6503 Bear Swamp Rd Unit 6505 Medina, OH 44256

Estimated Value: $358,000 - $508,325

6

Beds

4

Baths

2,660

Sq Ft

$169/Sq Ft

Est. Value

About This Home

This home is located at 6503 Bear Swamp Rd Unit 6505, Medina, OH 44256 and is currently estimated at $450,081, approximately $169 per square foot. 6503 Bear Swamp Rd Unit 6505 is a home located in Medina County with nearby schools including Highland Middle School, Highland High School, and Medina Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 11, 2022

Sold by

Pembridge Thomas D

Bought by

Soisman Megan and Tomayko Johnathou

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$262,000

Outstanding Balance

$250,485

Interest Rate

5.51%

Mortgage Type

New Conventional

Estimated Equity

$199,596

Purchase Details

Closed on

Mar 3, 2017

Sold by

Pembridge Pamela R and Pembridge Thomas D

Bought by

Pembridge Thomas D

Purchase Details

Closed on

May 11, 2001

Sold by

Hillrich Philipp and Hillrich Eva

Bought by

Pembridge Thomas D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$145,000

Interest Rate

7.16%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Soisman Megan | $1,146 | None Listed On Document | |

| Pembridge Thomas D | -- | None Available | |

| Pembridge Thomas D | $225,000 | Mcta |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Soisman Megan | $262,000 | |

| Previous Owner | Pembridge Thomas D | $145,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,564 | $114,440 | $47,030 | $67,410 |

| 2023 | $4,564 | $114,440 | $47,030 | $67,410 |

| 2022 | $4,611 | $114,440 | $47,030 | $67,410 |

| 2021 | $4,312 | $93,800 | $38,550 | $55,250 |

| 2020 | $4,486 | $93,800 | $38,550 | $55,250 |

| 2019 | $4,477 | $93,800 | $38,550 | $55,250 |

| 2018 | $4,389 | $87,680 | $40,860 | $46,820 |

| 2017 | $4,404 | $87,680 | $40,860 | $46,820 |

| 2016 | $4,186 | $87,680 | $40,860 | $46,820 |

| 2015 | $4,079 | $82,720 | $38,550 | $44,170 |

| 2014 | -- | $82,720 | $38,550 | $44,170 |

| 2013 | $4,489 | $91,590 | $38,550 | $53,040 |

Source: Public Records

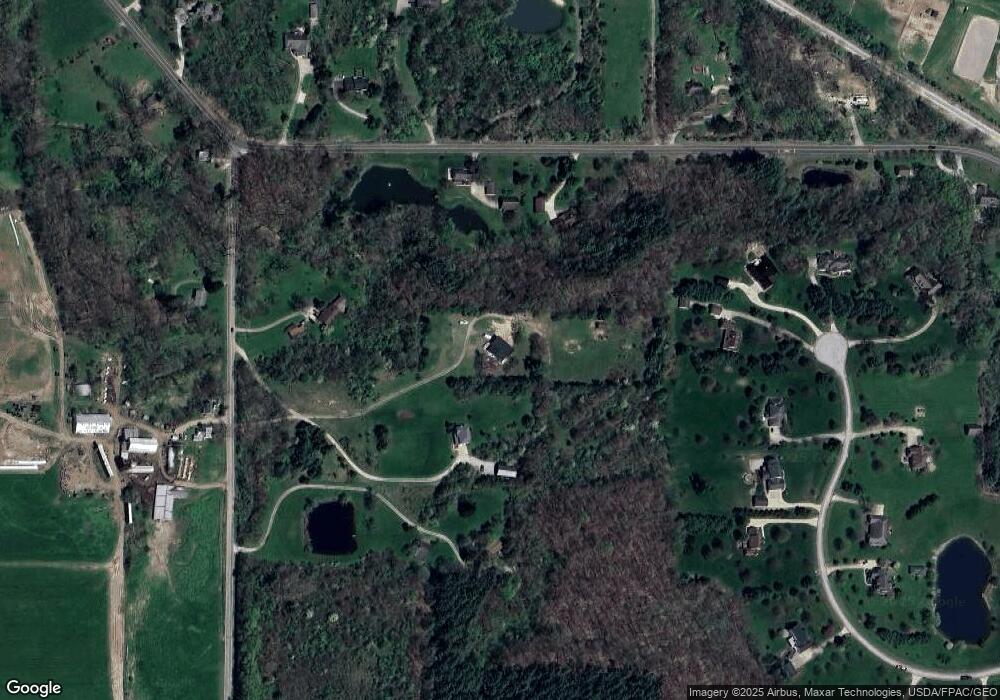

Map

Nearby Homes

- 2600 Sharon Copley Rd

- 6116 Boneta Rd

- 6144 Grey Heron Dr

- 6137 Grey Heron Dr

- 6124 Grey Heron Dr

- HIALEAH Plan at Villas of Blue Heron

- ALISTAIR Plan at Villas of Blue Heron

- FINLEY Plan at Villas of Blue Heron

- CHESTER Plan at Villas of Blue Heron

- KENAI Plan at Villas of Blue Heron

- SARASOTA Plan at Villas of Blue Heron

- ALDEN Plan at Villas of Blue Heron

- BEACHWOOD Plan at Villas of Blue Heron

- 6349 Manor Glen Dr

- 6099 Upland Ridge Dr

- 6980 Bear Swamp Rd

- 6316 Brynwood Dr

- 2843 Robert Gary Ct

- 6023 Mint Hill Dr

- 2866 Robert Gary Ct

- 6503 Bear Swamp Rd

- 6515 Bear Swamp Rd

- 2644 Sharon Copley Rd

- 6465 Bear Swamp Rd

- 6547 Bear Swamp Rd

- 3010 Halle Dr

- 3030 Halle Dr

- 2590 Halle Dr

- 2677 Sharon Copley Rd

- 6480 Bear Swamp Rd

- 2550 Halle Dr

- 0 V L Sharon Copley Rd

- 2573 Sharon Copley Rd

- 2570 Halle Dr

- 3025 Halle Dr

- 2655 Sharon Copley Rd

- 2699 Sharon Copley Rd

- 2595 Sharon Copley Rd

- 2531 Sharon Copley Rd

- 2530 Halle Dr