Davidson Dr

- 6220 Davidson Dr

- 6201 Davidson Dr

- 6207 Davidson Dr

- 6406 S 145th West Ave

- 6206 Davidson Dr

- 6212 Davidson Dr

- 6210 Davidson Dr

- 6218 Davidson Dr

- 6202 Davidson Dr

- 6115 Davidson Dr

- 6250 S 145th West Ave

- 603 Davidson Ct

- 6730 S 145th West Ave

- 604 Davidson Ct