Estimated Value: $213,000 - $233,136

2

Beds

2

Baths

1,748

Sq Ft

$127/Sq Ft

Est. Value

About This Home

This home is located at 6512 Amber Ct Unit 50, Mason, OH 45040 and is currently estimated at $221,784, approximately $126 per square foot. 6512 Amber Ct Unit 50 is a home located in Warren County with nearby schools including Mason Intermediate Elementary School, Mason Middle School, and William Mason High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 16, 2011

Sold by

Brown Terrence Mark

Bought by

Mcguinness Colleen M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$56,812

Outstanding Balance

$39,528

Interest Rate

4.37%

Mortgage Type

FHA

Estimated Equity

$182,256

Purchase Details

Closed on

Aug 25, 2006

Sold by

Allen Gerald W

Bought by

Brown Terrence Mark

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,269

Interest Rate

6.88%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 28, 1987

Sold by

Loughrea Loughrea and Loughrea Edward R

Bought by

Allen Allen and Allen Gerald W

Purchase Details

Closed on

Feb 2, 1982

Sold by

Ryland Group Inc

Purchase Details

Closed on

Aug 17, 1981

Sold by

Ryland Group & Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mcguinness Colleen M | $58,300 | Prodigy Title | |

| Brown Terrence Mark | $112,000 | Title Resolutions | |

| Allen Allen | $52,900 | -- | |

| -- | $46,000 | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mcguinness Colleen M | $56,812 | |

| Previous Owner | Brown Terrence Mark | $110,269 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,646 | $65,170 | $17,500 | $47,670 |

| 2023 | $1,884 | $39,186 | $6,457 | $32,728 |

| 2022 | $1,860 | $39,186 | $6,458 | $32,729 |

| 2021 | $1,762 | $39,186 | $6,458 | $32,729 |

| 2020 | $1,671 | $31,857 | $5,250 | $26,607 |

| 2019 | $1,536 | $31,857 | $5,250 | $26,607 |

| 2018 | $1,541 | $31,857 | $5,250 | $26,607 |

| 2017 | $1,426 | $27,521 | $4,389 | $23,132 |

| 2016 | $1,469 | $27,521 | $4,389 | $23,132 |

| 2015 | $1,472 | $27,521 | $4,389 | $23,132 |

| 2014 | $1,578 | $27,520 | $4,390 | $23,130 |

| 2013 | $1,582 | $32,920 | $5,250 | $27,670 |

Source: Public Records

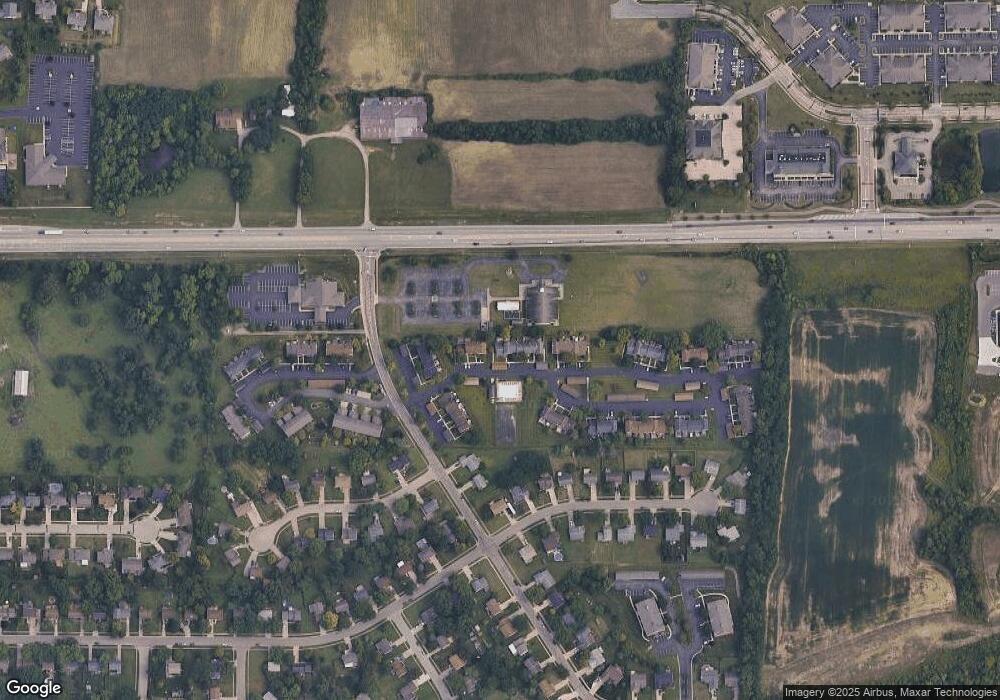

Map

Nearby Homes

- 6070 Fireside Dr Unit 45

- 6134 Nicholas Way

- 6142 Nicholas Way

- 6138 Nicholas Way

- 6387 Coverage Ct

- 6369 Coverage Ct

- 6403 Coverage Ct

- 6357 Coverage Ct

- 6383 Coverage Ct

- 6407 Coverage Ct

- 6375 Coverage Ct

- 6365 Coverage Ct

- 6361 Coverage Ct

- 6379 Coverage Ct

- 6411 Coverage Ct

- 6126 Nicholas Way

- 6146 Nicholas Way

- 6150 Nicholas Way

- 6358 Coverage Ct

- 6362 Coverage Ct

- 6510 Amber Ct

- 6510 Amber Ct Unit 51

- 6508 Amber Ct

- 6530 Amber Ct Unit 49

- 6506 Amber Ct

- 6504 Amber Ct

- 6534 Amber Ct Unit 47

- 6502 Amber Ct

- 6536 Amber Ct

- 6488 Amber Ct Unit 57

- 6484 Amber Ct

- 6078 Fireside Dr

- 6076 Fireside Dr

- 6482 Amber Ct Unit 60

- 6074 Fireside Dr

- 6110 Fireside Dr Unit 40

- 6072 Fireside Dr

- 6300 Amber Ct

- 6112 Fireside Dr

- 6114 Fireside Dr